Assessing Consumer Behaviour in a Cost-of-Living Crisis

Global inflationary pressures, rising food prices and other personal finance concerns for customers are bringing new challenges to the grocery market. After the coronavirus pandemic, the cost of living crisis is now taking centre stage and it is impacting customer behaviour in new ways.

First launched in 2020 and regularly revisited, the dunnhumby Consumer Pulse study shows findings from 300 shoppers in each individual country, tracking trends and highlighting changing habits to help retailers adapt their strategy.

Here we assess four key findings from Wave 9 of the study for South Africa.

- Personal finances are not yet as bad as the economy – but perceived inflation continues to bite

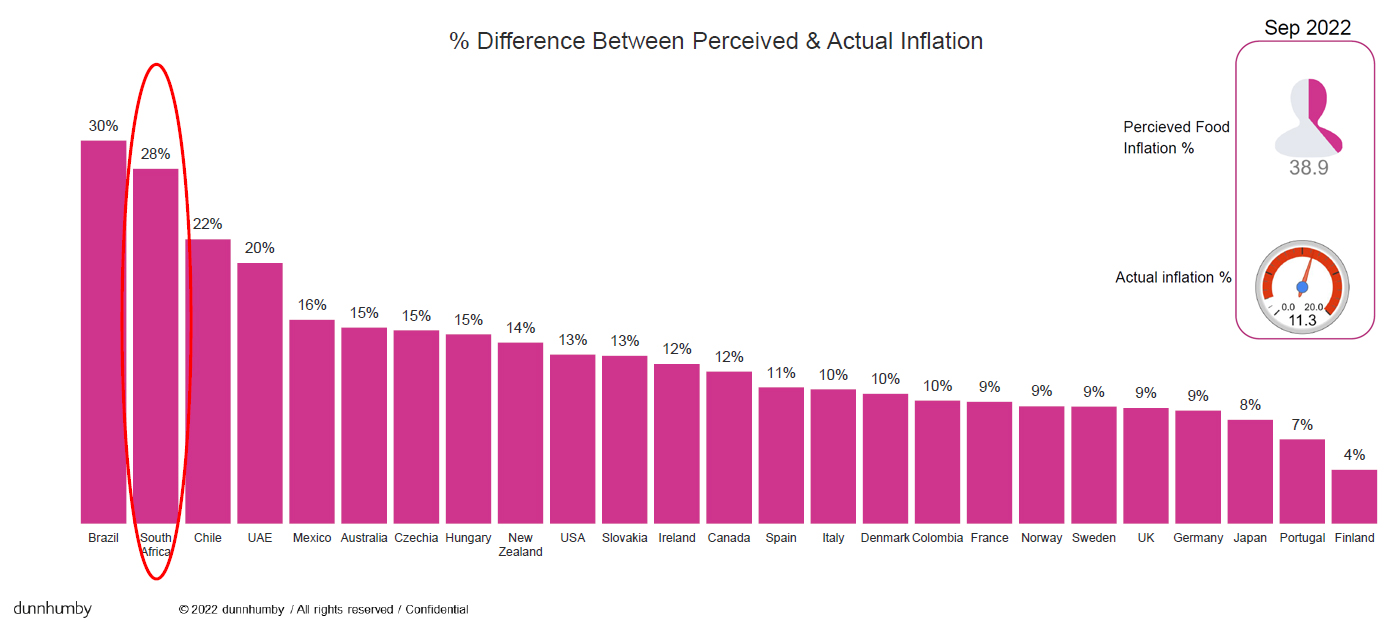

Food prices in South Africa were up 11.9% year-on-year in September 2022 (the highest since January 2009) and 11.3% year-on-year in August 2022 – and those increases are evidently being noticed by consumers. More than nine in ten respondents (93%) in our study felt food prices are higher than they were a year ago.Seven in ten (71%) of people say that their own finances are weak and even more (86%) say that nation’s economy is weak. However, as with other nations across the world, perceived food inflation in South Africa is much higher than actual inflation – 38.9% perceived against the reality 11.3%.In September 2022, South Africa had the fourth highest perceived food inflation in the world, even though it is the lower half of all nations for actual food inflation. That makes South Africa second highest globally for the difference between perceived and actual inflation.

- Customer satisfaction is highest in the world

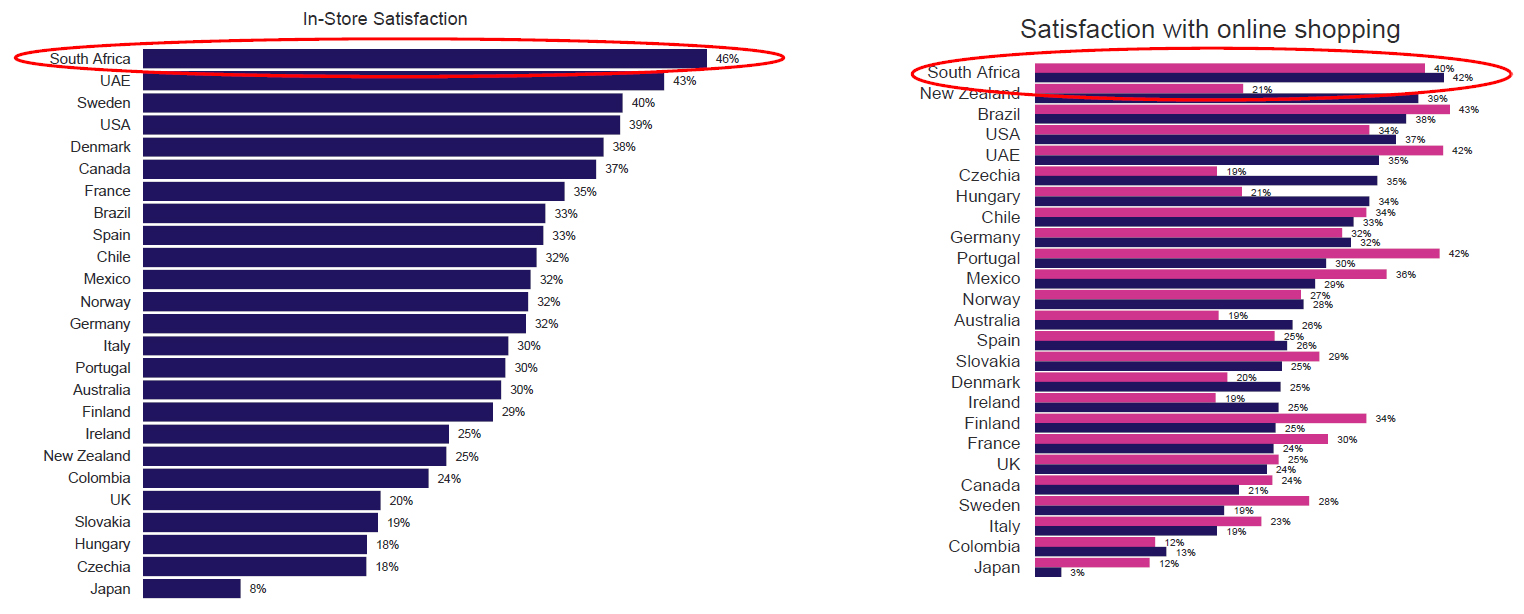

If retailers are to maintain customer spend in times of high inflation, it is vitally important that they meet and exceed expectations. South African retailers are doing better than any other country in the world in dunnhumby’s study.In-store satisfaction amongst South African shoppers was 46% in September 2022, click & collect satisfaction was 40% and delivery satisfaction 42%. These are the highest in the world, with satisfaction for online shopping channels around 28% higher than global averages.

- Customers are using value seeking strategies

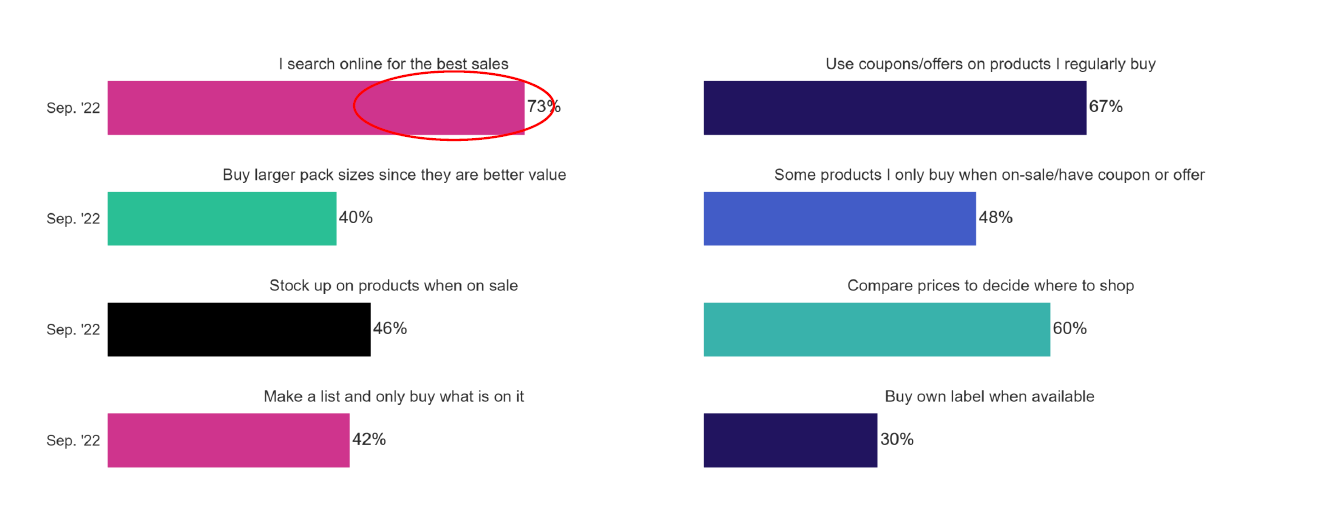

As you would expect in a period of high food inflation, customers are using value seeking strategies – and some strategies are more evident in South Africa when compared with the global average.Nearly three in four (73%) shoppers in South Africa say they search online for the best sales (compared with 45% for the global average) and two thirds (67%) use coupons and offers on products they regularly buy (against 52% globally).

- South Africans are health conscious

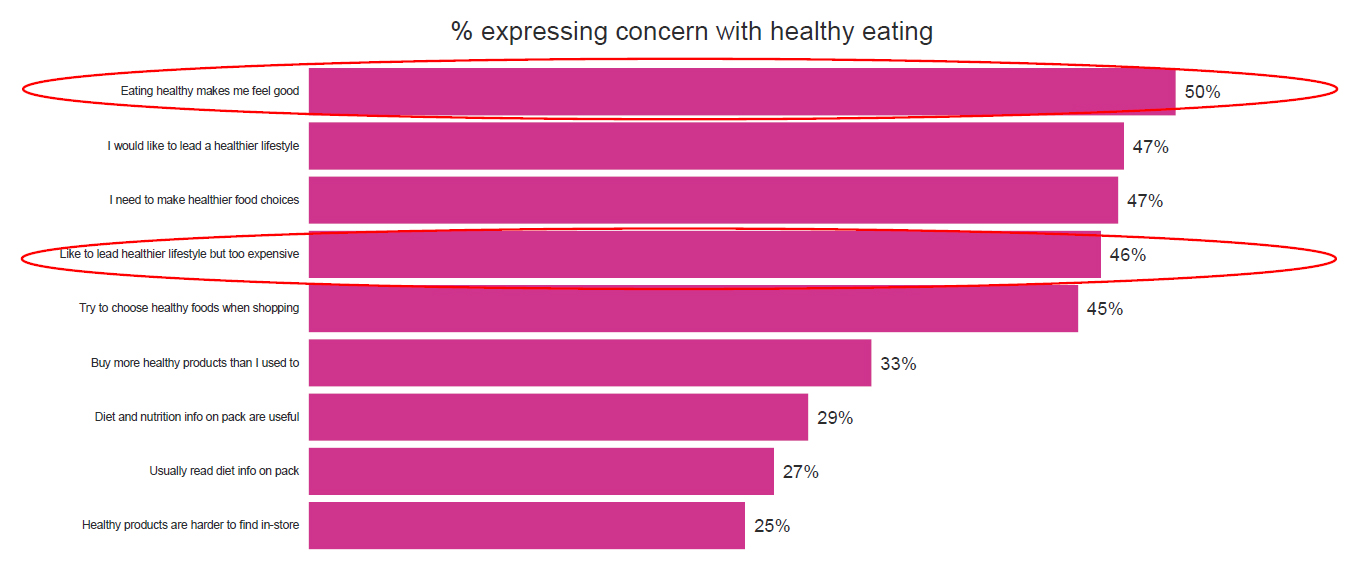

More than half of customers in South Africa are ‘concerned’ with health, which is the second highest globally. Half (50%) of shoppers in our study say that eating healthy makes them feel good, compared with a global average of 39%.Nearly half (46%) say that they would like to lead a healthier lifestyle but it is too expensive, against 26% globally. Suppliers and grocery retailers in South Africa may need to emphasise other aspects of healthy products, such as taste, to add perceived value if they are to capitalise on demand for healthier foods.

Conclusion

Trading Economics predicts that food inflation in South Africa will begin to level off and should trend around 5.6% in 2023, but our study shows the continued impact of perceived inflation and there is no quick fix.

Retailers must continue to focus on value seeking trends and customer satisfaction across all channels if they are to maintain market share.

We will be continuing the track these trends through dunnhumby’s Consumer Pulse surveys in 2023.

TOPICS

RELATED PRODUCTS

Amplify Customer understanding to create strategies that drive results

Customer First solutionsThe latest insights from our experts around the world