Multichannel retail pharmacy part one: the ecommerce boom

Retail, in its purest form has, and will be, building long term, meaningful, connections between customers, retailers and the solutions they offer. How do you provide them with the best possible way to meet their needs, at the right place, right time, and at a fairly perceived, mutually beneficial exchange?

This interaction, which used to be simple and straightforward, has become significantly more complex with the advance of technology and questions about how it can be used for purchase and fulfilment. While innovation and evolution have always been a constant, Retail Pharmacy is in the midst of a paradigm shift as it moves closer to healthcare. The role it plays in customer and patient lives has expanded, resulting in increased expectations from those customers on these purveyors of health and wellness.

This three-part series explores how this strategic shift, customer embrace of technology, and the overall accelerant provided by a global pandemic have translated to a very disruptive environment. And in no way has this been more apparent than the proliferation of ways customers can interact with retail pharmacies when purchasing goods and services.

In the first part of this series, we take a look at how the ecommerce boom has heralded an acceleration in innovation.

The ecommerce boom

Ecommerce in retail, and specifically in retail pharmacy, is not a new phenomenon. The earliest transactional websites went live 25 years ago, and app ecosystems developed 10 years later with the introduction of smart phones. These innovations allowed consumers to be more deliberate in their purchases, with greater opportunity to research products and compare pricing across retailers, whether historic industry leaders or new digital upstarts.

As a result, traditional retail pharmacies implemented strategies to cater to these customers, highly competitive pricing for example, that were not necessarily aligned to the brick and mortar business. There was limited concern as the total percentage of sales was quite small and even with strong annual growth, only represented 5% or less in sales as recently as 2020. Despite the small numbers, growth in digital was key to futureproofing the business as continued innovation began to clearly weaken the traditional competitive advantages offered by broad networks of convenient locations. As the ability to purchase became more seamless through improved sites, apps, and marketplaces; major change was happening on the fulfilment side as well. Amazon redefined delivery through speed and generous returns policies.

This acceleration of delivery expanded the viability of the fulfilment method. Items shipped to home were no longer limited to expensive or hard to find items but also everyday products and took on a convenience dynamic. In order to complete, retailers adopted similar offerings through internal development or partnering with third party intermediaries. Additionally, legacy retailers added click & collect (C&C) options, something digital-only players could not. This last innovation completed the decoupling of purchase and fulfilment from purely offline (buy and receive in-store) and online (buy digitally and shipped directly) to a blend of both. With the infrastructure broadly in place, consumers continued to change their approach to shopping, but it took a once-in-a-century event that essentially forced people, in the name of health and safety, to rapidly learn and exploit these digitally-driven solutions.

Ecommerce growth has rocketed as a percentage of sales, even for retail pharmacies whose locations were deemed essential to remain open during the initial months of the pandemic. As restrictions eased and consumers began to return to physical locations, the landscape has changed. Customers with a multichannel relationship with the retailer are demonstrating significant change in their behaviours and value to the business. These customers are not the traditional ecommerce-only customers that represented a niche segment for the business, but are a much larger and more representative set of a retail pharmacy’s core customers.

Despite the in-store resurgence as Covid-19 moves to an endemic status, digital growth has resulted in greater volume of sales online; driven by multichannel customers. It is imperative for a retailer to understand these customers and how best to serve them in order to thrive in the new era of retail. It requires a deep understanding of customer behaviour and a critical look at their digital strategies to ensure they are best positioned for this new normal.

First, a hard look at the numbers to understand that this is not the slow ramp of years past or a one-time impact from Covid. While the specifics may vary, we have seen ecommerce sales growth of 80%-150% during 2020 in the midst of stay-at-home orders and business shutdowns, but even as restrictions eased in 2021, ecommerce growth continued at levels between 40-75% YOY on a significantly larger base of revenue. Pre-pandemic digital sales have moved from 2-4% to north of 10% across pharmacy businesses. For those who question how much of this business can shift online, one pharmacy client now sees 20% of total sales coming from digital channels. While growth as a total % of sales has slowed, it is still buoyant. More importantly, it has reached a critical mass of customers and can significantly impact profitability and future growth strategies.

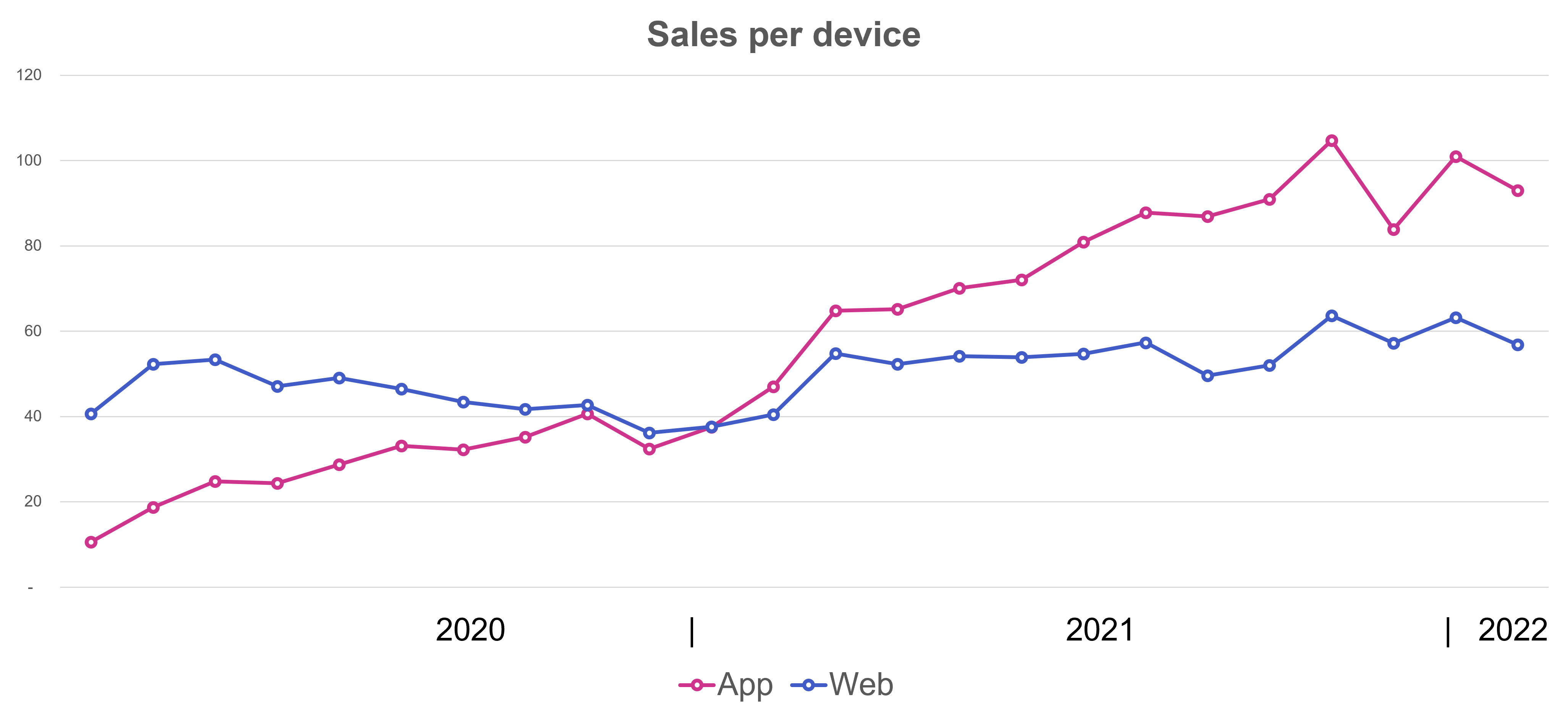

One other key development during this time is the method by which customers engage in digital. While use of the website has continued to grow, app revenues has increased at 7x the amount, making it the dominant digital purchasing point of contact.

With the establishment of these new patterns, more needs to be understood about these customers. Who are they? New or existing? Are they valuable customers? They are making digital sales of undeniable importance, but are they deal seekers to manage or high-value customers that must be aggressively grown and maintained? As we dig into the details of this customer behaviour, we endeavour to build a picture that will allow retail pharmacies to review and optimise previous go-to-market methods as well as understand the necessities and benefits of new plans of action.

If one thing is for certain, these new multichannel customers are not your legacy online business. Online-only customers, who previously dominated the digital retail space of legacy retailers, consistently ranked low in frequency and spend; typically just 50% of the average instore shopper. Given the convenience-oriented business model, those that relied on digital typically looked for very specific items or deals, resulting in infrequent and generally non-loyal customers. Given their historically small size, they did not have a great impact on the business. The multichannel customer that has gained so much traction in the last two years is different and deserves far more attention.

Multichannel customers across the spectrum of device and fulfilment are, on average, 3x more valuable than traditional instore only shoppers. While the defining factor of these customers is their embrace of non-traditional shopping methods, Over 60% of their transactions are still in-store purchases. While these insights are striking, one might consider if high customer spend is simply a characteristic of multichannel customers and not a change due to this offering. Are digital sales simply cannibalising sales that would have taken place in store? While likely that there are a few item purchases that jump from instore to online, the overall spend points conclusively to incremental purchasing as their instore spending remains consistent regardless of online engagement levels. Additionally, overall instore frequency increases, which, combined with a 25% higher spend per trip online, generates very valuable customer across both channels. As a result, multichannel customers have an outsized impact on retail performance and are critical to attract, develop, and retain.

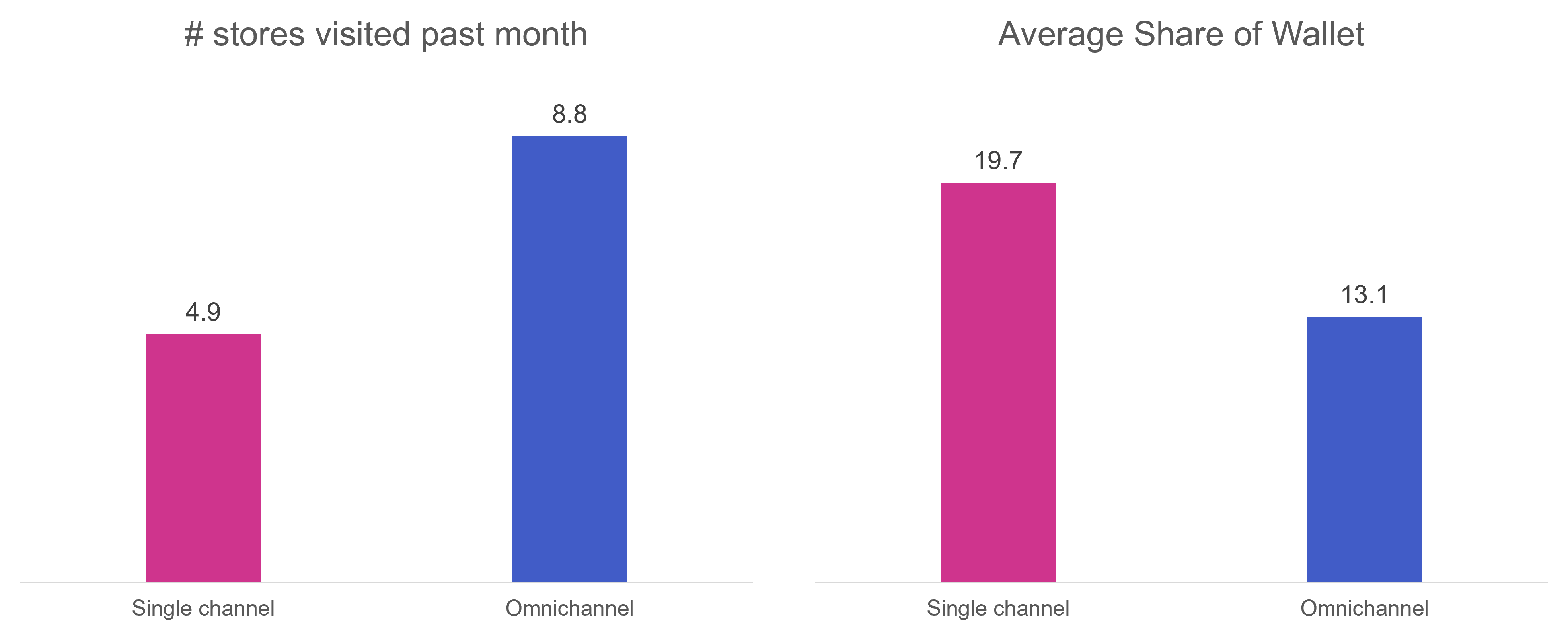

With such strong levels of engagement with the retail pharmacy, one could assume that these customers are inherently loyal. In the past, this would most likely be true, however, the adoption of multichannel retailing is actually showing an opposite effect. Insights from dunnhumby’s proprietary RPI studies indicate that as customers become more comfortable with multichannel shopping, they are interacting with more retailers and concentrating less of their spend at any one retail pharmacy. In fact, they visit nearly twice as many retailers per month than single channel customers (of which 97% are bricks and mortar customers).

Intuitively, this starts to make sense as the competition is no longer down the road, but simply a flip of the screen or app on the phone. This new reality, only serves to reinforce the necessity to drive your business in a customer-focused manner and ensure that your multichannel proposition is laser-focused to their needs. Whether you are looking to develop or refine the proposition, one must go even deeper into transactions and value to understand what best suits the customer needs across the increasingly complex offering within retail pharmacies.

References: Numbers referenced in this article are based on dunnhumby data or anonymised dunnhumby client data, and rounded to the nearest significant number for simplicity

TOPICS

RELATED PRODUCTS

Amplify Customer understanding to create strategies that drive results

Customer First solutionsMake Retail Media work for your business with Customer Data Science

Retail Media solutionsThe latest insights from our experts around the world