Covid-19 one year on: How the pandemic changed grocery retail

One year ago we launched the first of its global Consumer Pulse studies, designed to keep track of changes to consumer behaviours as a result of the pandemic.

Little did we know that twelve months later we would still be dealing with the impact of Covid-19. Further Pulse studies followed the initial survey, building a picture of the trends impacting retailers and brands around the globe.

Today, we examine results from the latest research, looking at just how much things have changed for retailers and their Customers in the last twelve months, and what, if anything, has stayed the same.

Twelve months on, trust and safety are still vital

Since our last study in December 2020, there has been progress in the fight against the virus. Successful vaccination programmes have offered a light at the end of the tunnel for many countries, yet the virus has not gone away. In many regions infection rates are increasing as governments navigate the largest vaccination programme in history.

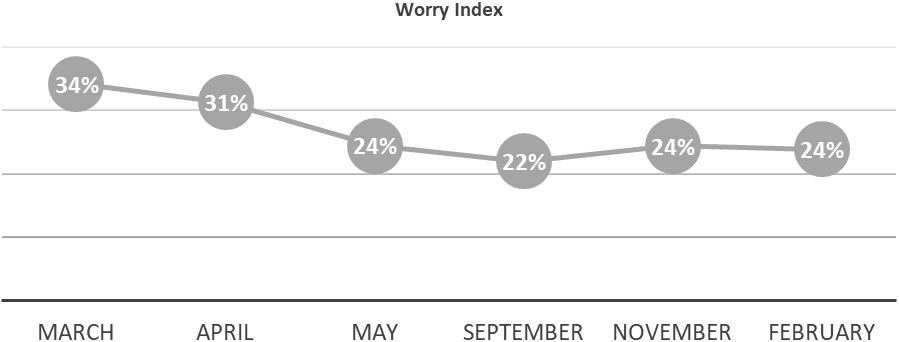

One of the primary issues that the research has focused on over the past year is the overall global attitude towards the pandemic. Expressed in the form of a “Worry Index”, this score reflects the extent to which consumers say they are concerned about the spread of the pandemic.

From a high of 34% in March 2020, the Worry Index steadily reduced throughout 2020 as consumers adapted to ‘pandemic life’, with some countries seeing a reduction in cases. However, since November, as infection rates rose, so again did the level of concern from consumers. The global score has remained constant into the new year, with one quarter of Customers continuing to class themselves as ‘worried’.

For retailers this is a clear indicator that Customers’ concerns have not gone away and shows that now is not the time to relax. Although there’s a light at the end of the tunnel, many consumers are still exercising caution, and retailers’ responses should reflect this.

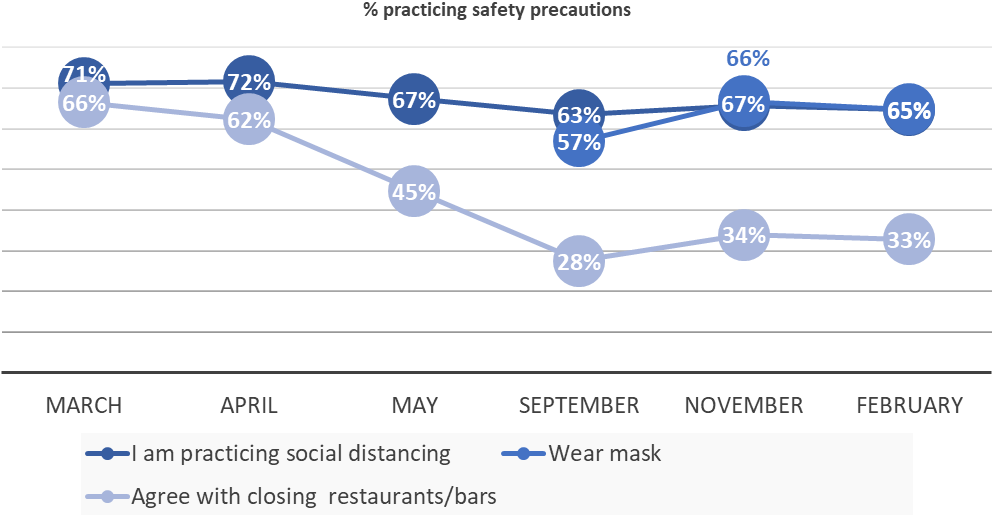

For instance, throughout the pandemic, retailers have been pressured with losing business from Customers who don’t want to wear face masks vs. from patrons who will only frequent places that require them, and this challenge is heightened further as several regions are now beginning to lift mask restrictions. Lately, when the US state of Texas ended its mask restrictions on March 10, both H-E-B and Kroger announced that they will still require any employees and Customers to wear masks until all grocery workers have access to the Covid-19 vaccine.

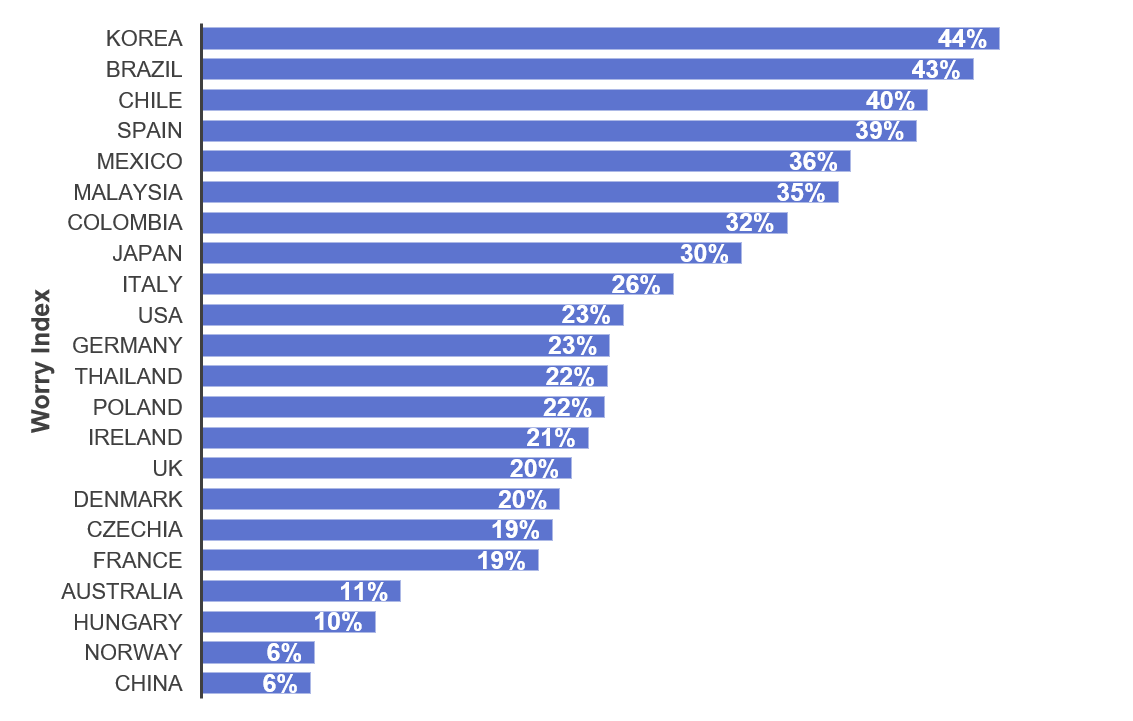

The level of consumer concern does vary between countries. Korea remains the market with highest level of worry with Norway and China on the other end. Only the US shows a meaningful change since November, declining from 32% to 23%.

This same sentiment continues with consumers’ views on restrictions. While the majority of people no longer agree that restaurants and bars should be closed, they are still taking personal precautions and are doing so at levels that have returned to the start of the pandemic.

Revisiting the Eight Emerging Trends

As the pandemic began to change shopping habits, we noted eight emerging trends:

- Value becomes a decision maker

- Localised shopping means new challenges ahead for retailers

- Food adventures will continue at home for foreseeable future

- Health, well-being, and humane behaviour become new benchmarks

- Online retail reaches tipping point

- Expectations for digital growth in tandem with the online boom

- Public goodwill must not be misspent

- Market consolidation will define the years ahead

One year on from the start of the pandemic, which of these trends are waning or growing, and what are our recommendations to retailers and brands?

Shoppers seeking Value

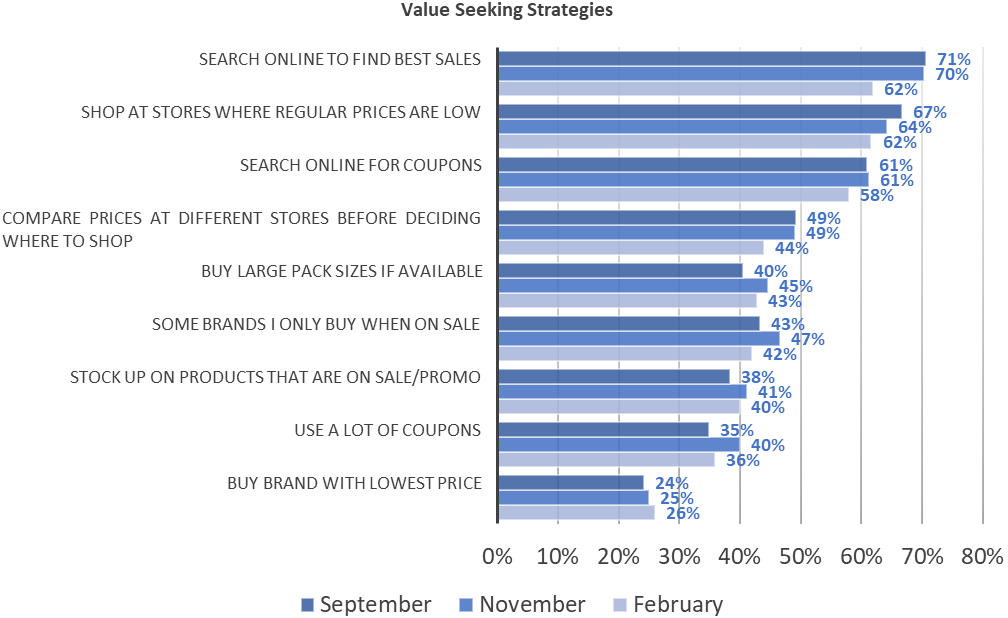

In previous studies, we noted that three factors are putting pressure on food budgets and pushing value to the front of Customers’ decision-making process:

- They are spending more on food for home than before the pandemic

- They are seeing increases in food prices

- They are concerned about their personal financial situation as well as their country’s economy

Given these ongoing pressures, it is not surprising to see Customers taking steps to seek value. Shopping at low-priced stores and searching online for the best sales are the most frequent examples Customers have given to save money, with more than 80% of shoppers using at least one of these strategies.

Many leading retailers have responded early to this, such as Tesco who have reset their value offer, investing in price-matching the discounters and introducing Clubcard pricing for more instant value for their shoppers.

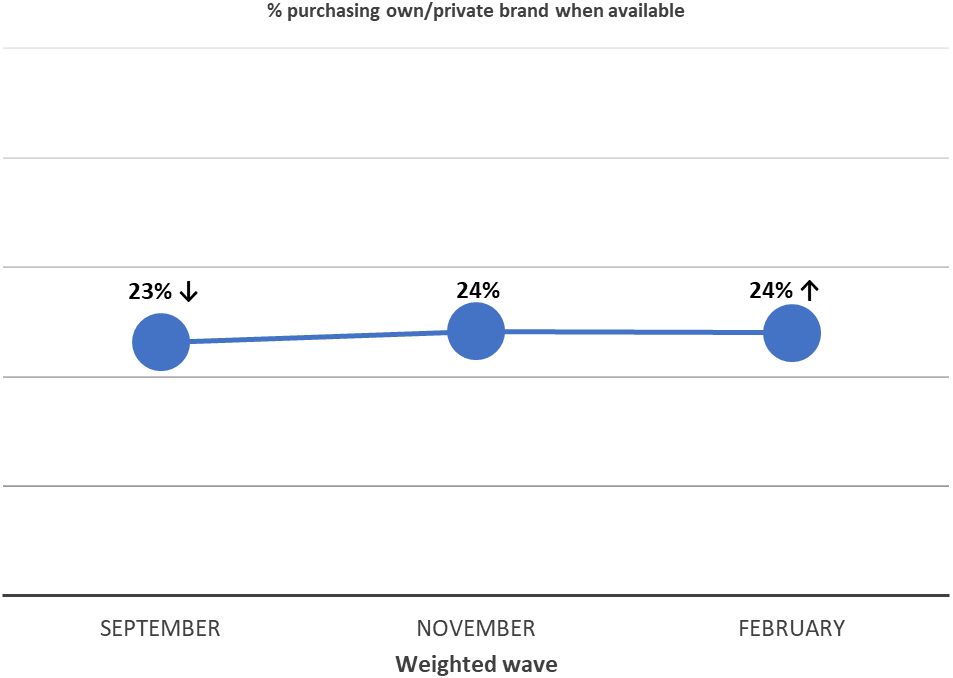

Private Brands also continue to play a key part in the range of options consumers are using to seek value, with 1 in 4 doing this, about the same level as claim they are buying brands with the lowest price. In fact, the most recent data from Nielsen reports that since the start of the pandemic in the US, private brand sales grew 29%, outpacing regular-branded product sales, which grew by 24%. In Colombia, Éxito saw its Frescampo private brand grow 30% during the pandemic. And during the crisis, around a quarter of consumers have tried private label brands for the first time, according to our data and in-line with a March 2020 survey by research firm AlixPartners.

Past the Tipping Point

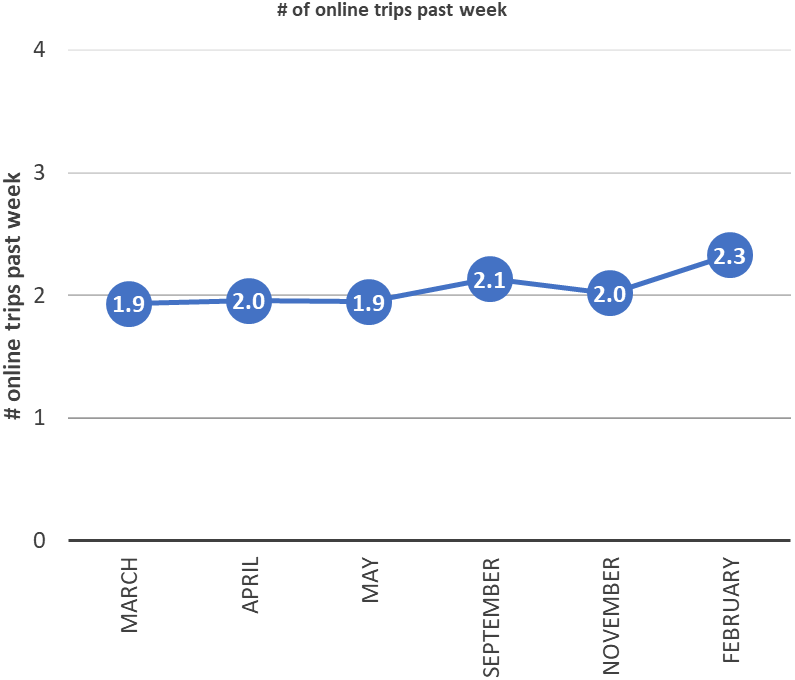

We have long noted that shift to online has been accelerated by Covid-19, but this latest survey confirms that this trend shows no sign of reversing.

The very first survey, back in March 2020, showed a surge in Customers shopping online, and unlike other shopping behaviours, this trend grew stronger in every wave of research. The digital channel is particularly strong in most of Asia and Latin America, where third-party delivery partners such as HappyFresh in Southeast Asia and Weee in Korea, Grab in Malaysia, and Rappi in Colombia have enabled grocers to ramp up their online capacity at pace.

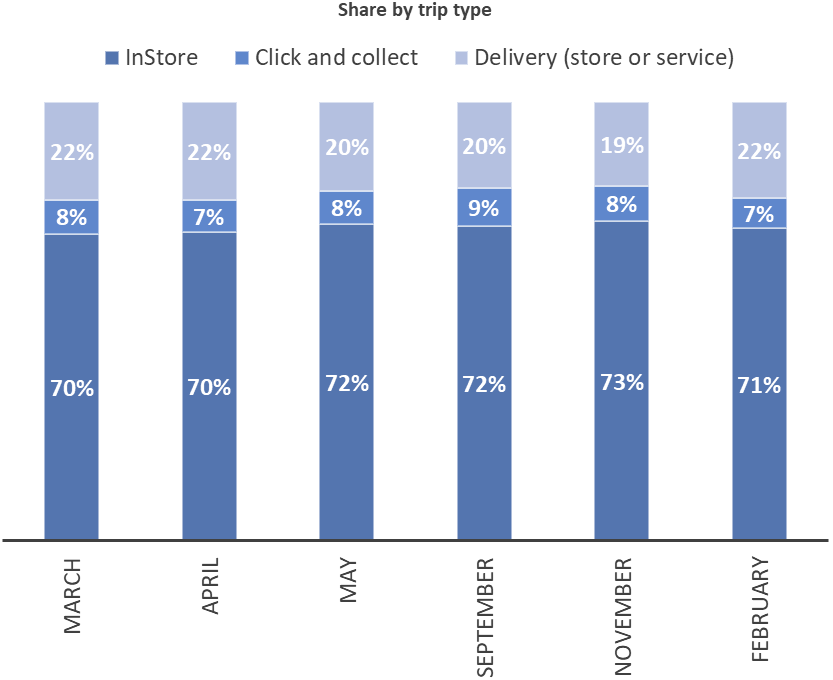

In the latest wave of research, we also identified the type of online offering most frequently used, with delivery services emerging as the most common form. Three Asian markets lead in share of online trips while markets in Central Europe (and Ireland) are at the lower end. Delivery is the dominant mode with Click and Collect most often used in China and France.

While the share of trips that are online has remained flat, the number of trips in-store has increased, which corresponds with the overall increase in weekly shopping trips. This is likely to be a result of Customers become increasingly comfortable with shopping in-store, their wish to return to pre-pandemic ‘normal’ and the in-store experience improving, as demonstrated by the level of satisfaction having increased.

Also notable is that people say they are now as happy with their online experiences as they are with the in-store experience. And retailers are clearly performing well; the level of satisfaction has increased across all options.

% of customers noticing each negative action

| MAR | APR | MAY | SEP | NOV | FEB | |

| Reduce hours | 52% | 49% | 39% | 26% | 32% | 33% |

| Out of stocks | 59% | 55% | 44% | 29% | 30% | 29% |

| Fewer employees in fresh sections | 25% | 23% | 21% | 21% | 20% | 19% |

| Quantity limits | 43% | 43% | 35% | 23% | 22% | 22% |

| Raise prices on items related to the virus | 34% | 36% | 36% | 35% | 30% | 30% |

| No Samples | 24% | 29% | 31% | 32% | 33% | 33% |

Instore experience lagged behind online early on, as stores struggled to adjust at scale to new safety and security measures. Although all channels now stand at the same level, it’s important to point out that satisfaction levels are below 50% across the board; there’s certainly a lot more that could be done; We explore in more detail how Retailers should respond to the new grocery retail landscape in our latest paper Customer First retailer responses for the year ahead in 2021.

Food at Home for the time being

Several of the other trends we identified back in 2020 continue but look likely to slow down or reverse as lockdown restrictions lift gradually across the globe.

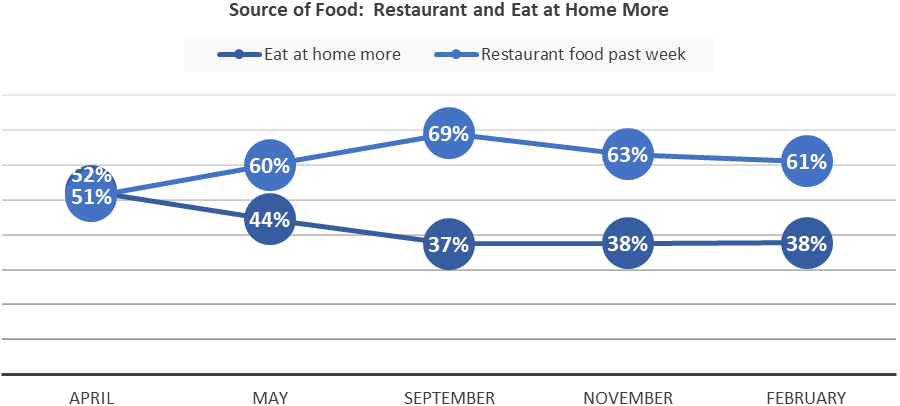

Whilst restaurants remain closed, or with limited capacity, food adventures will continue at home for the foreseeable future. The recent data shows that restaurant food consumption, whether in the restaurant or via delivery, has increased (although this has also declined since the September peak) while the number of Customers who claim they are eating at home more than before the beginning of the pandemic has declined.

As visits to restaurants have increased, food-at-home loses share to these visits. But 4 in 10 shoppers continue to say they are eating at home more than they used to.

Health and wellbeing set new benchmarks

Covid-19 is a health crisis that has made many people more aware than ever of the importance of a healthy lifestyle. While we have only recently began tracking how this impacts behaviour around overall health and wellbeing, we can clearly see a change in the way people shop.

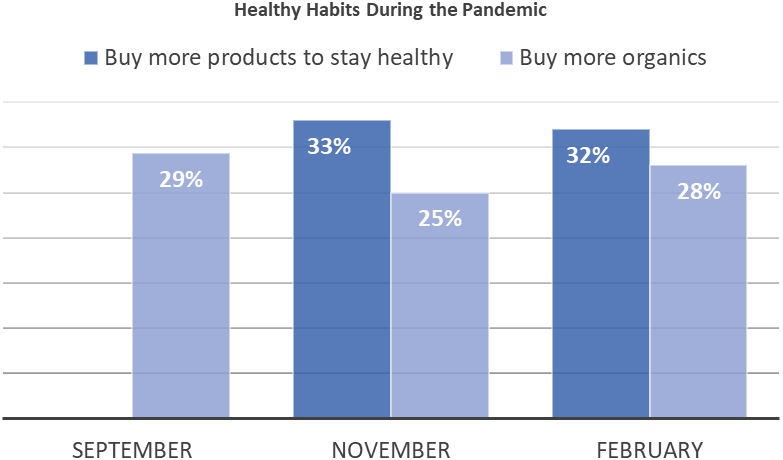

One in four shoppers says that they are eating more organic foods, and one in three buying products focused on staying healthy. Not surprisingly, those who are scored as ‘Worried’ in the Worry Index are more likely to buy products to stay healthy than those who are not.

Retail pharmacies are front and centre as a key destination for health and wellness products and services. As the Customer is increasing their focus on more proactive wellness, pharmacies must respond with an expanded emphasis on new products and services as well as a strong targeted communication of these changes to their key Customers.

Public goodwill must not be misspent

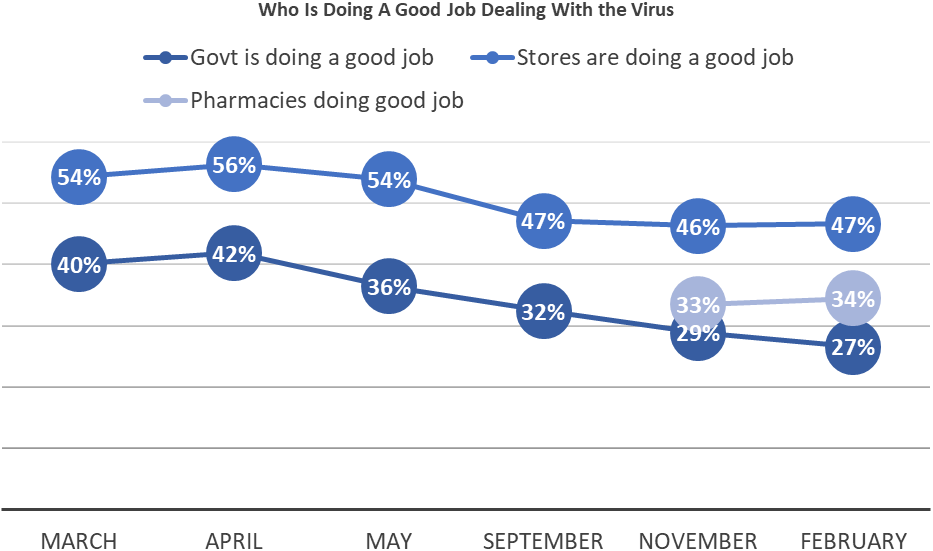

As we navigate our way out of this crisis, the public need to trust their institutions to be doing the right thing, whether government or grocery store.

Throughout the course of this study, we have found that stores have often been more trusted than government bodies. And while trust in both has steadily declined as the pandemic continues, stores remain 20 points higher than the government in the eyes of consumers.

This study shows that certain retailer actions, such as out-of-stocks, quantity limits or reduced hours, did have a minor negative impact on Customer satisfaction. While shoppers are now less likely to notice these retailer actions, three out of four shoppers still report seeing at least one of them. Shoppers recognise that they are necessary, but it still makes them less satisfied with their experience.

Of course, after a year of living in a pandemic, there are signs of consumer fatigue. From frontline grocery store colleagues to the shoppers themselves, people have been through a lot in the past year, whether emotionally or financially, and have heightened expectations of their store experience.

In order to help shoppers through what we hope is the beginning of the end of this pandemic, grocery stores need to walk a narrow path between Customer satisfaction and Customer safety. The grocery retail industry has changed significantly over the last twelve months, and many of these changes are undoubtedly here to stay. But by putting the Customer first in every decision, retailers can continue to keep the trust, and loyalty, of their most valued Customers.

RELATED PRODUCTS

The latest insights from our experts around the world