The long road to normal: shopper attitudes, 18 months on

It’s been a year and a half now since dunnhumby launched the Consumer Pulse – a global research programme designed to track shopper attitudes across the pandemic. During that time we’ve learned much about shifting priorities, changing needs, and the complex web of factors that drive shoppers to behave as they do.

At the beginning of September, we conducted our seventh piece of research in this series, particularly keen to learn whether shoppers felt that things might finally be getting “back to normal”. And desperate though they may be to return to pre-pandemic life – or something that resembles it – this latest Pulse tells us that shoppers are only too aware that they’re not there yet.

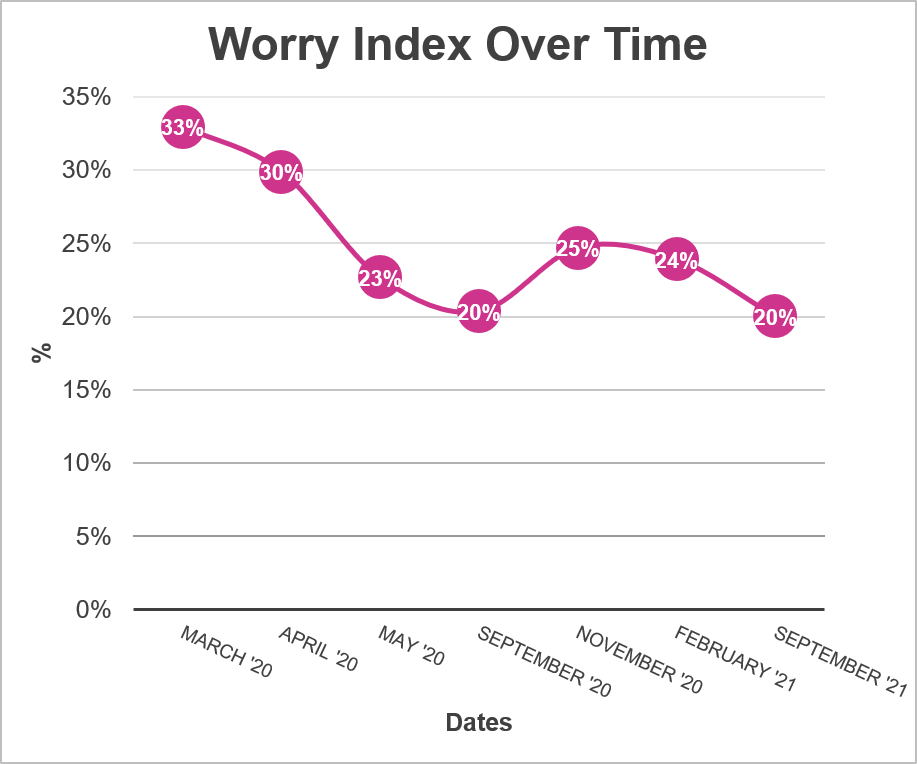

Worries about Covid have fallen, but caution remains high

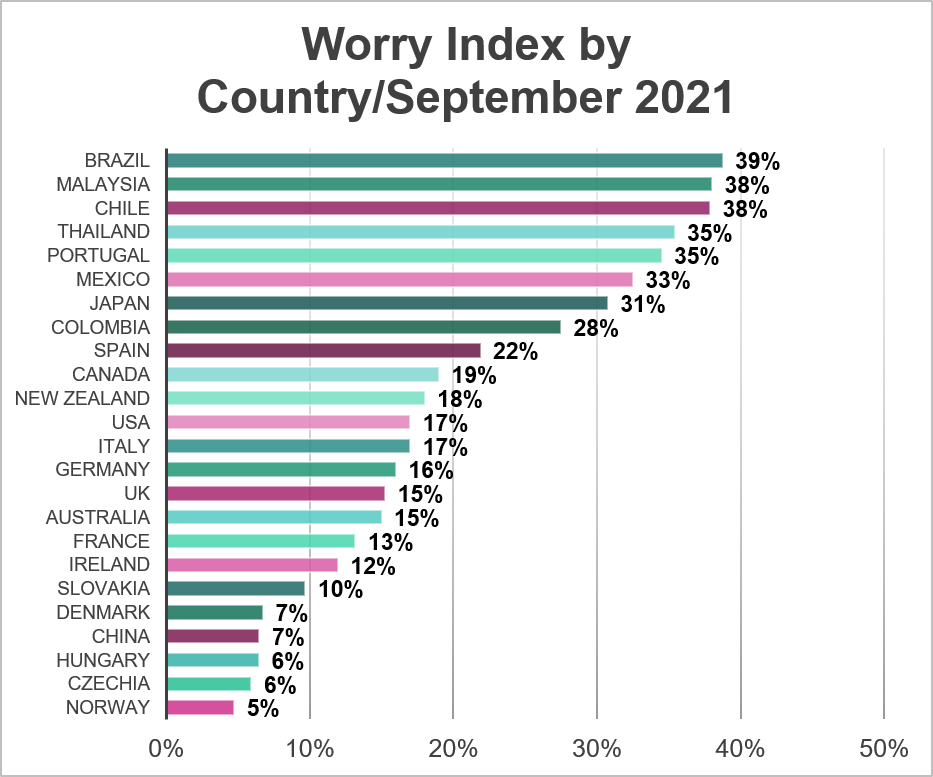

Overall concern about Covid – measured by our “Worry Index” – is now at its lowest point in more than a year. Just a fifth of shoppers now have significant fears about the virus, with Customers in Brazil and Chile continuing to show the greatest concern.

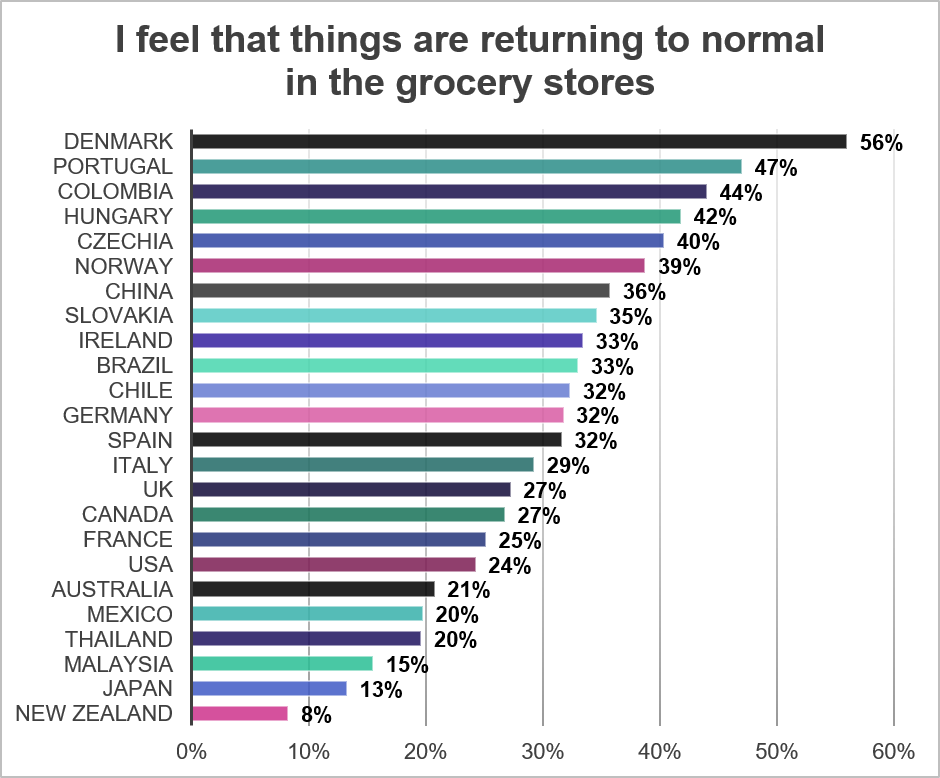

While worry may be on the wane, however, that doesn’t mean that shoppers feel that things are back to normal quite yet. Denmark is the only country in which more than half of respondents believe that normality has returned, and the majority of people around the world are keenly aware that shopping continues to be a very different prospect to the one they enjoyed pre-2020.

APAC shoppers are particularly vocal here. Those from Australia, New Zealand, Japan, Malaysia, and Thailand are the least likely to agree that things are returning to normal – little surprise when the weeks leading up to this seventh Pulse saw infections spike to an annual high in all of those nations bar Malaysia[1] and countries like Australia implemented yet another round of lockdowns.

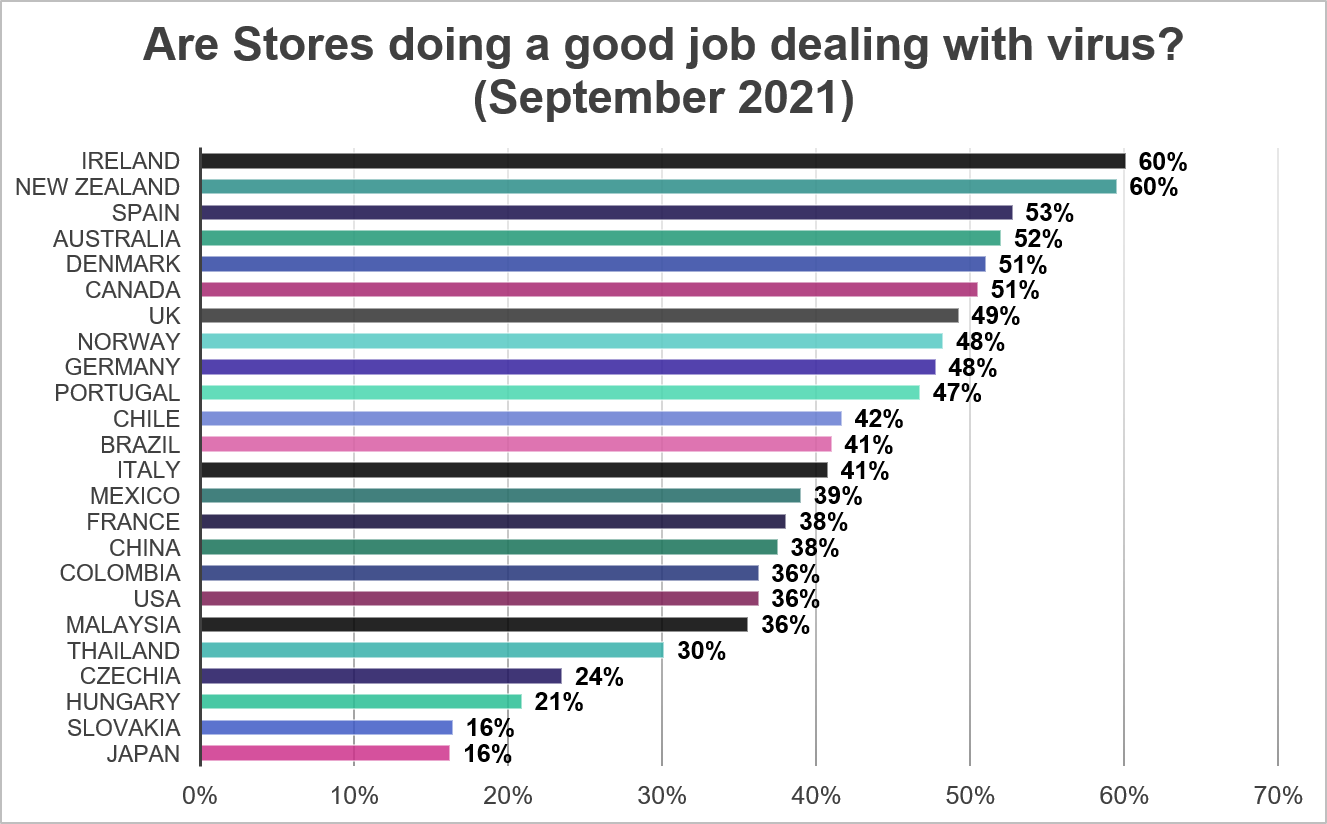

Are stores doing a good job?

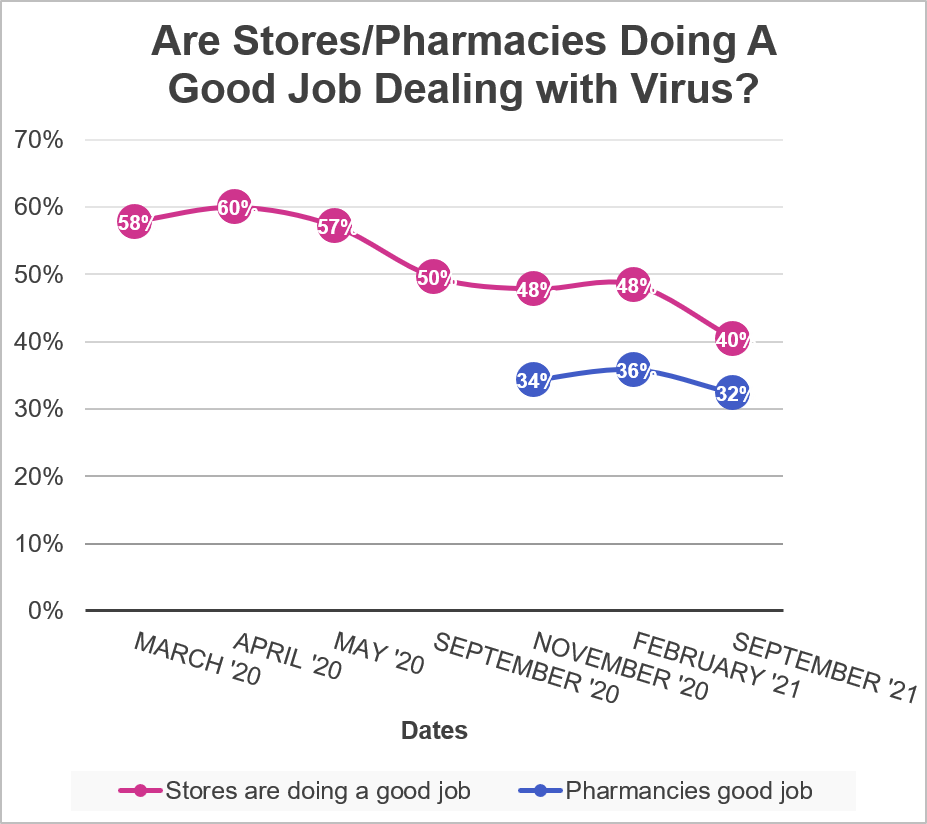

One thing we have measured throughout the pandemic is customer perception of how well stores are handling the impact of the virus. While initially shoppers indicated high levels of trust (with some countries seeing supermarkets rated more highly than governments in their ability to deal with the impacts of Covid), it’s clear that fewer people agree that stores are doing a good job now as the chart below shows.

Although some countries are seeing much higher levels of trust than others (60% of Irish shoppers are satisfied with stores, compared to only 16% of Japanese shoppers), those that have seen the biggest shift from positive to negative all have one thing in common: low levels of concern about Covid. It appears that some shoppers want to return to normal and anything that interferes with that (store restrictions, unvaccinated shoppers) could be adding to their dissatisfaction.

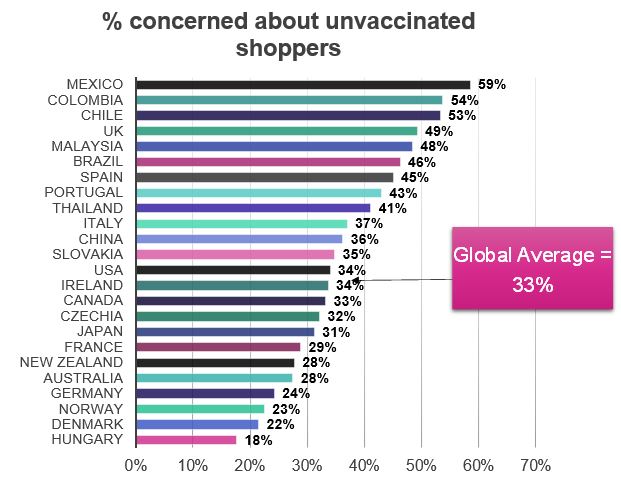

Unvaccinated shoppers present cause for concern

As the global response to the pandemic has developed, so too has the Pulse. One of the new metrics in this edition relates to unvaccinated shoppers – specifically, how worried people feel about them when they’re buying groceries. And though some of the results here tally with vaccine rollouts around the world, others are more surprising.

Shoppers in Mexico and Colombia demonstrate the greatest concern here. In both of these countries the latest vaccination data shows that fewer than a third are fully vaccinated, and only around 50% have had their first shot[2], going some way to supporting these results.

Less explicable is the presence of Chile and the UK towards the top of this table: almost three-quarters of Chilean citizens, and two-thirds of Brits, are now fully vaccinated. Overall worries about the virus remain high in Chile (38% worried) of course, but are much lower in the UK (15%).

While we don’t have the data to fully understand why shoppers in some countries are more worried than others, Retailers in those locations would be well served by continuing to highlight the protections that they have in place. That need becomes particularly acute when we look at the dramatic decline in the number who feel that stores are doing a good job of dealing with the virus – down to just 40% from an all-time high of 60%.

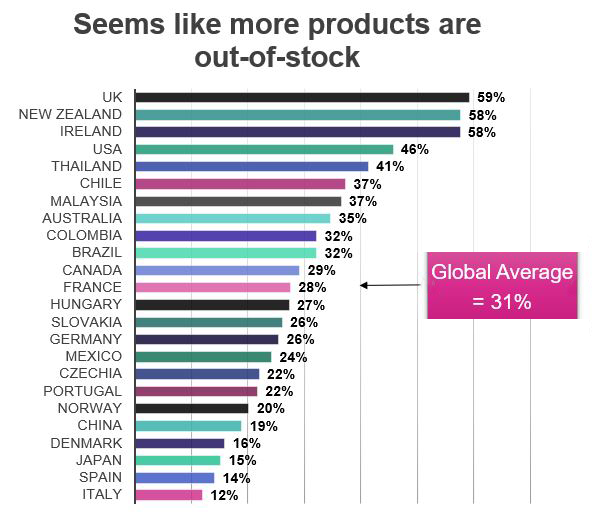

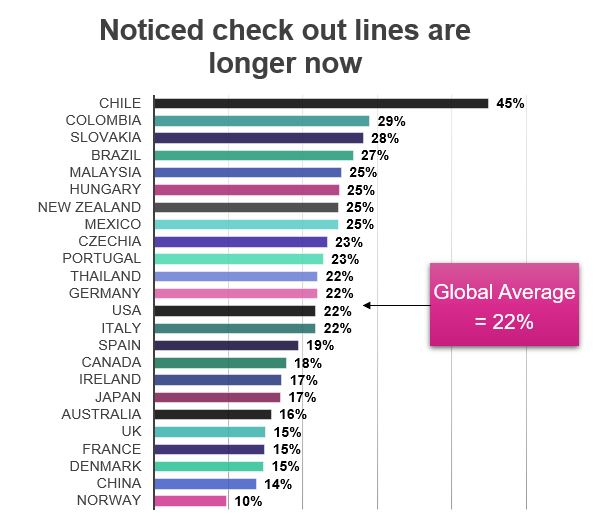

Perceived or actual, side-effects of the pandemic are starting to show

For Grocery Retail, the early days of the pandemic were defined largely by disruption – supply chain troubles and preventative measures conspiring to make shopping a largely uncertain experience. From our latest Pulse, there’s some indication that a similar situation is beginning to develop, albeit with little consistency in terms of where.

Around a fifth of shoppers (22%) around the globe say that they feel like checkout lines have gotten longer. Close to a third (31%) believe that products are now out of stock more often.

Though it is possible to associate the first of those results with staff shortages, it should also be noted that people are simply shopping more often as well. The average number of trips to store each week has risen from 4.7 in March last year to 6.4 today, and there is likely to be some correlation here – stores are simply much busier than they have been quite some time.

While that will likely have had some impact on out-of-stocks too, supply chain issues must also be taken into account. Brexit has had a notable effect on the supply chain to both the UK and Ireland[3], both of which feature highly here. In the US, port congestion is proving to be similarly debilitating[4].

Financial pressures continue, and the pursuit of value remains strong

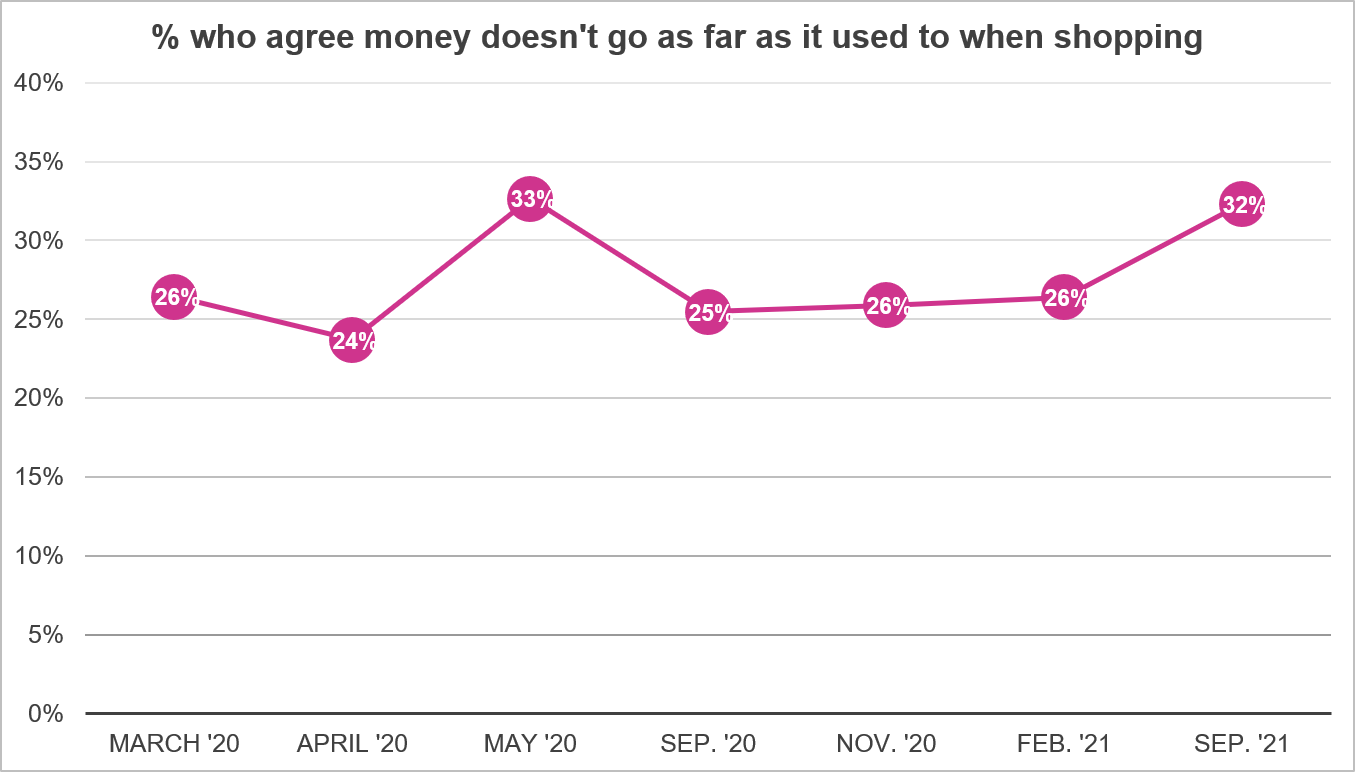

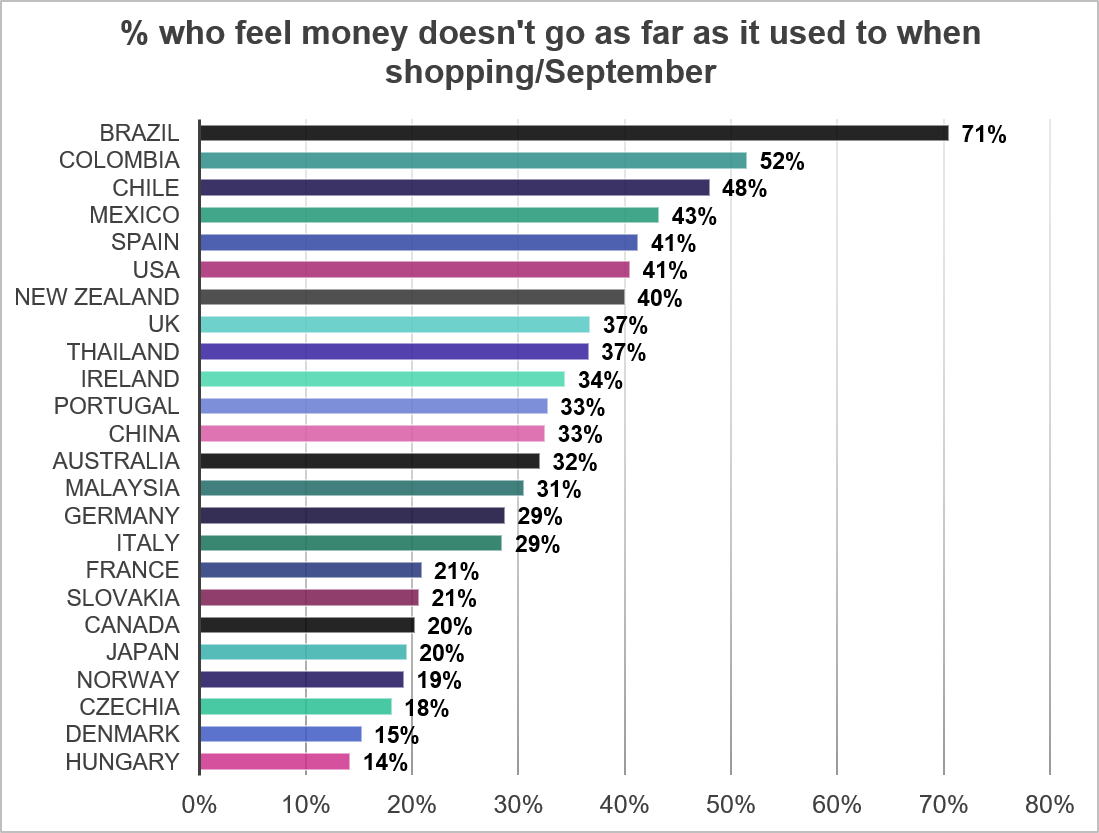

One of the most notable trends throughout the pandemic has been growing price sensitivity amongst shoppers. Across the Pulse studies, many respondents have told us not just that they’re spending more on groceries than they were pre-pandemic, but that they believe the price of food has increased as well. One third of all shoppers believe their money is doesn’t go as far as it used to when shopping.

While again, this differs from country to country, it’s clear that the majority of shoppers in the Latin American region are feeling the pinch more severely than shoppers in Europe.

The natural countermeasure to financial troubles, of course, is to prioritise value above all else. Again, the data here remains broadly in line with our past study, with well over two-thirds of shoppers still engaged in “value seeking” strategies such as shopping at stores with the lowest prices, searching online for cheap deals and stocking up during sales. There has been little change in the prevalence of these behaviours since February. However, there is an increase in the number of different value seeking strategies shoppers are using, indicating that price sensitivity is something all retailers need to address in their offering.

Is the love affair with grocery Ecommerce over?

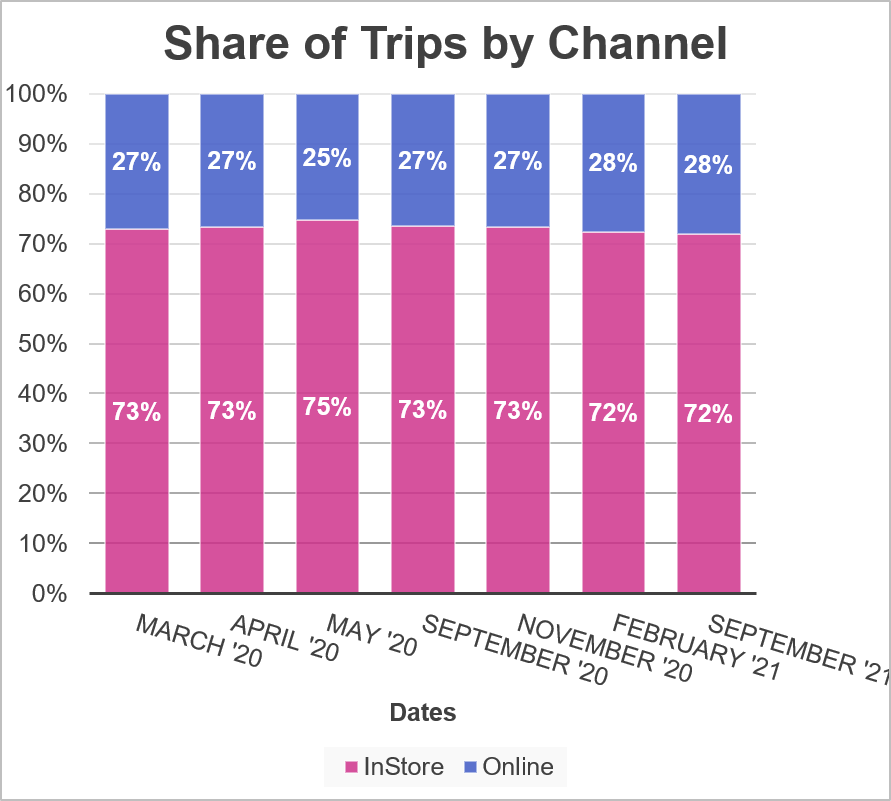

The latest results confirm that about half of people shop both online and in-store, but in-store still accounts for most trips, with just over a quarter of grocery shopping missions conducted purely online. Good news is that satisfaction with online shopping is at the level of in-store, but the number who say they will increase online shopping is declining, suggesting a return to pre-pandemic behaviours.

What we can learn from the latest Customer Pulse

New concerns are replacing old ones. While shoppers are now markedly less worried about Covid than they were at the end of last year, that doesn’t translate into a belief that everything has gone back to how it was. Instead, shoppers are now focusing on “side effects” of the pandemic, quick to highlight longer lines, out-of-stocks, and the declining standard of preventative measures.

To counter this, Retailers may need to dust off some of their tactics and strategies from the early months of 2020 – back when issues like speed, stock, staffing, and safety were the watchwords. Fatiguing though it may be, “normal” remains a distant prospect yet.

[1] COVID-19 Data Repository by the Center for Systems Science and Engineering (CSSE) at Johns Hopkins University

[2] Mathieu, E., Ritchie, H., Ortiz-Ospina, E. et al. A global database of COVID-19 vaccinations. Nat Hum Behav (2021)

[3] Supply chain problems – Institute for Government, 10th September 2021

[4] 65 cargo ships queue outside America’s biggest ports in supply chain disruption

TOPICS

The latest insights from our experts around the world

Understanding evolving customer needs in the age of AI and data abundance