How are the behaviours of UK shoppers changing in response to inflation?

A long-looming threat is now an established reality. After months of discussion about the potential consequences of skyrocketing inflation, people around the world are finding out first-hand that the raw cost of living is now higher than it was 12 months ago – and dramatically so in some locations.

Keen to understand the impact of this change on shopper behaviours, we recently conducted a survey of almost 10,000 grocery customers across 25 markets – including hundreds of shoppers from around the UK. That, in tandem with historical data from previous studies, has allowed us to build up a comprehensive picture of the country’s response to the rising cost of living.

Here are some of our key findings.

Financial worries – both personal and general – are mounting

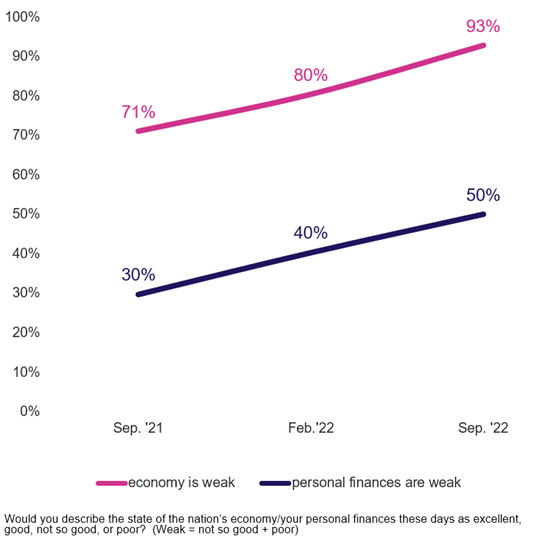

One year ago, in a separate piece of research, we asked UK shoppers to tell us their thoughts on both the state of the national economy, and their own personal finances. At that time, close to three-quarters (71%) said that they felt the economy was weak, while less than a third (30%) felt the same way about their own financial situation.

Today, that outlook is far less optimistic. More than nine in 10 (93%) believe that the economy is “not so good” or “poor”, with concern about their personal finances rising in tandem (50%). The tipping point for economic worry has been hit, with half of customers now holding a broadly negative perception about the state of their finances.

Shoppers are almost unanimous in believing that food is now more expensive

While there’s still some variation in terms of personal finance perspectives, that’s not the case when it comes to the cost of food. Shoppers hold an almost unanimous belief that they’re paying more for food than they were 12 months ago, with an overwhelming 98% stating that the cost of groceries has risen over the past year. None of our respondents stated that they felt food prices had fallen during that time.

Shoppers believe that food inflation is higher than it is – but the gap is closing

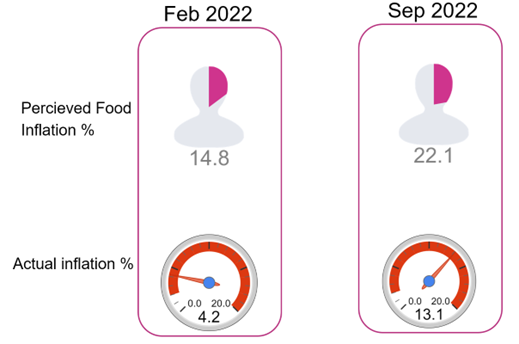

Asked how much they felt food prices had increased by, the average response was around 22% – higher than the actual rate of UK food inflation at 13%. Nonetheless, while shopper perceptions about the rising cost of food might outstrip the reality, there are clear signs that the two are coming gradually closer together.

In February, another dunnhumby study showed that shoppers felt food prices had increased by some 15% over the past year. That means that the perceived rate of inflation has increased by around 50% between then and now. The actual rate of inflation on food in the UK, meanwhile, has risen by 212% during that period. Shoppers may still be overestimating when it comes to rising food prices, but reality is quickly catching up.

UK shoppers are well grounded compared to their global counterparts

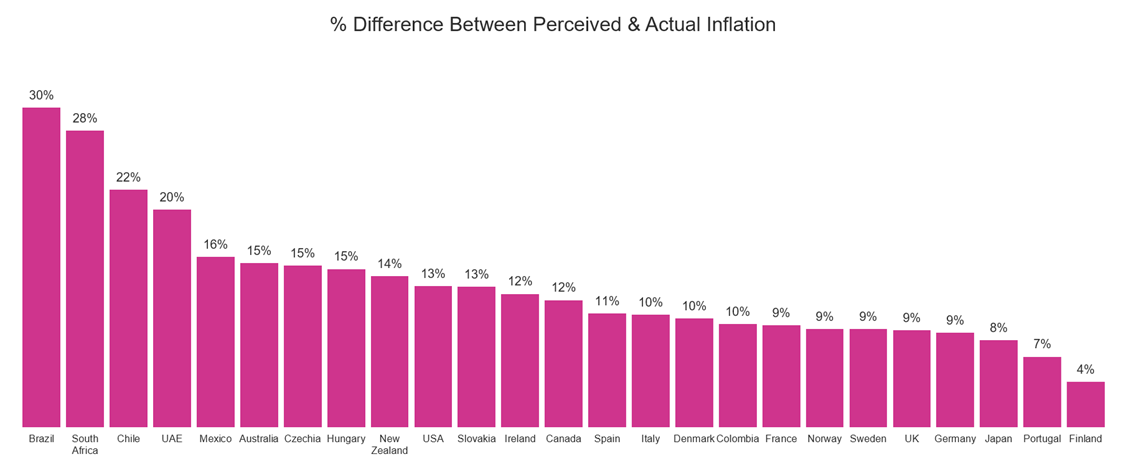

As might be expected, where food prices are rising particularly sharply, perceptions about inflation are significantly higher too. Respondents from Hungary, Chile, Colombia, and Czechia hold some of the strongest opinions about the rate at which the price of food has increased, entirely logical considering that inflation in those countries has been particularly acute.

This correlation doesn’t tell the full story of perception and reality, though. Elsewhere, we see major discrepancies between what shoppers believe and what is really happening – respondents from Brazil, South Africa, Chile, and the UAE stating that the cost of food has risen by more than it actually has. In Brazil, for instance, shoppers believe inflation to be almost a third (30%) higher than it is in reality.

The UK, alongside countries such as Japan and Finland, sits towards the bottom of this chart. While they may still have an exaggerated opinion of inflation, customers here are still much more grounded than many others from around the world.

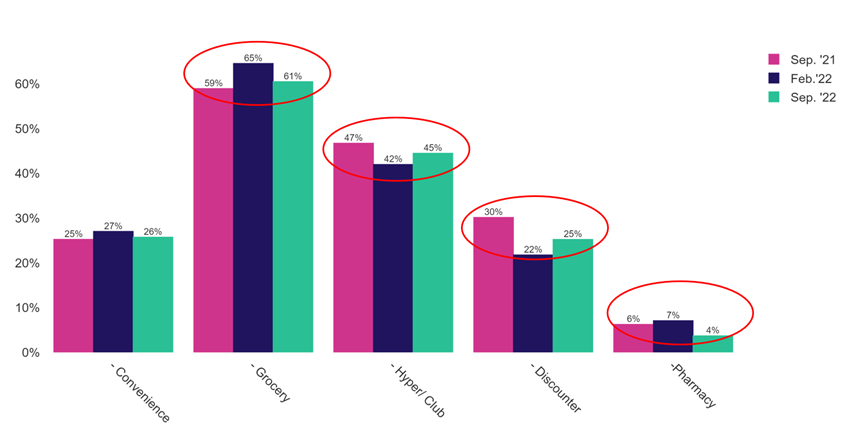

Visits across all store formats have remained relatively consistent over the past year.

Value-seeking strategies continue to gain traction

In response to the tougher economic climate, a growing number of shoppers are now adopting “value-seeking” strategies. With only a fraction (7%) of customers stating that they “don’t pay attention to prices” when shopping, the focus for many is on taking every step that they can to maximise the value of their grocery shop.

Some of the most popular actions include searching online for the best sales (35%, up from 25% in 2021), using coupons or offers on the products they normally buy (62% vs. 47% in 2021), and buying own-label goods when available (43% vs. 35% in 2021). Some shoppers also seem to be becoming increasingly selective, opting to buy certain products only when they’re on sale or are discounted via a coupon (53%).

Cost-conscious they may be, but UK shoppers are still keen on treats

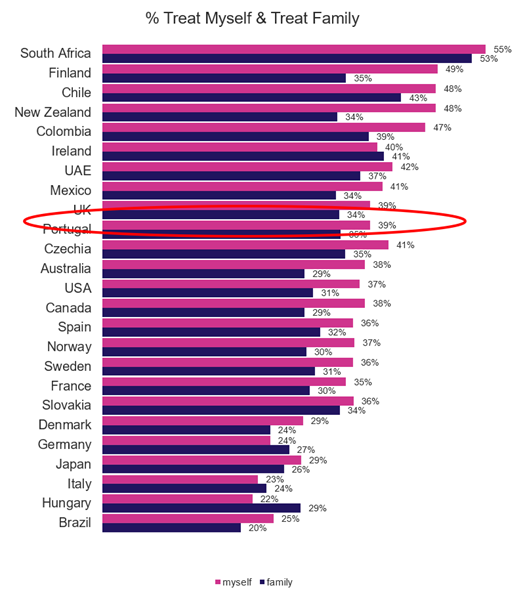

While times may be tough, the desire to treat themselves continues to be a critical concern for many customers. Self-care seems to be particularly important, with global shoppers more likely to buy something special for themselves (39%) than for their family (34%). The UK sits at the higher end of the “treating” index, Ireland being the only country in the region to place higher.

While the UK’s high ranking here could be explained by the country’s realistic view on inflation, the presence of South Africa, Chile, and the UAE – all nations where perception far exceeds reality – at least partially discounts that line of thought.

Loyalty is waning in the face of inflation, with customers likely shopping around for the best deals.

Health and sustainability take a backseat to cost

As shoppers look to reduce their spend, value-seeking actions like those described above aren’t the only tactics that they’re employing. As well as capitalising on discounts, vouchers, and sales, we also see clear evidence that they’re prepared to make sacrifices when it comes to issues of healthy eating and sustainability as well.

Although many shoppers continue to say that they’re conscious of the environment (55%) and that they’d like to lead a healthier lifestyle (28%), support for both of those statements has declined over the past year. Cost almost certainly has a bearing here. More than a quarter say that leading a sustainable (28%) lifestyle is now just too expensive to pursue, with a fifth (18%) saying the same of healthy eating.

TOPICS

RELATED PRODUCTS

Amplify Customer understanding to create strategies that drive results

Customer First solutionsThe latest insights from our experts around the world