Price Line Strategy – when and how to differentiate prices

Imagine you’re in the supermarket to buy some yoghurt. The most important feature for you is that the yoghurt is lactose-free, so you search that section of the fridge area. You quickly identify your size and brand and start to think about which flavour to go for. But how unfair does it feel when you discover the flavour you want is more expensive than the other flavours?

Customers don’t care about different cost per SKU (stock keeping unit), or slightly different line extensions. They want logical shelf prices that make it easy to find the products that meet their needs. This requires a balance of art and science, and the retailers who get this right will find themselves with more loyal customers and stronger price perception.

Confusing line pricing is a problem

A common strategy for retailers with extended product lines is to differentiate prices on the higher-level need states while assimilating prices on the lower-level need states. Products with similar prices within a need is what we define as line pricing, but it is also known as family pricing or series pricing. However, a quick search online reveals a lot of bad practise when it comes to logical line pricing at some supermarkets. Here are some examples uncovered:

- Different prices for black vs. blond hair colorant with same brand and need

- Different prices for same size, brand and need within yoghurt category

- Different prices for shampoo and conditioner within same brand, size and need

- Confusing additions to some product lines without clear rationale to the customer for the price differential

So there clearly is a challenge to get this right both online and in-store, but how do we define needs from a customer perspective? And how can we use this insight to set logical line prices?

Some theory on logical line pricing for customers

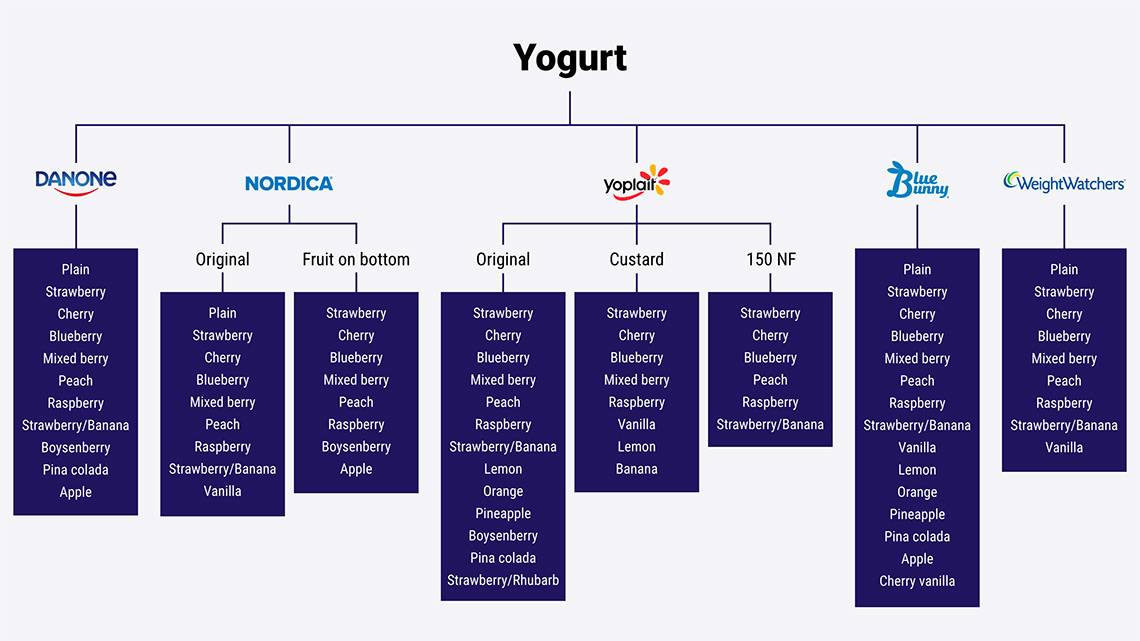

To explain what we mean by different need states let’s turn to the yoghurt category at a European retailer. A Customer Decision Tree takes into consideration the substitutability of each product as well as the breadth in the coverage of customer needs. At the root of this Customer Decision Tree, we have yoghurt. Underneath the root, we have the brand preferences such as Danone, Nordica, Yoplait, Wells Blue Bunny and Weight Watchers. Finally, we have the lower-level need states such as Fruit on the Bottom and Custard.

Figure 1 – Customer Decision Tree

Every year thousands of new products enter the market and a lot of them are extensions to existing product lines. This means that retailers get to benefit from existing supply chains and build on established brands. However, from a pricing perspective the question is whether to price in line with existing products or to expand the price ladder. On the other hand, retailers who differentiate prices provide a broader offering that could better capture a wider set of customers willing to pay different amounts.

Furthermore, if customers’ choice is driven by flavours, firms could be better off pricing popular flavours low to attract buyers. Conversely, if customers perceive all flavours within a line to be similar, then having the same price for all flavours makes more sense. In a study conducted by Draganska and Jain (2006)1 the researchers found that customers in the yoghurt category value line attributes (higher-level need states) more than flavour attributes (lower-level need states). This confirms the current best practice of uniform prices within lower-level need states and differential prices across higher-level need states.

A practical framework for retailers

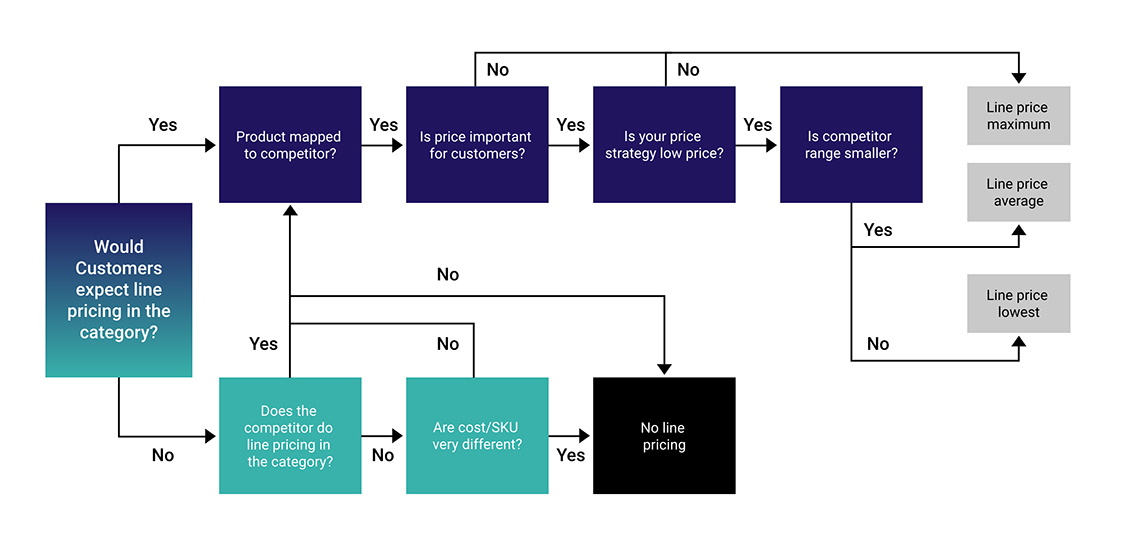

Understanding the Customer Decision Tree will provide insights into which group of products to price uniformly. However, a decision needs to be made about whether line pricing is the right thing to do, and if it is, should prices be benchmarked against the lowest, average, or maximum price? This process of tailoring your line pricing and setting the right benchmark will include elements such as:

- Customer expectation

- Price importance

- Competitor range and price strategy

- Cost per SKU (stock keeping unit) and margin considerations on aggregate level

- Pack size execution in-store

The question on customer expectation is especially worth understanding well and should be the key factor driving this decision. Online panels with the ability to connect what people say with their behavioural data (price sensitivity, cross-shopping etc.) is a great approach but focus groups or smaller surveys can also help. A simple way would also be to look at the Customer Decision Tree as a proxy to what customers would expect in terms of line pricing.

Generally, line pricing items across substantially different pack sizes is not advised as that might go against the expectation to get bigger value with bigger packs and could cause problems with store execution. Furthermore, expect more challenging conversations if you consider uniform pricing across brands as many suppliers prefer brand blocking rather than needs-based spacing2. Spacing products together will likely increase the expectation of line pricing i.e., if the products aren’t together, line pricing could be relaxed.

Finally, from a practical perspective, understanding the margin constraints on an aggregate level might be a critical part of the analysis to progress this conversation internally. For example, if the retailer is price matching, a typical product price war will impact the price point of the whole line.

Figure 2 combines the above elements into a simplified “Yes/No” decision tree that can be used to highlight gaps in understanding and can help determine the right outcome3.

Figure 2 – Price Line Framework

Recommendations for retailers

Price lines can be a powerful way to provide fair prices that your customers can trust, and that build on established brands. However, without the right data, you run the risk of confusing customers and damaging your value perception. We recommend three strategies for getting line pricing right:

- Get insights into the different need stages. dunnhumby Assortment is an excellent tool to profile need states and understand price sensitivity

- Use qualitative insights such as a panel or focus groups and behavioural insights to answer questions on attitude and price sensitivity

- Go through the Price Line Framework to identify gaps in understanding to determine the right approach

- Learn more about our Pricing and Promotions solutions for Retailers and for Brands.

1Consumer Preferences and Product-Line Pricing Strategies: An Empirical Analysis by Draganska and Jain (2016)

2I’m assuming that line priced items will also be spaced together in the store

3When no competitor alternative exists, conjoint analysis can be used to set price level

TOPICS

RELATED PRODUCTS

The latest insights from our experts around the world

Navigating a shifting world: the headline results from our latest Consumer Pulse

Keeping it relevant and authentic: engaging consumers along the purchase journey