From niche to necessary: why specialist retailers are on the rise in Europe

What’s the biggest story in retailing right now? Could it be the dominance of the big discounters? Geopolitical pressures and inflation? Well, we can now add a new contender to the list, one that traditional retailers can no longer afford to ignore.

Specialist retailers – once seen as niche players catering to health-conscious, ethical, or convenience-driven shoppers – are stepping out of the shadows and into the mainstream. As dunnhumby’s latest Pulse research shows, they’re reshaping how consumers perceive value, loyalty, and trust.

A warning from the fringes

Specialist retailers are no longer sitting on the edges of the market. Their proposition – deep, focused, and purpose-led – is paying off. Visits to specialist stores across Europe have more than quadrupled since Autumn 2023, according to the latest Consumer Pulse research from dunnhumby. Over the same period, footfall to supermarkets, hypermarkets, and discounters has remained flat.

For traditional grocery retailers, that signals a clear risk: the potential erosion of high-margin categories and shopper missions, particularly around health, sustainability, self-care, and quality – that are increasingly migrating to more focused, agile formats.

These are not just isolated trends. They point to a structural shift in how shoppers think about their grocery missions – and which banners they trust to deliver.

Why (and where) specialists are thriving

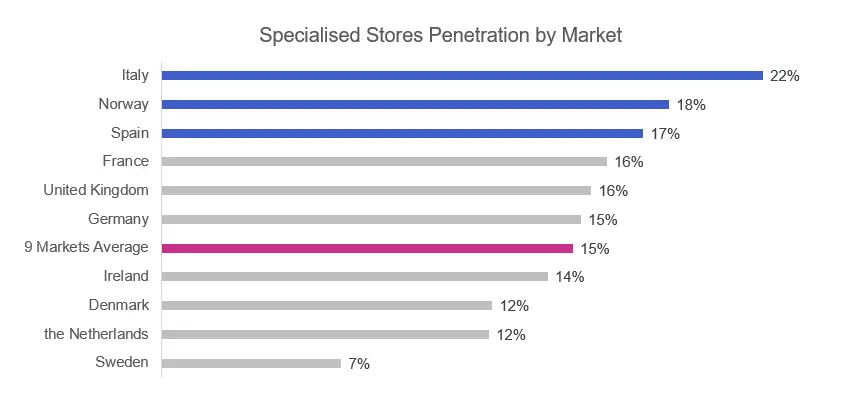

The rise of the specialists isn’t happening by chance. It reflects deeper consumer shifts seen consistently across Europe. Specialist penetration is highest in Italy, Norway, and Spain, with France showing significant growth potential.

In a post-inflation Europe, shoppers are redefining value. It’s no longer just about price at the shelf. Increasingly, value is being viewed through the lens of meaning. Whether that’s organic ingredients, local sourcing, ethical production, or trusted health credentials, sustainability, freshness, and ethics are the battlegrounds of modern grocery – and the heartland of the specialist retailer.

As our Pulse research shows, this is especially evident in markets like France and Spain, where emotional connection to retailers is on the rise, and where specialist formats are making clear gains.

Digging deeper: the formats that are winning

Specialist retail isn’t a single model – it’s a diverse, evolving set of formats that tap into specific, high-intent shopper needs. Across Europe, several categories stand out for their ability to attract footfall and drive growth:

- Health and beauty: pharmacies and wellness retailers are expanding their everyday ranges to increase shopping frequency.

- Organic and ethical: retailers like Biocoop, Naturalia, and La Vie Claire in France, and specialist organic stores in Italy, continue to gain share as shoppers seek healthier, more sustainable alternatives.

- Frozen convenience: brands such as Picard demonstrate how premium frozen foods can meet both quality and convenience needs.

- Pet care: specialist pet retailers, though less prominent, are also capturing more mission-driven trips.

The trend is clear: mission-led retailers are expanding their product ranges, investing in brand reach, and increasing the number of trips they serve.

Data from the Pulse study shows that frozen and organic specialists, particularly in Italy, are ramping up brand awareness and reach to compete directly with mainstream players. Esselunga, one of Italy’s most successful supermarket chains and considered a hybrid between large chain and a specialist retailer, is a great success story. It wins on store experience, loyalty, private label assortment, and variety.

Specialist retailers build deeper emotional bonds

While mainstream retailers have traditionally relied on scale and assortment to drive loyalty, specialists are winning hearts and wallets by building stronger emotional connections.

In both France and Spain, shoppers report higher satisfaction and emotional alignment with specialists, particularly those who deliver on clear, purpose-led missions. Here the focus moves beyond product to trust, shared values, and a deeper connection with shoppers’ values and lifestyle choices.

What traditional generalist retailers can learn

This isn’t a revolution. Mainstream retailers don’t need upend their existing business models and become specialists. But they do need to compete with them – and that means making some adjustments. Here are three actions you can take.

- Reclaim key shopper missions

Healthier choices, sustainable sourcing, personal wellness. These themes now drive the modern grocery mission. Retailers must ensure they deliver against these needs, not just through their product range, but also through clarity of purpose.

- Bring more meaning into your assortment

Variety is no longer just a numbers game. Shoppers are looking for choices that reflect their lifestyle, values, and aspirations. Assortments should be curated to align accordingly.

- Use loyalty smarter

Loyalty programmes need to evolve beyond discounts and transactions. The best-performing specialists are creating emotional bonds, not just collecting data. For mainstream retailers, that means designing loyalty schemes that reward alignment, purpose, and relationship – not just spend.

The message is clear: the rise of specialist retailers isn’t a passing trend. It’s a structural evolution in how, where, and why shoppers engage with the grocery market.

TOPICS

RELATED PRODUCTS

Explore how AI-powered loyalty programmes enhance customer experiences and drive sales with dunnhumby’s personalised, data-driven solutions.

Start Your Loyalty & Personalisation ConsultationCreate customer-centric ranges using AI-powered science

Get a Personalised Assortment PlanThe latest insights from our experts around the world