Discounters in maturity: understanding the retail phenomenon

Discount grocery retailers are firmly established in many countries now, but as maturity grows their offer is becoming more than just price. Here dunnhumby looks at the secrets to discounters’ success and how they are differentiating to keep growing their market share.

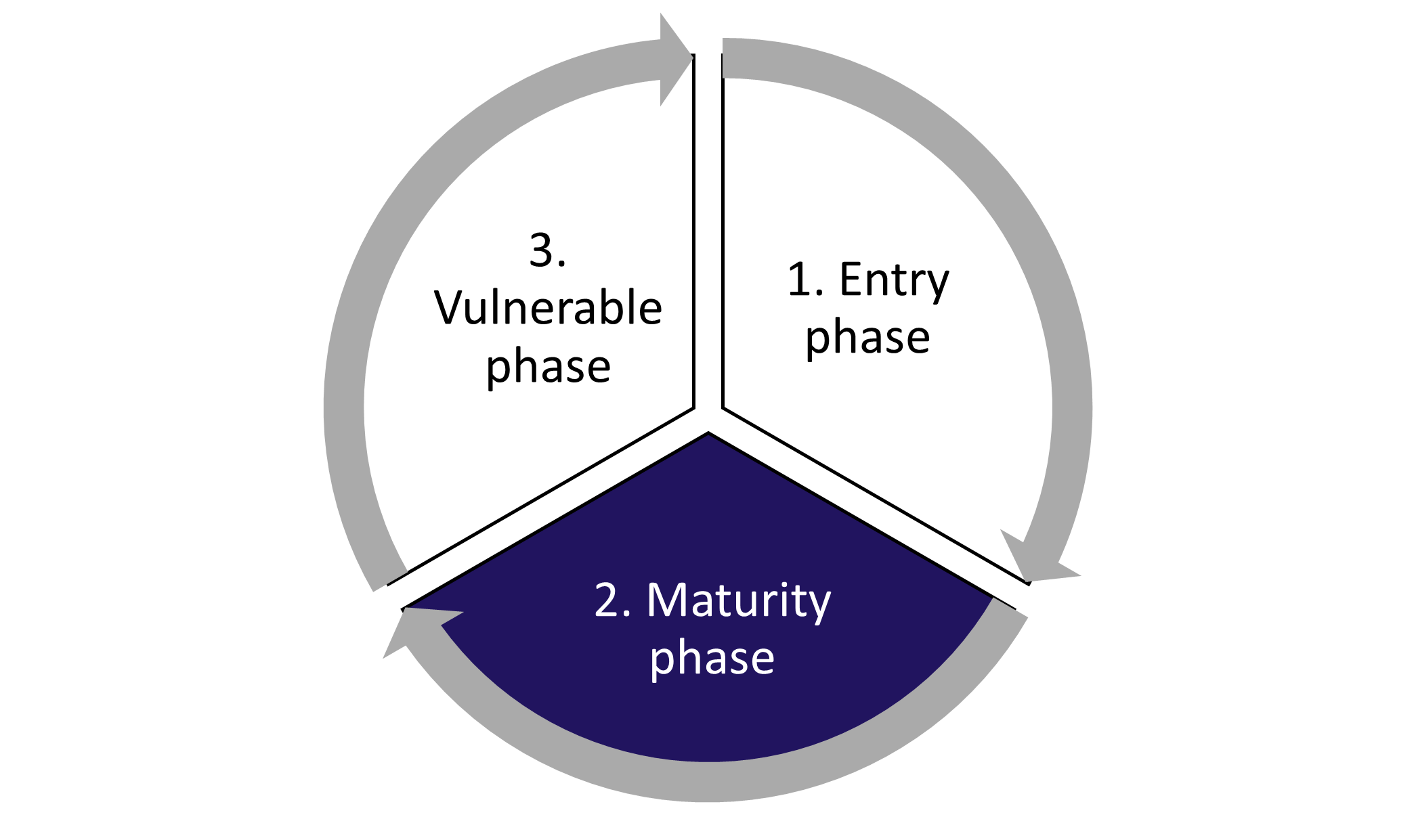

In the wheel of retailing shown below, discounters have successfully transitioned from the entry phase (low price, low margins) to the maturity phase in many countries (new services, higher margins).

In Norway, Germany, Denmark, Poland and others, discounters’ share is more than one third of the grocery market. In the UK, Aldi recently moved above Morrisons to break the long-standing ‘Big Four’ supermarket line-up, with Lidl aiming to do the same soon.

Such brands are no longer an emerging threat, they are propping up a thriving, rapidly maturing category which continues to grow market share.

In many cases, discount retailers emerged from the financial crisis of 2008 as consumers changed their shopping habits and value-seeking behaviours increased. At that time, discount chains worked on premise that they were less expensive, but that came with an expectation of lower quality and a ‘basics’ approach to customer experience.

Now, with a global cost of living crisis driven by food inflation, rising energy prices and a looming recession, shoppers are seeking value once again. The latest wave of dunnhumby’s Consumer Pulse Survey shows value seeking behaviours are growing as inflation bites. Discounters are well placed to take advantage, but with greater maturity in the current retail market, their ability to generate sales per store declines.

There are two challenges that this article will focus on:

- For discounters – how to evolve the value proposition to differentiate from competitors, retain customers and keep on growing in the market, without compromising on price?

- For non-discounters – how will discounters evolve over time, and what are the supplement benefits customers are valuing from their offer?

How to evolve in a discounter scene

Thanks to our RPI research we have been able to analyze the results from 29 discounters from 11 countries, examining the performance of discounters and what distinguishes successful vs. less successful discounters. The insights below are what we learnt.

While price is positively correlated with success in the discounter category, there is more to consider. In reality, there are two main trends currently used globally; service direction discounters – those that while keeping a good price, invest to enhance their offer on specific customer needs or benefits; and stay-hard discounters, who keep following the lowest price point strategy.

In the US market, for example, this is demonstrated by Trader Joe’s, the service direction discounter, which is OK on price, but rewrites the discount rule by focusing on quality and speed, alongside great prices only on organics. Aldi is the stay-hard discounter - best on price, good on speed but low on quality in comparison to other retailers.

Clearly not all discounters’ customers want to the same and there are contrasting approaches to success in Mexico in particular, where different discounters are using different formulas to win customers. Here Walmart – offering a combination of grocery and non-grocery products - scores higher in the dunnhumby Retail Price Index (RPI) 2021 for emotional connection, store experience and quality of products. Bodega Aurrera, a purely grocery business, scores higher on price.

With this in mind, let’s consider some specific strategies and considerations that are helping discounters to grow market share globally.

- Improving store experience

Evidence shows store experience drives preference and the greatest gap between strong and weak performers in our RPI findings are in store experience. But what exactly is ‘store experience?’

In practice, there are two dimensions. One objective is to deliver frictionless shopping, making it easy and fast for consumers to shop and check out, with convenient locations a key factor. The other is for an enjoyable experience – a pleasant, in-store environment, with friendly, helpful and available staff. For discounters, the first dimension is the one to prioritise.

- Showcase value

Discounters are innovating in many directions, but mostly on activities that can grow the value perception of their customers and improve the relationship with them. Under this umbrella, we’ve seen a proliferation of promotions – moving them from pure everyday low prices (EDLP) to mid-low pricing models and using loyalty and personalisation to drive CRM initiatives. The key here is that they are investing on non-price levers to have an impact on value perception. Future-proofing stores, driving regional partnerships and increasing ecommerce possibilities are all ways in which they are innovating to succeed.

- ‘Discountvenience’

Another shift is the way in which discounters are matching more non-discount retailers with urban store propositions. Aldi Australia has opened stores in urban locations where their range brings an ‘on the go’ experience, with a wide range of bakery and food-to-go products – this is a good example on driving innovation that connects value and in-store experience.

- Reduce, reuse, recycle

Sustainability has come to the fore in recent years and another strategy by discounters has been to increasingly drive ESG with a positive impact on price perception. Lidl has established partnerships to create closed loops for plastic, reducing the environmental impact of its operations and tapping into consumer demand for improved ESG performance.

A non-discounter’s perspective

Of course, we must also consider the response of non-discounters as they seek to mitigate discounter growth. How can they react and what should they be doing in a changing market?

Much of this comes down to understanding customers better. Retailers need to which of their customers also shop with discounters – and why? What key shopping missions and categories that has prompted customers to switch to discounters? Once this is established, retailers can act on these insights with strategic and tactical initiatives. They can leverage the strengths of their own brand and proposition in relation to discounters’ weaknesses (e.g. loyalty card, service) and build new offers on their relative weaknesses. It could be a case of highlighting the pharmacy offering, the gastronomy service, or the mix of brands and deals people can find at a retailer’s store. These are all great examples of distinctive activities that help set a retailer apart from discounters and good options about which retailers can remind less loyal customers.

Another solution is to assess the value perception of stores, compared to discounters, and develop effective responses to improve the they way retail levers can be used to deliver stronger value message to your price sensitive customers, or to those who are switching to discounters.

As with any retail strategy, the most important thing is to test, measure and adapt. Review the impact of your action using customer ROI measures connected to loyalty KPIs at customer and category levels.

Get in touch

If you want to understand more about discounters in the current grocery market, whether you are a discounter looking to take advantage or a non-discounter seeking to protect share, get in touch with our expert team. dunnhumby Inflation Discovery & Plan enables retailers to identify the priority actions they can take and the key areas to absorb inflation to deliver to the changing needs of their customers, while creating savings to protect their margin.

Get in touch with your local dunnhumby representative for more information.

RELATED PRODUCTS

Amplify Customer understanding to create strategies that drive results

Customer First solutionsThe latest insights from our experts around the world