Who Will Hold Onto Their New COVID Customers?

First published in Winsight Grocery Business.

The $64,000 question is … can retailers keep their new-found COVID customers? The grocery market grew about 10% in 2020 and many retailers, particularly traditional banners, experienced growth in excess of 10%. Many of these traditional banners, which had been growing slower pre-COVID, increased market share in 2020. In contrast, several of the dominant pre-COVID banners, such as Walmart, Trader Joe’s and Costco, stumbled a bit and were the source of new customers and market share for traditional banners such as Albertsons, Harris-Teeter and Ralphs.

To understand if the traditional retailers will be able to hold onto some of these new customers, we need to consider a few questions. First, was the reason for the great year due to internal or external factors? In other words, did the retailer grow 12% because of the great adaptations they made during COVID or was it driven by external factors such as changes in how customers’ shopped and prepared food during COVID? If it was primarily the internal decisions, then the retailer will have a better chance of keeping those shoppers, but if it was driven externally, then the growth will only last if the catalyst remains.

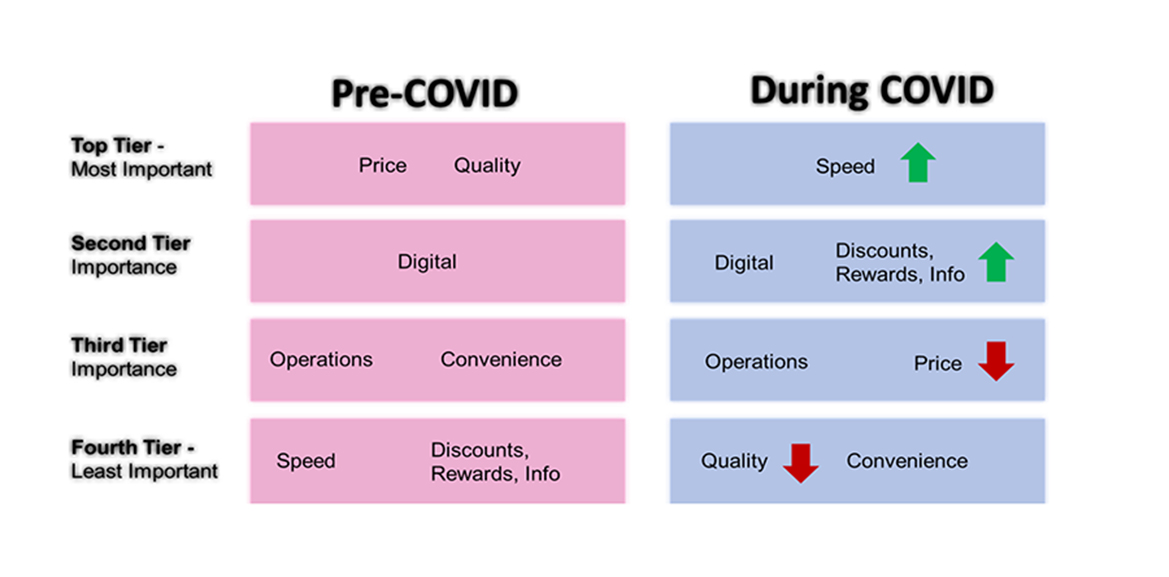

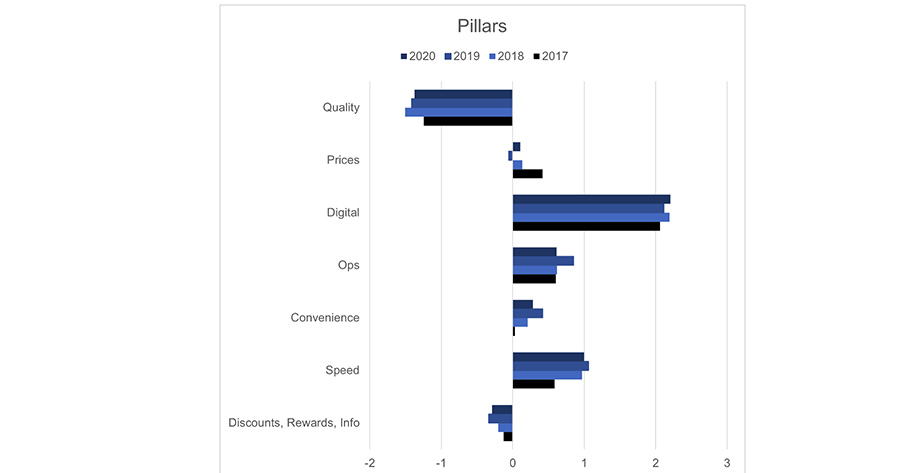

Looking at dunnhumby’s Retail Preference Index (RPI) data, which we fielded in November 2020 and has been completed annually for the past four years, we see two things. First, shoppers’ needs changed significantly during COVID and second, how shoppers perceived retailers were consistent with previous years. Looking at the graphic below, we see that pre-COVID customers preferences were driven largely by price and quality, but those two preference drivers were much less important during COVID. In contrast, speed was not important pre-COVID but jumped to the top because of its correlation with safety.

Our price metric is comprised on how shoppers perceive a retailer’s overall prices, and quality is comprised on both product and store experience perceptions. We call the combination of price and quality perceptions the value core. It was by far the biggest driver of where one shopped and was the most predictive at explaining both financial and emotional performance before 2020. However, during COVID, importance shifted away from price and quality and toward speed, safety and digital perceptions.

In 2020, for shoppers it was less about finding one’s optimal combination of price and quality and more about shopping in a retailer where they felt safe and could simply get the items they were looking for and get out quickly. This meant that banners such as Walmart, Costco and Trader Joe’s were not as desirable because they were often perceived to be slow or crowded. Many traditional banners, on the other hand, were perceived to be a quicker, easier and safer shopping alternative. In addition, most traditional banners suffered from poor price perceptions before COVID but during COVID shoppers were willing to trade-off higher prices for a safer shopping experience. Essentially, COVID redistributed shoppers from the pre-COVID industry stalwarts to those banners who had fewer shoppers before the pandemic. It was the great retail flattening and resulted in many traditional banners having the best year in decades.

So this leads us back to our initial question, can retailers keep their new-found COVID customers? As we have seen above, the external drivers, particularly what customers’ valued, changed significantly in 2020.So did some retailers adapt to these changes better and does this help to explain their superior performance? If they did, we would also expect to see their customers’ perceptions change.

Target made one of the largest jumps in the 2020 RPI rank and in their 2020 financial performance but had very little change in customer perception for 2020. Target did well not because of changes made in 2020, but because they were already perceived to be a speedy, clean and safe over the previous three years. A robust e-commerce offering was also a nice tailwind.

Thus, the data suggests that retailer’s 2020 performance was driven more by the customers’ valuing different things vs. retailers adapting to this change. Those banners who were strong on speed and safety prior to the pandemic were simply better positioned for 2020. It was less about the improvements in their e-commerce platform, phone app or additional safety measures and more about their established pre-COVID actions and perceptions.

What will stick with customers in the post-COVID world? Below are some of the biggest COVID trends along with how they were trending before and during COVID. We also include our hypothesis and expectation for a post-COVID world.

| COVID Trends | Pre-COVID | During COVID | Post-COVID |

|---|---|---|---|

| E-commerce | E-commerce penetration was growing but slower than other industries. Share of sales was estimated to be about 5% of grocery sales in 2019. | E-commerce trial and shop expanded significantly in 2020 and most think sales penetration has at least doubled to 10%. | E-commerce penetration will remain higher than pre-COVID because many shoppers are more comfortable ordering, picking up or having their groceries delivered. Thus the e-comm hurdles and obstacles for many have largely been overcome. |

| Visits and baskets | Before COVID, in-store visit counts were flat, and we estimate baskets were growing at the rate of inflation which aligns with overall grocery spend. | Because people wanted to limit their public exposure and were eating more meals at home, visits fell and basket sizes increased significantly. | When COVID fades there will be no reason to limit exposure, so we would expect visits to increase and basket size to fall. We also expect the number of visits to different retailers to increase. |

| Grocery spend | Grocery sales increased 2.7% in 2018 and 2.6% in 2019. | Grocery sales increased 11% during 2020. | Grocery sales are expected to be down 1%-2% in 2021. In 2022 and over the longer term, we would expect grocery to return to 2%-3% growth per year. |

| Food-at-home vs. food-away-from-home | Food-away-from-home (FAFH) spend was higher than food-at-home (FAH) and growing faster than grocery. | During 2020 restaurant spend (FAFH) dropped 20% while grocery spend (FAH) increased 10%. | This shift was also due to minimizing public exposure and government mandates. Thus, when people are more comfortable in public, we would expect FAFH and FAH to return to pre-COVID trends. For 2021, we expect restaurant spend to be up over 10% while grocery will likely be down 1%-2%. |

| Grocery retailer preference drivers | Price and quality were the key preference drivers, while speed and safety were the least important. | Speed and safety became much more important, while price and quality fell significantly. Shoppers wanted to safely shop for groceries and were willing to pay extra for that peace of mind. | This shift was driven largely by people limiting their public exposure, so when COVID fades, we expect speed and safety to be less important and price and quality will once again drive retailer preference. |

The data shows that what shoppers valued changed significantly during COVID due to a need to reduce exposure and feel safe. However, as COVID fades, these will no longer be issues, so we would expect these preference drivers to look more like pre-COVID than they did during COVID. The data also shows us that customer perceptions of retailers were consistent with the pre-COVID years. Thus, it had less to do with individual retailer actions and more to do with customer’s needs changing. If these 2019 vs. 2020 performance shifts were driven by some retailers outmaneuvering others, we would expect to see their perceptions improve while others deteriorate. We simply did not see that.

What does this say about which retailers will be able to keep their new COVID customers? Since we expect post-COVID to look more like 2019 than 2020, those retailers with a strong value core (price + quality) in 2019 will be best positioned post-COVID. We also expect that those retailers with more brand equity to hold onto their shoppers. Our proxy for brand equity is emotional connection, which is a composite of trust, satisfaction and emotional intensity. If we build a scatter plot on the retailer’s value core and emotional connection, those retailers in the upper right-hand quadrant would be strong on both value and emotional connection, while those in the lower left quadrant will be weak on both. As a result, we would expect those in the upper right-hand quadrant to be better positioned for the post-COVID world.

Outside of e-commerce penetration and a clean store, we don’t expect much else to carry over into the post-COVID world. As a result, we would expect those who outperformed in 2020 but underperformed in 2019 to underperform in 2021/2022. In contrast, those who led the market in 2019 but stumbled a bit in 2020, we would expect many of them to rebound. Simply put, price and quality will return as the dominant preference drivers when the fear of going in public evaporates.

This brings me to an interesting psychological concept called self-serving bias. It is a bias where we attribute our successes to internal factors and our failures to external factors, and nobody is immune. In this case, many retailers are attributing their 2020 success to their internal actions while discounting the external impact. Many are incorrectly assuming it was these internal 2020 changes that drove success, so they are loading up the budget with more of those actions in 2021.

Some retailers are also building or buying new stores on the crest of a potentially declining market, which can be a risky growth strategy. When building out 2021 and 2022 strategies and budgets, retailers should base them more on 2019. 2020 was largely an outlier and much of what drove performance will fade with COVID. We would instead recommend reinvesting funds in improving existing stores and reassessing their key value items, which will be more important in a more price sensitive market.

The latest insights from our experts around the world

Navigating a shifting world: the headline results from our latest Consumer Pulse

Keeping it relevant and authentic: engaging consumers along the purchase journey