Navigating a shifting world: the headline results from our latest Consumer Pulse

How do shoppers react to the changes happening around them? It’s a question that every retailer wants to know the answer to. Over the past five years, it’s also one that we’ve tried to get to the bottom of with the Consumer Pulse. This biannual research study surveys shoppers across Europe to find out how the latest global events are shaping their needs, priorities, and concerns.

Previous Pulse studies have covered five European markets - France, Germany, Italy, Spain, and the United Kingdom. This time around, and keen to expand our understanding of what’s going on across the continent, we added five more nations into the mix. Welcome, then, to our most expansive Pulse study yet, now covering Ireland, the Netherlands, Norway, Sweden, and Denmark as well.

We’ve got plenty of insights to share this time around so – without any further ado - let’s dive into the results.

- Contextualising confidence

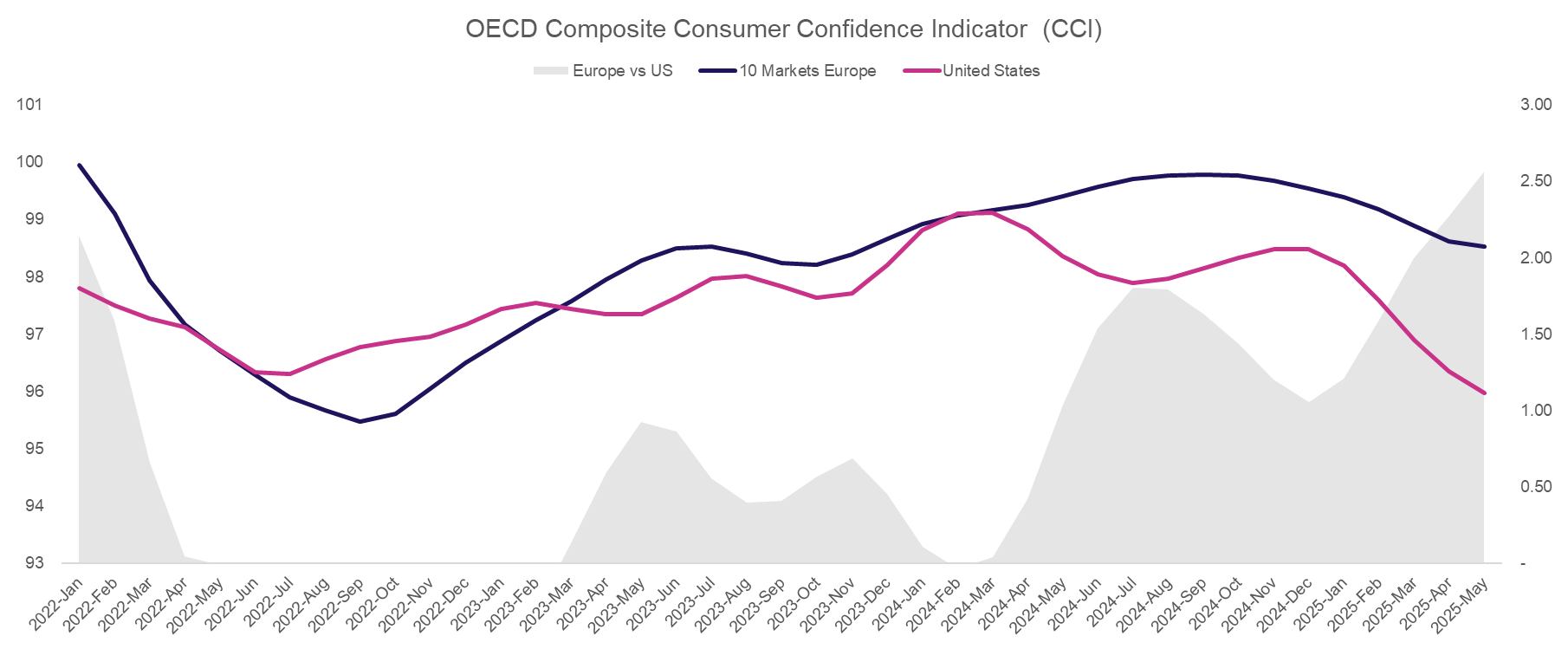

Before we get into the data, let’s take a moment to reflect on the context in which our latest Pulse study was conducted – something that’s best done through the OECD’s Consumer Confidence Index (CCI). The CCI measures consumer confidence on a scale from 1-100; simply, the closer a country’s score is to 100, the more confident its people are.

When looking at CCI data from the past year, it’s immediately clear that a split is emerging between shoppers in the US and the EU. In February 2024, consumers in those regions were almost perfectly aligned, with a confidence score of around 99.10. By October ‘24, however, those scores had diverged – standing at 99.77 in Europe and 98.33 in the US. And, by May of this year, the gap had grown bigger still: 98.53 for Europe and 95.97 for the US.

Between the beginning of 2024 and now, a significant confidence gap has opened up between European and US shoppers.

Consumer confidence is falling in both territories, then – it just happens to be falling both faster and further in the US. In fact, the “delta” (or, the difference between the two) is now at its greatest since January 2022.

- Tariffs weigh heavy on shoppers’ minds

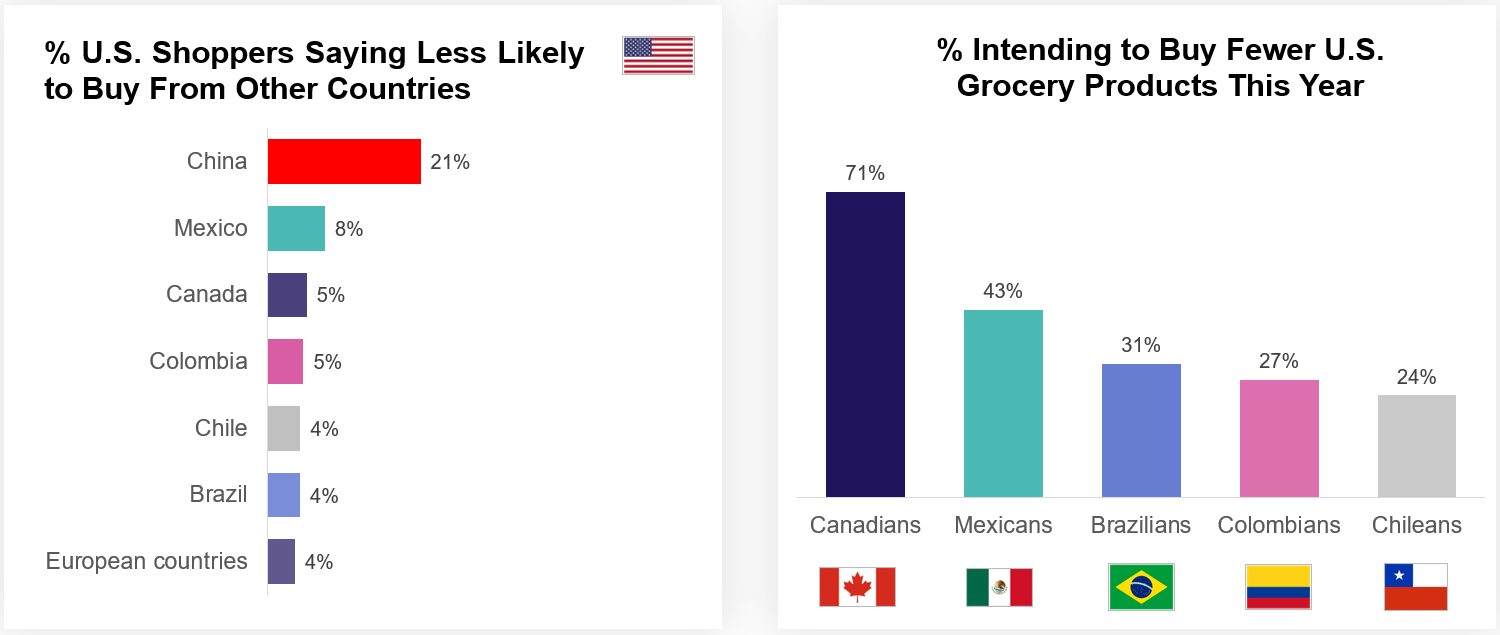

One potential reason for this divergence may be the recent introduction of tariffs – something that seems to have driven an outstated response amongst non-US consumers. While shoppers in the States are focused primarily on reducing their reliance on products from China, for instance, customers elsewhere are passionate about the intent to buy less from the US.

Take Canada. While only 5% of Americans say they’re now less likely to buy produce that originated from Canada, 71% of Canadians say the same in reverse. For Mexico, those numbers stand at 8% and 43% respectively. For Brazil it’s 4% and 31%. International shoppers, it seems, have been activated by the introduction of tariffs – something that could easily be having a ripple effect on North American consumer confidence.

Comparatively few shoppers in the US are looking to cut back on purchases from other countries in the Americas. The same does not apply in reverse, however.

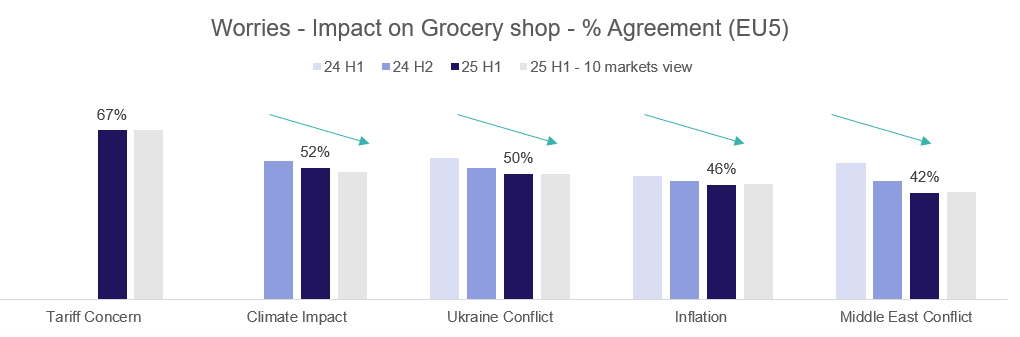

If tariffs are impacting consumer confidence though (and there’s no concrete evidence here to suggest that’s the case), then this isn’t a US-only issue. A question we’ve asked Pulse respondents time and again is “what are you worried about when it comes to your grocery shop?” Over the years, responses have varied – ranging from Covid-19 through to climate change. The biggest issue today, though? Tariffs.

Results from this latest Pulse show that two-thirds (67%) of European respondents are concerned about the impact of tariffs on their grocery shop. That’s significantly more than climate change (52%), the ongoing conflict in Ukraine (50%), and inflation (46%). Spanish and Irish shoppers are more worried than most, while those in Germany and France appear to be the best-insulated against the issue.

With concerns about inflation taking a back seat to other worries, it’s unsurprising to find that consumers are less concerned by economic issues on the whole – for the most part, at least. In France, Germany, Italy, and Spain, the number of people who say they’re concerned about the state of the economy has fallen since we last spoke to them. So too has the number who say the same about their own personal finances. Economic anxiety is on the decline.

Tariffs are now the biggest concern for European shoppers when it comes to their grocery shop.

There is one outlier here, though, and that’s the UK. In stark contrast to their continental cousins, British shoppers are now more worried about both the health of the economy and their position within it than they were six months ago. Importantly, that downturn bucks a yearlong trend, too – across our past three Pulse studies, optimism amongst UK shoppers has been growing.

For Brits – as it is for the French and Spanish – it’s the economy as a whole that presents the greatest cause for concern here. While German and Swedish shoppers are focused primarily on the state of their personal finances, and Italians and Irish with both in equal measure, only a few countries are really immune to economic concern. Shoppers from Norway, Denmark, and the Netherlands are all less likely to have financial worries than their European counterparts.

Shoppers’ economic anxieties tend to focus either on personal finances or national affairs.

- Private brands, discounters, and coupons: the key shopper behaviours

Sentiment is one thing, behaviour another. We know how Europe’s shoppers feel about what’s going around them, but how are they acting in response?

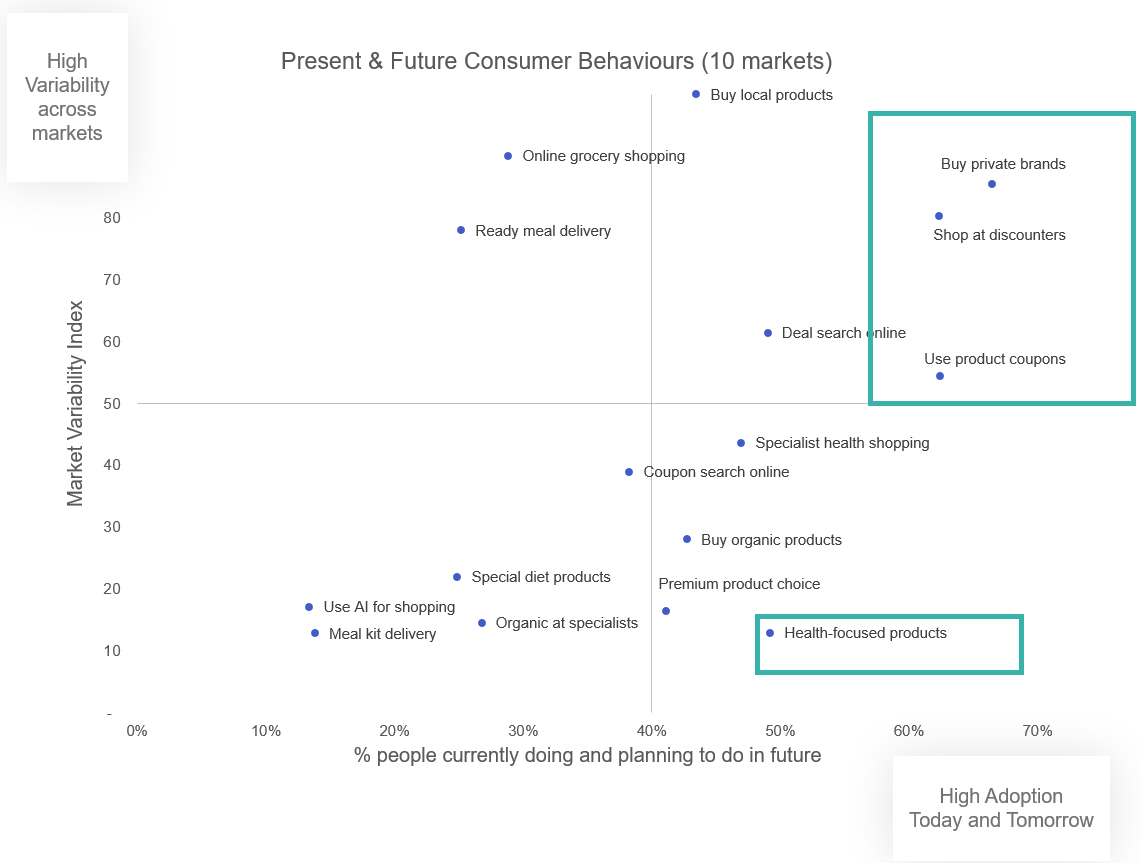

To find out, we gave our respondents a list of actions. Included in that list were things like “using AI for shopping”, “having ready meals delivered”, and “searching for coupons online”. We then asked them to tell us which – if any – they were doing already, or planned to start doing in the future.

Three trends lead the way here. Across the continent, shoppers are more likely to be “buying private brands” (66%), “visiting discount retailers” (62%), and “using coupons” (also 62%) than they are to be doing anything else. Even though there’s considerable variance between countries here, these are the most common behaviours as a whole across Europe.

Buying private brand, shopping at discounters, and using coupons are the three most common behaviours across Europe.

So, what exactly is it about these three behaviours that makes them so commonplace?

- Private brands are delivering on a variety of customer needs

In recent years specifically, private brands have become a significant driver of customer loyalty - and we see four reasons for this:

- They deliver value for money: let’s get the most obvious factor out of the way first. Private brands give customers cheaper options, without them needing to compromise too greatly in terms of quality. On the subject of which…

- They give retailers a greater degree of quality control: in recent years (through our Retailer Preference Index studies), we’ve seen shoppers begin to put the quality of Private Brand products on a par with (or even above) national brands. A high-quality offering can help to build long term trust.

- They offer an element of exclusivity: for retailers, the prevalence of named brands can make it difficult to offer customers something genuinely different at the shelf. Private brands help here, too, enabling retailers to create something that’s unique to their stores.

- They can make shopping easier: when private brands span multiple categories across a store, they make shopping easier for customers. Being presented with a brand they already know and love helps to shortcut their decision making, regardless of category.

- The discounters’ popularity points to the ongoing pursuit of value

Shopping with the discounters has become an enduring behaviour over our past few Pulse reports. We first noticed it towards the end of 2023, when a growing number of respondents told us they planned to buy more from discount stores going forwards. Today, that translates into an inextricable link between “discount retail” and “value for money”.

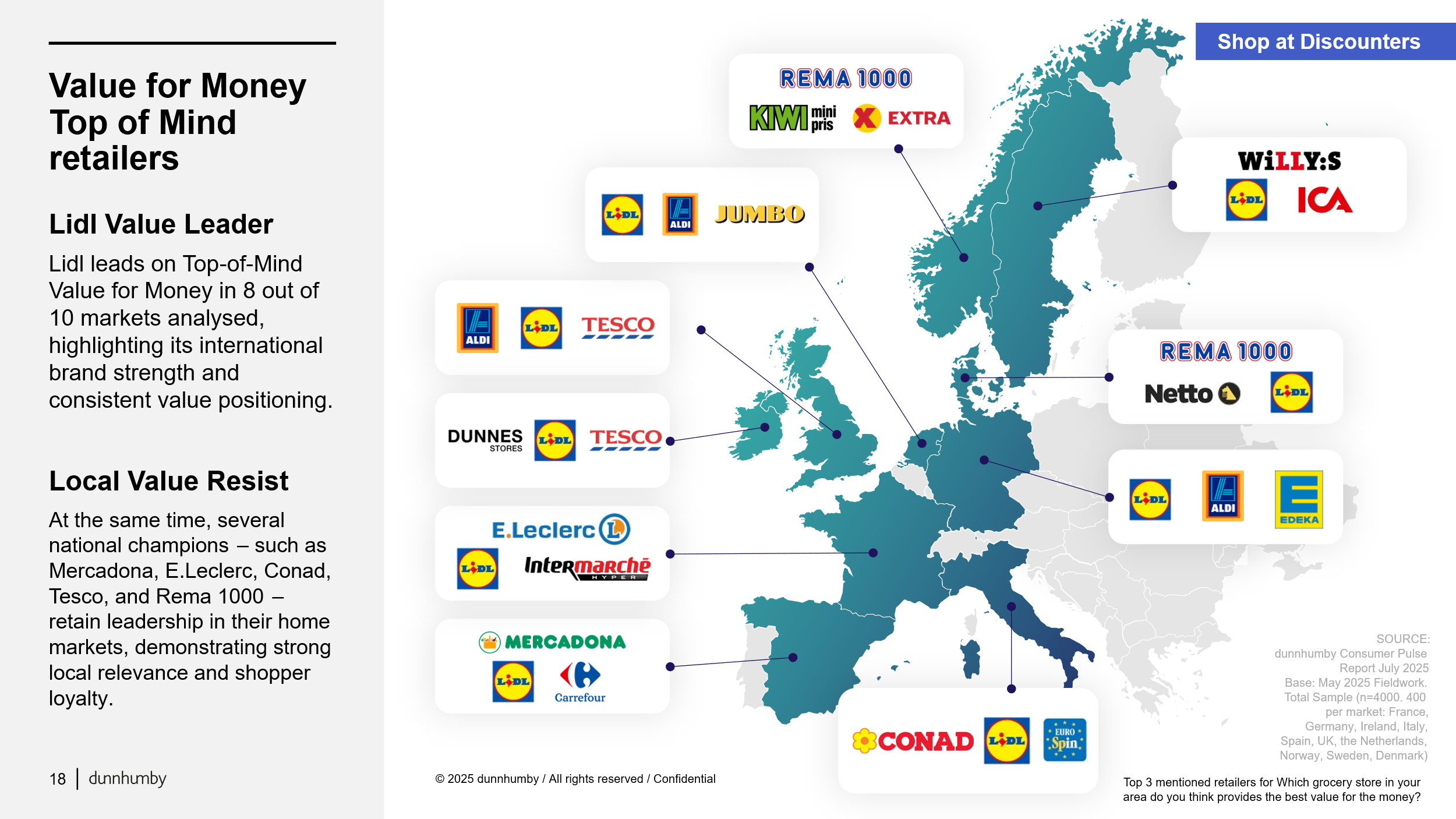

When we asked respondents to state which retailer in their area provides the best value for money, they voted Lidl into the top three in eight of the European markets included in this Pulse. Only shoppers in Norway failed to put the discounter on the podium, testament to Lidl’s international brand strength and consistent value proposition.

While shoppers seem to make an easy connection between discount retail and value, though, it’s not all bad news for mainstream retailers. From Tesco and Mercadona through to Conad, E.Leclerc, and Rema 1000, a number of “national champions” are similarly well-regarded in terms of value for money. Demonstrating a clear ability to deliver on localised needs, they’re a good reminder that value isn’t just about price at the shelf.

Europe is fast becoming a “yellow label” continent, with Lidl frequently cited as delivering the best value for money.

- Coupons meet a core loyalty need – but there are other ways to win

Money-off coupons continue to be the most popular loyalty mechanic across Europe. And, when we look at what matters most to shoppers, it’s not hard to see why. In most of the countries we surveyed, respondents told us that there’s nothing more important than saving money when signing up to a loyalty scheme. Only in Denmark did they disagree (pointing instead to personalised offers).

In spite of that fact – and in line with Danish shoppers’ more nuanced approach here – discount coupons aren’t the only way for retailers to win. Personalised offers hold plenty of appeal too, particularly in Norway and the Netherlands, while Germans and Brits value an easy points redemption experience.

More than anything, the results here tell us just how fragmented customer needs are in respect to loyalty. If you want to win, you need a proposition that covers multiple bases, rather than excelling at just one.

- How European behaviours align

We know that there’s a degree of fragmentation in terms of how shoppers think about loyalty programmes, but what about shopping more generally? Do customers across Europe behave entirely distinctly, or do they converge around certain themes?

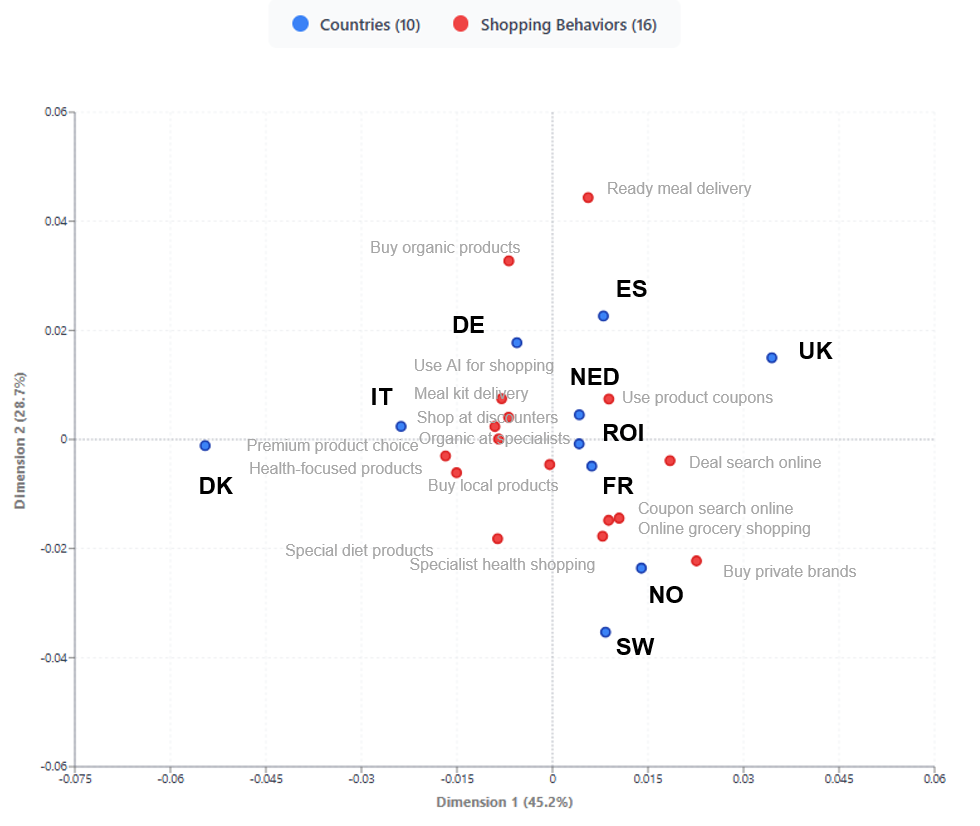

With this latest edition of the Pulse covering more EU countries than ever, we took the opportunity to take an in-depth look at behaviours across the continent. What we found was that shoppers tend to fall into one of three categories:

- Savings & Convenience: in Spain, the UK, and Germany, shoppers typically prioritise actions that make shopping easy and help save them money. Whether they’re using AI to help them shop, using coupons at the checkout, or using ready meal delivery services, shoppers in these countries value simple, cost-effective shopping.

- Savings & Health: remove the Convenience dimension from the above and replace it with Health, and you have a list of the priorities for shoppers in Norway, Sweden, Denmark, and Italy. Here, it’s all about health-focused produce, organic goods, and special dietary requirements.

- Balanced Markets: for shoppers in the Netherlands, France, and Ireland, a balanced approach prevails. Rather than focusing on individual themes in isolation, shoppers in these markets tend to adopt a wide range of behaviours – something that’s likely to require retailers in those markets to adapt at pace.

Shoppers either tend to centralise around certain issues – savings, convenience, and health – or have a generally balanced approach to retail.

The divergence on show here isn’t limited just to behaviours, either. Our latest round of research shows that the shopping journey itself is becoming fragmented, too – with customers increasingly lured by the appeal of specialist retailers.

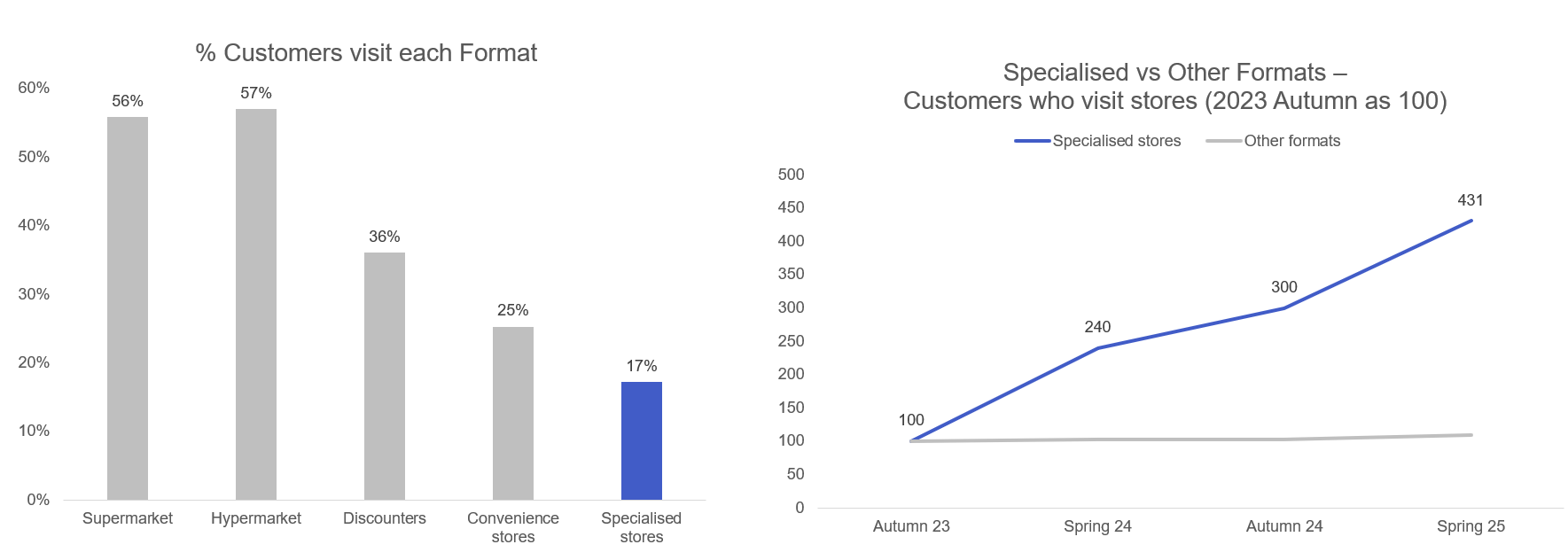

Right now, just 17% of customers across the continent visit specialist retail stores, a relatively small number when compared with those who say the same about the discounters (36%), supermarkets (56%), and hypermarkets (57%). But this like-for-like comparison doesn’t tell the whole story.

When we look not just at the percentage of visits today, but how they’ve changed over the past couple of years, we can really start to understand the pull that the specialists have. Since autumn 2023, specialist retailers across Europe have seen a 331% increase in traffic. Over the same period, traffic to every other kind of format has remained flat. Their market share may remain comparatively small, but the specialists are drawing in shoppers like no other store can.

While the number of customers visiting supermarkets, hypermarkets, and discounters has remained flat since 2023, specialists have seen a fourfold increase in traffic.

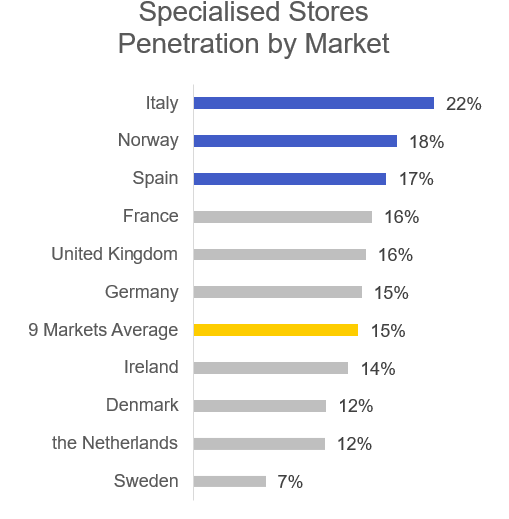

Right now, this is primarily an issue for mainstream retailers in Italy, Norway, and Spain to have on their radar; penetration of specialist stores is at its highest in these three markets. For those in Ireland, Denmark, the Netherlands, and Sweden, on the other hand, the issue is a little less pressing.

The specialists are at their strongest in Italy, Norway, and Spain. Swedish, Dutch, Danish, and Irish shoppers are less likely to visit dedicated retailers, on the other hand.

Nonetheless, that’s unlikely to stay the case for long. In a deep analysis of the specialists’ strengths and weaknesses, we’ve identified clear ways for specialists to deepen their relationship with shoppers.

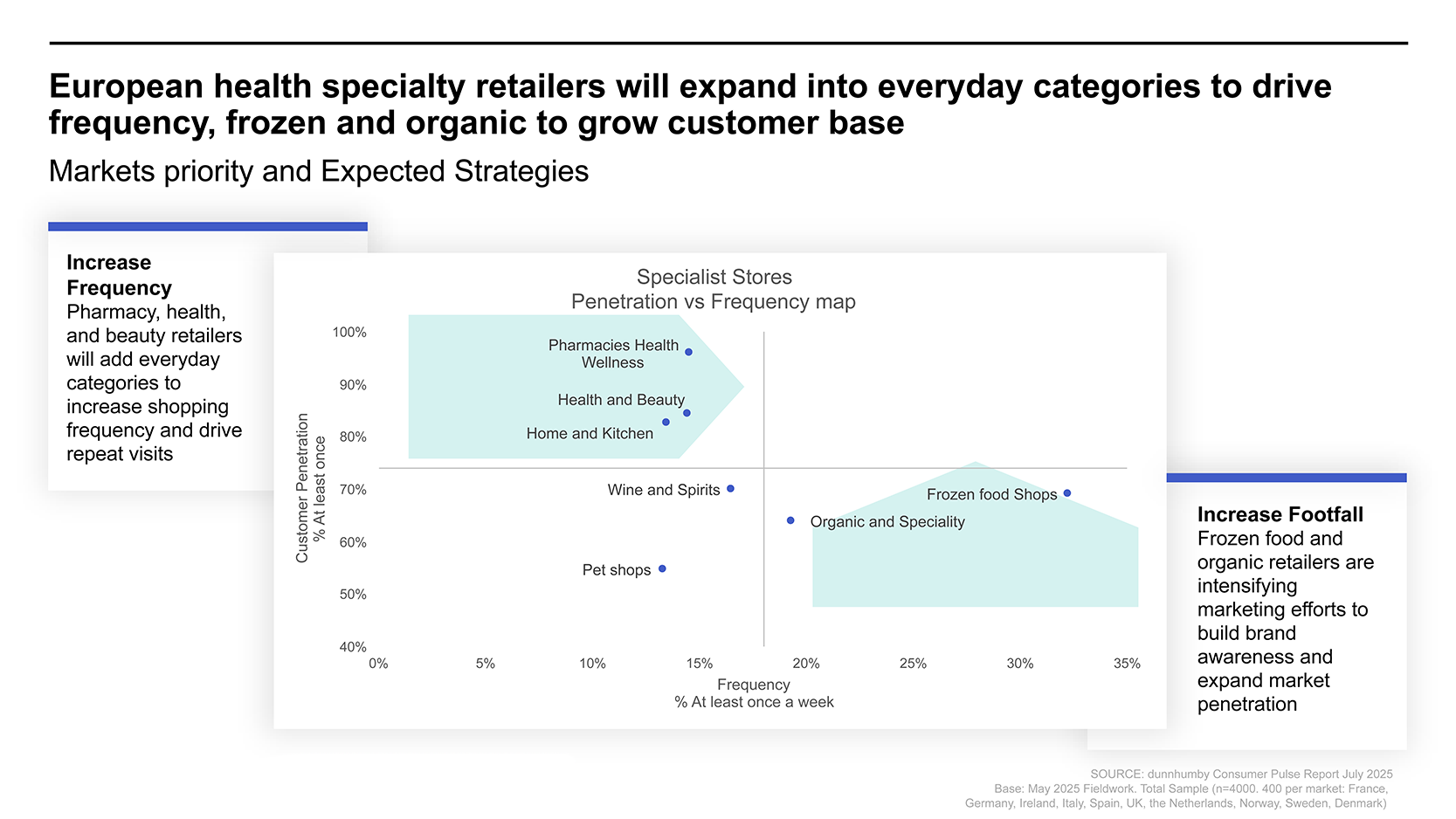

Today, the specialists tend to win in one of two areas: customer penetration or visit frequency. Simply, they typically have either a large number of unique customers, or a moderate number of customers who make repeated visits. Pharmacies, health and beauty stores, and home and kitchen retailers are normally found in the first of those camps, with frozen food shops and organic retailers in the second.

For those who need to increase their visit frequency (pharmacies etc.), expansion is the likeliest course of action. By adding everyday categories to their portfolio, they’ll be able to increase shopping frequency and drive repeat visits. For those who need to increase customer penetration, meanwhile, brand awareness-focused marketing campaigns point the way forward – helping them to build up their standing with shoppers.

For specialist who already have good customer penetration, category expansion is likely to be the focus.

For those who excel at visit frequency, growing brand awareness will be key. - Three trends, three responses

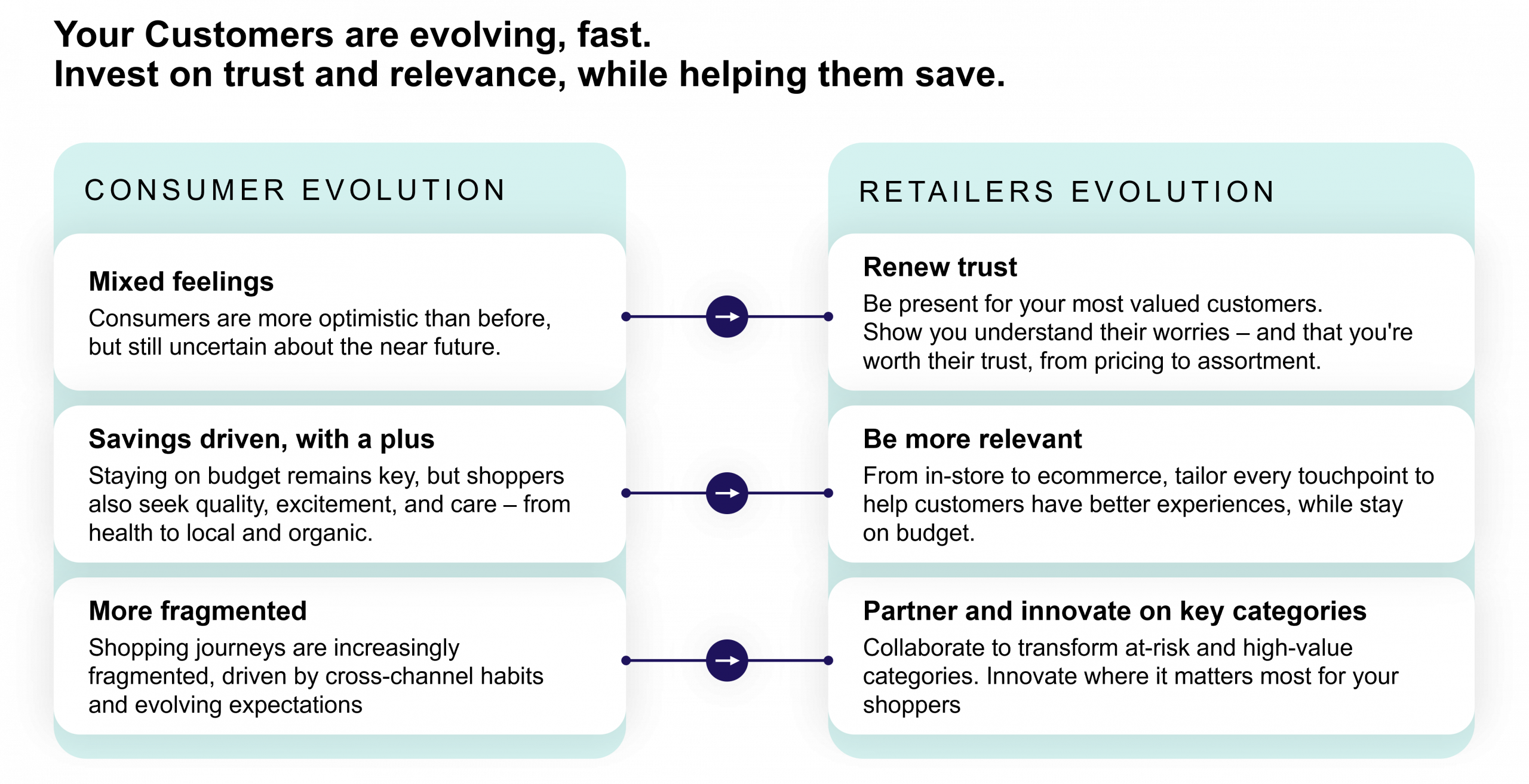

Lots to consider, then – but what does this all mean? Let’s finish off by rounding up the three biggest trends we see around consumer behaviours, and what they mean for retailers.

RELATED PRODUCTS

Explore how AI-powered loyalty programmes enhance customer experiences and drive sales with dunnhumby’s personalised, data-driven solutions.

Create experiences that deliver long-term loyalty and customer valueThe latest insights from our experts around the world

From pilots to production: how to embed AI in the everyday

Agentic Commerce: How to win and retain customer loyalty