H-E-B, Trader Joe’s, and Costco’s Formula for Private Brand Lasting Success

H-E-B wrestled back control of the #1 spot from Amazon in our annual grocery RPI ranking this year. How they’ve done it is pretty simple. More than any other retailer, they make it possible for customers to get superior product quality and superior savings. With the pandemic and safety-driven customer behavior receding, customers are retraining their focus back on what has always mattered most to them: getting more for their money. H-E-B is simply best aligned to what matters most to customers over the long-term.

What has enabled H-E-B to defy the laws of grocery physics and simultaneously deliver superior quality and savings? The full answer is likely complex. It involves a dogged adherence to the right strategy, with well-coordinated execution across the entire value chain. But if I could point to one thing that would most explain their success, it would be their private brand organization. H-E-B ranks near the top of the market in the customer perception of “I love their private/store brands,” and they rank #1 in “their private/store brands save me money.” They even beat Aldi on this latter measure, for whom private brand is perhaps more famously central to its strategy.

- The most loved private brands and a mention to Target

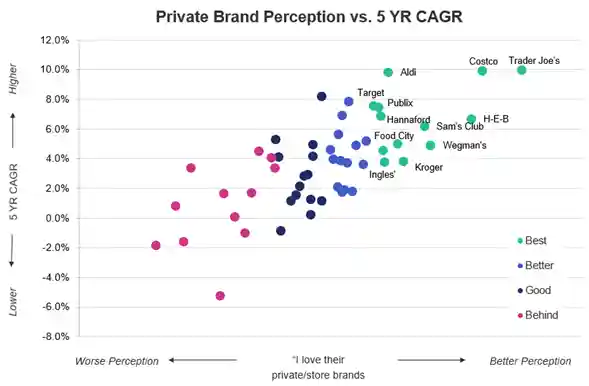

In fact, the top five retailers on private brand love perception are some of the best positioned retailers for long-term grocery success (see our overall RPI rankings). Trader Joe’s, Costco, H-E-B, Wegman’s, Sam’s Club… these are four very different retailers with one thing in common: a best-in-class private brand organization.

Additionally, there is Target. Many headlines about them have been focused on their digital transformation the past few years. However, what the rest of the market should take notice of is their improvements in private brand. They’ve gone from market average on private brand love perception in 2018 to the top quartile in 2022 (ranked 13th on private brand love, out of 60+ retailers), thanks to their excellent rollout of the Good & Gather brand which launched in 2019. In three short years, Good & Gather became a $2B brand. For context, it took Kroger’s Simple Truth five years to hit $2B.

- What great Private Brand perception means for long-term growth

The impact of excelling at customer perception of private brand are compelling. Not only does private brand success help with profitability, it also helps the topline. The top quartile retailers on private brand love have an average 5 YR sales CAGR of 8.6%, compared to 4.7%, 2.8% and 1.3% for the 2nd, 3rd and 4th quartile private brand retailers, respectively.

In the near future, private brand is likely going to become more critical than ever for retailer growth and profitability. Saving customers money is more important than it was in 2019, and this shift started back in 2021, before record inflation took hold. A period of extended uncertainty – between the pandemic and record inflation – will likely launch another extended period of value-seeking, much like the Great Recession launched the Discounter Decade of the 2010s. People are looking to retake some control, and grocery is the largest line item on the average household budget where people can make daily decisions to save money.

- What do best-in-class private brand retailers have in common, and what can retailers learn from them to better position themselves for the future?

- The entire organization adopts the mindset that private brand sits at the heart of the entire retailer’s value proposition.

- They have a private brand architecture that is aligned to their overall retail positioning, with a focused set of brands that span every major customer needs state, and with brand positions that are clearly articulated and well-maintained. (See how H-E-B is one of the closest adherents to the best practice architecture)

- They have a dedicated, internal private brand organization that has the right mix of retailer, brand marketer and analytical skills, and that is independent of but partners with merchandising and marketing functions at the retailer. This ensures that private brand is prioritized in assortment, communication, targeting and measurement decisions.

- They have a nuanced understanding of the most important categories and needs in which customers seek private brand, and focus their private brand resources on those categories and needs.

- They build private brand love among associates, so that associates not only buy these products but take pride in selling and evangelizing them with customers

It doesn’t take long to type this list of to-do’s, but it can take years to put this organization in place for the long-haul. Once that’s done, customer loyalty and dollars are solidified. This is why H-E-B’s leadership in this area is a huge competitive advantage, now and for the foreseeable future.

TOPICS

The latest insights from our experts around the world