Ensuring product availability on the right items, the Customer First way

For the second time in as many years, stock shortages are starting to undermine the grocery shopping experience. Across the world, demand for key lines has begun to outstrip supply – leaving stores with empty shelves, and shoppers with little alternative but to look elsewhere.

Unlike the shortages of 2020, many of which were caused by panic buying, most of the current issues surround the transportation of goods. Almost half a million cargo containers were queuing off the coast of Southern California in October[1], with more than three-quarters of ports worldwide suffering from “abnormally long” turnaround times[2]. On the roads, North America[3] and the UK[4] each face a shortage of truck drivers in the high tens of thousands. And in Europe, supplier delivery times are now the longest they’ve been since at least 2007[5].

Even in Asia-Pacific, the point of origin for many shop-bought goods, problems still exist. With extreme weather having ruined crops and impacted supply chains in the country, Chinese citizens have been urged to stock up food for the winter – sending prices soaring[6]. Just across the East China Sea, a decline in the production of Malaysian palm oil has forced Japanese suppliers to drive up the price of everything from margarine to chocolate[7].

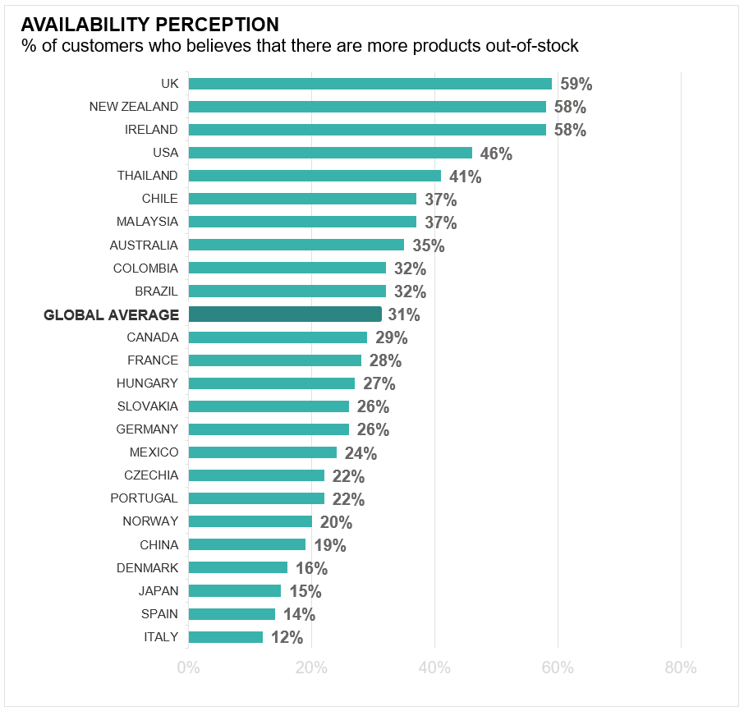

Critically, the consequences of this disruption are only too apparent to shoppers. In the last two weeks of October, one in six British adults said that they had been unable to find essential food items[8]. In the US, carbonated drinks, chicken, coffee, toilet paper, and more have all made it onto a list of “hard to find” foods[9]. And in the most recent edition of dunnhumby’s own Consumer Pulse study, we saw significant numbers of shoppers highlighting the problem of out-of-stocks.

Figure 1: dunnhumby Consumer Pulse Wave 8

For Retailers, the problem doesn’t end when a Customer leaves the store. Out-of-stocks may be frustrating in the moment, but they can also have a corrosive effect over the longer term. This may begin with the loss of a few items from each basket, but can end with the loss of a shopper as a whole – their loyalty gradually whittled away as they visit other stores to find what they need.

In lieu of an overnight revolution in the supply chain, Retailers clearly need some way to mitigate the commercial and relational damage that can be done by stock shortages – and Customer data science can be employed to good effect here. While it may not be able to solve the root cause problems of disrupted supply, data can at least be used to alleviate some of the symptoms, particularly when used as a prioritisation tool.

Helping Customers find more of the things they need means maintaining the On-Shelf Availability (OSA) of those products. As simple as that may sound, it is naturally much harder to ensure the OSA of 1,000 products as than it is of, say, 10. This is where tiering comes in.

The granularity of data available to grocery Retailers today is such that it is entirely possible to identify which products are the absolute priority for loyal Customers, based on a combination of business and customer metrics such as product sales, units, and product preference by loyal Customers. With a very high degree of confidence, we can produce a list of 50-70 items that Retailers must have available at all times – what we would define as Tier 1 goods. In Tier 2, we’d place the next 100 to 200 “most important” items. This allows Retailers to set clear parameters around minimum OSA levels for each tier – 100% for Tier 1, for instance, and 95% for Tier 2.

Tiering can also help to ensure that Retailers aren’t overrepresenting within certain needs. Take crisps (or chips) as an example: there’s little point in having an abundant supply of plain crisps from two competing Brands on the shelf if other flavours are all out of stock. In that instance, we’d recommend moving one of those products into Tier 2, and moving another flavour into Tier 1 (if needed).

Even when products have been tiered, of course, issues outside of a Retailer’s control can sometimes make 100% OSA an impossibility. In those instances, Customer substitutability science comes into play. Here, when a Tier 1 item is unavailable, the next best equivalent – and the one that is most acceptable to Customers as a replacement – can be elevated out of Tier 2. Additionally, shelf-space allocated to the unavailable item can be reduced, ensuring that there are no long-term issues in terms of presentation to shoppers.

As well as these strategic approaches, data-driven tiering can also be used in some more tactical ways too. Potential applications here include:

- Placing visual markers on the shelves of high-tier lines, helping store teams to identity these lines and closely monitor the stock on shelf.

- Ensuring that Tier 1 items are tagged as non-removable on the Retailer’s ERP system, even if they have been deprioritised elsewhere within the business.

- Focusing replenishment efforts on items that matter most to Customers, maximising the effectiveness of restocking.

- Reviewing the space allocated to Tier 1 products, including facings, to ensure that they have enough space on the shelf.

- Setting higher “safe” inventory levels and wastage allowance for Tier 1 items, reducing the risk of them going out of stock.

- Prioritising the delivery of Tier 1 products from distribution centres and negotiating shorter lead times with suppliers wherever possible.

- Using your transaction data to monitor and flag on-shelf availability issues with these key lines.

While many of the current problems with stock shortages have manifested, if the last two years have shown us anything, it’s that issues can arise anywhere and at any time. Even before this recent bout of disruption, availability has been an area that is increasingly hard to manage and predict.

A sharper and more focused view on what Customers really want will only ever deliver returns – whatever the future of global supply may hold.

[1] Nearly half a million shipping containers are stuck off the coast of Southern California as the ports operate below capacity – Business Insider, 6 October 2021

[2] Global Port Trackers Show Where the Worst Ship Logjams Lurk – Bloomberg, 12 October 2021

[3] How will the US deal with a shortage of 80,000 truckers? – BBC, 8 November 2021

[4] How serious is the shortage of lorry drivers? – BBC, 15 October 2021

[5] What longer delivery times say about global supply chains – World Economic Forum, 3 November 2021

[6] China urges families to stock up on food for winter months – The New York Times, 2 November 2021

[7] ASEAN supply chain woes drive up food prices in Japan – Nikkei Asia, 28 August 2021

[8] Coronavirus and the social impacts on Great Britain: Personal experience of shortage of goods – Office for National Statistics, 19 November 2021

[9] Grocery store shelves bare? These products may be hard to find amid supply chain disruptions – USA Today

TOPICS

RELATED PRODUCTS

The latest insights from our experts around the world

Understanding evolving customer needs in the age of AI and data abundance