Declining mental wellbeing and changing behaviours: exploring the true impact of the cost-of-living crisis

Late 2024. That’s the Bank of England’s estimate for when the current inflationary period will come to an “end”, closing off three years that have been defined by eye-watering price increases. From checkout counters to check-in desks, and from mobile phones to mortgages, the cost of living has risen precipitously over the past 24 months, putting many households under growing strain.

How exactly have those rising costs affected the mood and behaviour of the nation, though? How are people dealing with the situation at an emotional level? What actions have they taken to try and reduce inflation’s impact, and how are those decisions manifesting in grocery specifically?

Shopper Thoughts is dunnhumby’s customer panel. Designed to answer questions like those above, Shopper Thoughts provides access to thousands of grocery customers , allowing consumer-packaged goods companies to get a read on everything from macroeconomic trends through to in-depth views on , brands, retailers, and channels . Key themes explored through Shopper Thoughts include brand engagement, likelihood to purchase, and the response to marketing campaigns.

For the past year, in addition to a number of brand-specific studies, we’ve been polling our panel on a range of inflation-related topics. With our latest wave of research having been completed just a few weeks ago, and with more than 12 months of data behind us, we now have a good picture of the UK’s current attitude towards the rising cost of living. Below, you’ll find insight into a few of the standout themes.

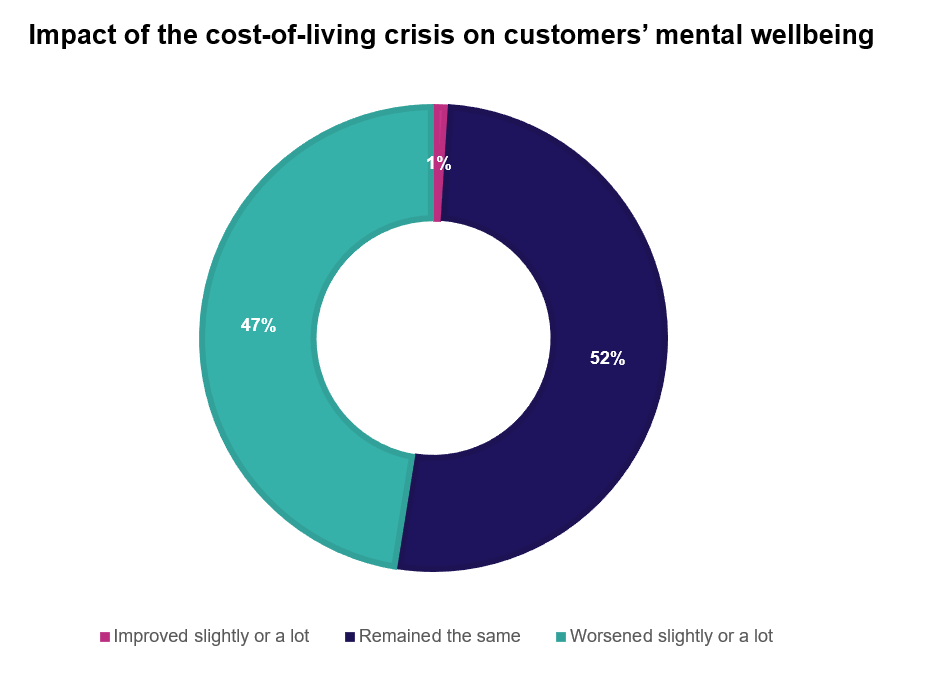

Inflation is having a direct – and deleterious – impact on mental wellbeing

One of the starkest issues highlighted by our latest round of research is the link between the rising cost of living and mental health. Asked how the economic circumstances of the past two years had affected them, almost half (47%) of respondents suggested that their mental wellbeing had declined as a direct result of the cost of living crisis.

The cost of living crisis is having a direct impact on mental wellbeing. One in 10 respondents say that their mental health has worsened “a lot” as a result of rising prices.

While age and gender do appear to cause some subtle differences here, this largely remains a story of the “haves and have-nots”. Qualitative responses show a clear divide between those who have a financial buffer against inflation and those who do not. People who are struggling to make ends meet say that current circumstances are “scary” and “stressful”, with many stating that they are “very worried” about what the year ahead might hold. Brenads and retailers will play a critical role in minimising the impact of inflation where possible to mitigate the dire circumstances that many customers face.

Buying behaviours are changing – with core categories now impacted

To see how inflation might be affecting grocery shopping specifically, we asked whether respondents had started to cut back on their spend – a question that we also posed back in April 2022. While just over half (56%) told us that they had scaled back or stopped their spend in at least one category a year ago, a full two-thirds (66%) now attest to having done so.

Two-thirds of UK customers have now reduced or eliminated their spending in at least one category. That’s up from 56% that said the same last year.

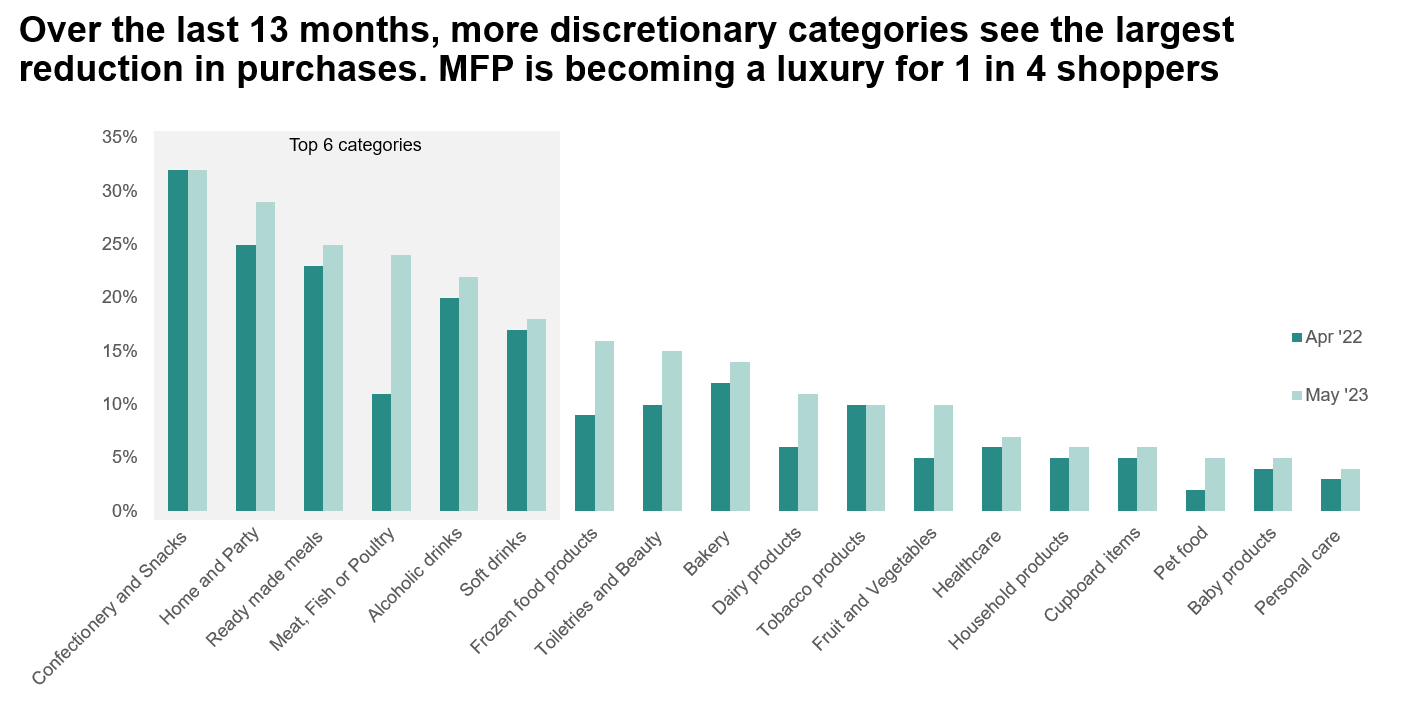

Looking at individual categories, a first-glance would suggest that shoppers are focusing their cutbacks around discretionary spend. Confectionary and Snacks (32%), Home and Party (29%), and Ready Meals (25%) are the areas in which most people have reduced or stopped their spending. When we compare responses from today with those from a year ago, however, it becomes apparent just how hard inflation is beginning to bite.

Spending on discretionary products has fallen the most due to inflation, but a growing number of shoppers are having to scale back in core categories too.

Between April 2022 and today, we see growing evidence that a number of shoppers may be reducing or eliminating their spend across several core categories. Cutbacks in Meat, Fish, and Poultry (11% last year to 24% today), Frozen Food (9% to 16%), Dairy (6% to 11%), and Fruit and Veg (5% to 10%) show that many customers are now having to make even harder choices about where to save money.

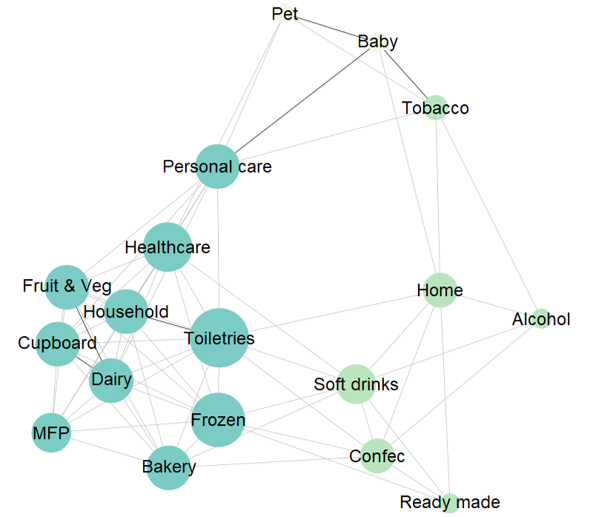

One interesting addition here: we also see evidence to suggest that there is an almost viral aspect to cost saving. Put simply, when shoppers reduce their spend in one category, they’re likely to cut back in another closely related area as well. If someone buys fewer Toiletries & Beauty products, for instance, the chances are that they’ll also buy fewer Household products too.

Cutbacks in one area can prompt similar reductions in linked categories. Shoppers who reduce their spend on Fruit and Veg are likely to do the same in Dairy, for example.

Own-label on the up as shoppers explore cheaper alternatives

Value seeking behaviours appear to have become increasingly common over the past 12 months, with customers reporting actions ranging from shopping around for better prices through to scratch cooking and home baking. Naturally, many shoppers say that they have started to scrutinise their spend on national brands as well, with those products often perceived to be more expensive than own-brand alternatives.

In our Shopper Thoughts study from September 2022, 47% of respondents told us that they were planning to cut back on (or stop) buying branded products in the coming months.

Checking in again today, the reality is that 56% of customers say that they’ve reduced their spending on national brands, demonstrating the degree to which money-saving behaviours have been adopted in the time between the two polls. This intent appears to be translating into actual behaviours, too; other sources suggest that private label sales have grown by more than 14% in the past year, and now account for almost 55% of the market

While there is undoubtedly an element of attrition at play here – some customers simply cutting out those products altogether – own-brand sales do seem to be growing in kind. 44% of respondents said that they’re still buying those specific items, but are simply “trading down” to own-label versions.

As the cost of living crisis continues, and even in spite of the Bank of England’s reassurances that inflation will soon begin to ease, it is clear that retailers and brands need to keep pace with the resultant impact on shopping behaviours. As shown by the results of this latest study, new behaviours are still in the process of being formed; the challenge now lies in adapting to them effectively.

[1] The facts and figures behind own-label's incredible growth – The Grocer, 14 May 2023

TOPICS

RELATED PRODUCTS

Helping brands get the most from retail media

Retail Media & Audience Targeting solutionsMake Retail Media work for your business with Customer Data Science

Retail Media solutionsThe latest insights from our experts around the world