How maximising your media assets can create a sustainable new revenue stream

We’re all aware of the surge in ecommerce and its impact on grocery retailers. Grocery ecommerce rose from 2%-3% of all grocery sales before the pandemic to as high as 14% during its peak. Whilst there is every expectation that this figure will settle somewhere in the middle, figures show that British shoppers spent £1.4bn on groceries online during the month of January, up 121% for the same period last year1.

Of course, grocery retail is already a sector with narrow margins, which faces increased pressures from incumbents, discounters and digital natives like Amazon and Ocado. This accelerated shift of consumers to online channels only adds to the squeeze because as we have already explored in our ‘Grocery Beyond the Tipping Point’ report, scaling up an ecommerce operation is expensive; it requires a huge commitment in resources, from store pickers to delivery drivers, a fleet of vans to sophisticated digital assets.

As a result, there is increased pressure to drive new profit in the grocery sector. And one way to address this challenge is through building new revenue streams and monetising your data and media assets.

The era of retail media

With all of this mind, it’s no surprise that we’re seeing more and more retailers establishing their own retail media business to drive revenues. Traditional retailers are strengthening their position, as demonstrated by the likes of Carrefour Links, a new data-based business from the French grocery retailer, and Fnac Darty’s Retailink, offering ‘tailored, omnichannel experiences’. Retail media is no longer limited to the likes of Amazon and Alibaba.

Grocery retailers that can effectively pivot and establish their own retail media business are likely to reap the rewards – and with leading retailers seeing several million visitors to their e-commerce sites each month, they already have a vast captive audience that can readily be harnessed. By building strategic retail media networks through their existing digital platforms, grocery retailers can effectively build additional revenue streams and increase profit margins. We call it ‘maximising your media assets’.

The opportunities are clear. For a retailer running its core business on a 2% – 4% margin, the prospect of setting up a retail media business that could run at a 40% margin is appealing.

Not only do grocery retailers already have a vast online audience, but they also have access to data-led audience insights. First-party transaction and sales data enables advertisers to hyper-target and personalise communications based on actual purchase behaviours, not simply demographic, interest or intent – and for the first time access closed-loop, attributable measurements of success. It’s an incredibly valuable asset.

This unique combination of insight and volume has led to retail media establishing itself as the third biggest marketing discipline after broadcast media and digital media. And with grocery cementing its place as the biggest category within retail media, more grocery retailers are now investing in the opportunity.

Retail media Is not just ecommerce

Most or all of the focus on retail media recently has been on eCommerce. This isn’t surprising – a number of retailers have launched platforms focusing purely or heavily on eCommerce activation and the industry news has been similarly focused in this area. eCommerce is definitely a big opportunity for retailers launching media

But it isn’t just about eCommerce. Take Tesco Magazine, for example, which overtook The Sun in 2012 to become the UK’s most read printed publication. According to PressGazette, in 2020 nearly two million copies were printed, making it the highest women’s interest and lifestyle publication in circulation2.

For grocery retailers, eCommerce still represents a minority of sales and revenue opportunity. The majority – and in most cases the vast majority – of interactions grocers have with customers are in and around the store. By only focusing on eCommerce, retailers could be missing out on what is a bigger opportunity in their physical estate and other owned assets

What retailers need to focus on is bringing the same approach that they’ve launched in their eCommerce businesses to their entire estate, starting with the store. By having connected media through online and the store, as well as on owned and 3rd party direct channels, grocers can better join up their CX and massively grow both the size and the value of their retail media businesses. It’s not easy to get this right, but it is the right thing to do for grocery businesses and customers.

Using retail Media to enhance the customer experience

Whilst retailers have understood the potential and plan to act, there are several connected and significant barriers.

Structural challenges around linking and harmonising data across banners, channels, online and offline engagement and locations still prevail, as well as being able to build and derive insights from a single view of the customer. Connected loyalty strategies to create linked data assets are instrumental in powering the wider ecosystem.

Retail media has often been a channel-led approach, often with third party syndicate models allowing CPGs to buy into individual channels at scale across multiple retailers. Whilst these offer a light touch route for retailers to begin unlocking revenues, they result in a siloed approach to communications across disconnected channels. For CPGs this makes buying inefficient and ineffective as they need to ‘shop by channel’ and cannot manage audiences through the ‘sofa to store’ journeys that they are aligning increasingly blurred shopper marketing and advertising budgets to.

More significantly it results in a disjointed and less relevant experience for customers, who are bombarded with a bewildering set of untargeted offers and coupons, and having to work out what is relevant to them particularly through small-screen devices. The syndicate model exacerbates this. Restricted use of customer data results in less sophisticated personalisation across unconnected channels at a time when customers need and expect a more relevant curation of the experience.

This is having such an impact that it is ultimately influencing where customers choose to shop. Less engaged customers, who are less loyal, erodes the potential media asset and in turn restricts the retailer’s ability to maximise value.

Sustainable growth through a ‘flywheel’ approach

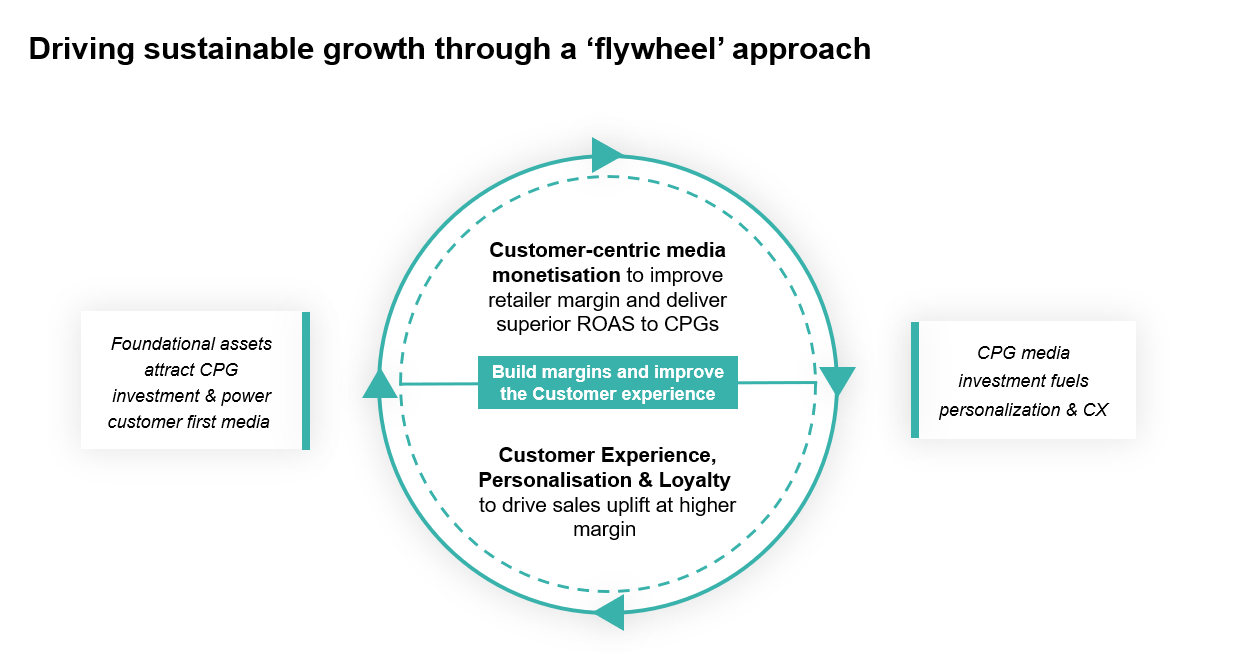

At dunnhumby, our success comes from driving sustainable growth for the retailer through a ‘flywheel’ approach where we combine our personalisation capabilities with our media monetisation capabilities.

Scaled, highly engaged audiences across measurable media are attractive to advertisers, helping capture the unfair share of advertiser spends into your retailer media ecosystem to further enhance customer experience. But it requires inspiring and engaging propositions that meet customer needs, executed with a joined-up, personalised customer experience.

Above anything else, any successful retail media business must deliver benefits for the retailer, the brand and the customer. If one of them is dissatisfied, the retail media business will fail.

The greater the customer experience, the higher the sales uplift is for the retailer, the greater the return on advertising spend for brands and therefore the higher the media investment from consumer-packaged goods. This leads to higher profit for retailers, enabling them to reinvest in the customer experience and thus the cycle repeats. Enhanced customer experience can also drive improved loyalty, which means more efficient promotional campaigns and reduced reliance on pricing because effective personalisation can drive price perception.

A compelling case for retailers

All of this presents a compelling case for retailers. The accelerated shift to grocery ecommerce has dramatically enhanced the value of retailers’ existing media assets, supported further by the demise of third-party cookies and the rise of first-party data.

At the same time, margins for consumer-packaged goods are under pressure and marketing campaigns are increasingly focused on online sales to maximise return on advertising spend through increased audience targeting and personalised solutions.

Effective retail marketing in the current climate allows for an end-to-end user journey, targeting consumers at all stages of the shopper journey. By using all media channels, from direct mail to ecommerce platforms, in-store and offline, retail media can deliver personalised, hyper-targeted marketing campaigns that deliver results and increase grocery revenues.

dunnhumby have always focused on both the digital and physical opportunities in retail media and have connected solutions to deliver highly targeted and measurable advertising to customers wherever they are – in the store, on ecommerce, via CRM and on third party addressable channels. And we’re excited to soon be launching our new platform to allow retailers to maximise the value of their media assets and create a sustainable new revenue stream.

The latest insights from our experts around the world