In che modo i media pubblicitari influenzano i comportamenti dei consumatori?

Questa è la domanda chiave per chiunque prenoti uno spazio pubblicitario. Indipendentemente dal fatto che si tratti del brand, del consumatore, della performance o di qualsiasi altro tipo di marketing, c’è un problema che probabilmente li terrà svegli la notte: “i media che utilizziamo hanno veramente un impatto sui comportamenti dei clienti?”.

Sfortunatamente, questa domanda è anche una delle più difficili a cui rispondere.

Con così tanti media a loro disposizione, gli specialisti del marketing di oggi si trovano davanti ad un panorama di misurazione decisamente frammentato. Ad un’estremità della scala ci sono aspetti come gli ascolti televisivi e la diffusione della carta stampata: indicatori di portata inesatti ma utili. Dall’altro, c’è la scienza di precisione offerta da alcune forme di retail media, dove è possibile tracciare una linea diretta tra un cliente che vede un annuncio pubblicitario e l’acquisto del prodotto presentato.

Anche quando l’impatto di un media può essere misurato con precisione, però, i risultati non sempre ti dicono tutto quello che vorresti sapere. Ad esempio, immagina che un consumatore veda un post sui social media che promuove una bevanda analcolica e che decida di acquistare tale bevanda. L’avrebbe comprata comunque? O avrebbe, invece, acquistato un prodotto della concorrenza? Quanto è stata incrementale quella vendita?

L’unico modo per saperlo con certezza è attraverso l’applicazione di una scienza dei dati molto approfondita. Tuttavia, possiamo comprendere meglio l’impatto di un media sui comportamenti dei clienti grazie ad una nuova ricerca condotta da dunnhumby verso la fine dello scorso anno.

Quali media hanno maggiori probabilità di far cambiare idea agli acquirenti?

Il Consumer Pulse è un programma di ricerca internazionale giunto al suo quarto anno. Infatti, Pulse è stato introdotto nel 2021 come un modo per monitorare i cambiamenti nei comportamenti dei clienti in seguito alla pandemia. Negli ultimi anni sono state condotte numerose edizioni di ricerca, ciascuna delle quali ha contribuito a far luce sulle mutevoli esigenze degli acquirenti mentre il mondo passava dal Covid-19 alla crisi dovuta dall’inflazione e quindi dall’aumento del costo della vita.

Sebbene la maggior parte delle domande che poniamo nel Consumer Pulse sono progettate per esplorare l’atteggiamento dei consumatori rispetto ad argomenti come prezzi, valore e soddisfazione, abbiamo utilizzato il nostro ultimo studio in Italia per chiedere ai nostri intervistati sul tema della pubblicità. Nello specifico, abbiamo chiesto loro di dirci quali canali di comunicazione li avevano spinti ad acquistare un prodotto che altrimenti non avrebbero acquistato.

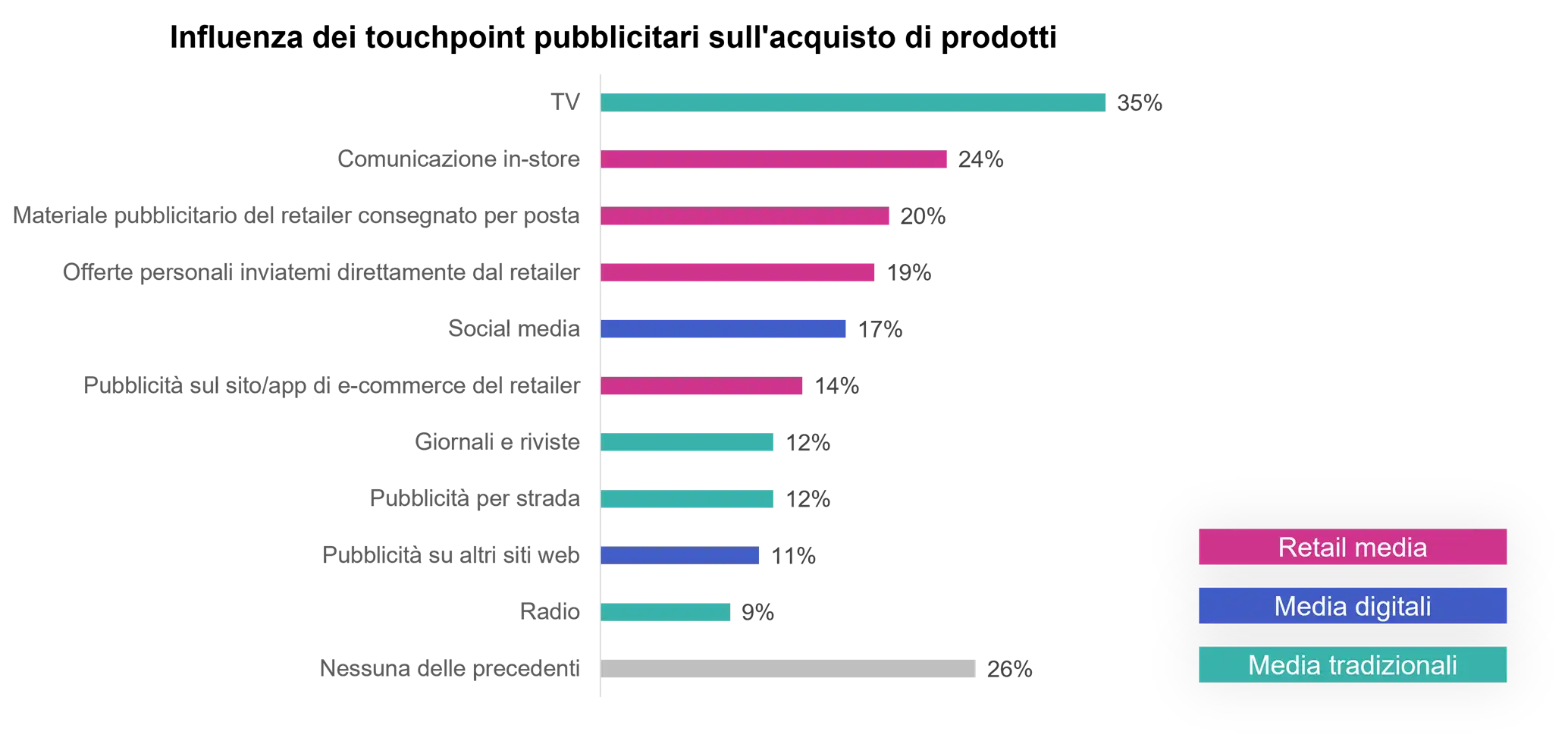

A prima vista, i risultati sembrerebbero confermare l’impatto che i media tradizionali hanno sui consumatori italiani; su dieci canali diversi, la TV è quello che ha spinto più persone a fare un acquisto non pianificato. Oltre un terzo (35%) ha affermato di aver acquistato un prodotto direttamente dopo aver visto una pubblicità in televisione. In verità, però, l’importanza della TV è solo una parte della storia.

Subito dopo la pubblicità televisiva, seguono tre canali del retail media. I media in-store (24%), le attività mailing dei retailer (20%) e le offerte personalizzate inviate dai retailer (19%) sono considerati altamente influenti sul comportamento dei clienti. Gli intervistati affermano, infatti, che questi media sono quasi due volte più efficaci dei metodi pubblicitari tradizionali, come giornali e riviste (12%), e della pubblicità out-of-home (sempre 12%).

Non tutti, però, si lasciano influenzare. Mentre la maggior parte del nostro pubblico ha affermato di essere stata influenzato ad acquistare qualcosa da un annuncio almeno una volta, un quarto degli intervistati (26%) afferma che nessuno dei media pubblicitari in evidenza è riuscito ancora a convincerli.

L’impatto varia a seconda del background dell’acquirente

Osservando più in profondità le risposte ottenute, alcune forme di media sembrano essere più efficaci di altre a seconda delle caratteristiche demografiche degli intervistati.

Per esempio, le donne hanno maggiori probabilità di essere influenzate da uno spot televisivo (41%) rispetto agli uomini (31%) e lo stesso vale per gli annunci che compaiono sul sito web o sull’app di e-commerce di un retailer (24% contro 8%). Paradossalmente, le donne sembrano anche essere anche le meno influenzate dalla pubblicità nel suo insieme, con un terzo (30%) che afferma di non essersi mai lasciate influenzare da nessun tipo di pubblicità, rispetto ad appena un quinto degli uomini (19%).

Oltre al genere, anche l’età può avere un impatto notevole sui comportamenti degli acquirenti. Mentre la TV è efficace in tutte le fasce d’età, le pubblicità sui social media hanno un’attrazione molto maggiore sui giovani tra i 18 e i 54 anni (26%) rispetto agli over 55 (6%). I media in-store e le mail dei retailer hanno un effetto inverso, con un quarto degli acquirenti di età superiore ai 55 anni (25%) che afferma di essere stato spinto ad acquistare un prodotto da questi canali.

Alcuni canali sembrano essere più efficaci anche in base al modo in cui qualcuno sceglie di fare acquisti. Le pubblicità sui social media, ad esempio, hanno un impatto maggiore su chi fa acquisti online e si fa consegnare la spesa in negozio (38%) rispetto a chi ritira la spesa di persona (25%) o utilizza un servizio di consegna di terze parti (sempre 25%). È interessante notare che i media in-store sembrano avere un livello di influenza quasi identico, indipendentemente dal canale di acquisto.

Dalla nostra ricerca, abbiamo anche appreso che:

- La pubblicità televisiva ha più influenza su coloro che sono preoccupati per l’economia (36%) rispetto a coloro che non lo sono (20%);

- I media in-store sono più efficaci sui consumatori con figli (32%) rispetto a quelli che non ne hanno (21%);

- Le offerte personalizzate hanno la maggiore influenza sui clienti che guadagnano tra i 60.000 e gli 80.000 euro all’anno (38%).

Al giorno d’oggi, la pubblicità televisiva e video rappresenta quasi il 40% della spesa pubblicitaria italiana[1]. Questo dato sembra essere in linea con i risultati da noi ottenuti. Del resto, non è chiaro quanto venga assegnato esattamente ai canali di retail media, tra cui in-store, offerte personalizzate e mailing, soprattutto considerando che la stampa e l’out-of-home, insieme, rappresentano solo un decimo degli investimenti pubblicitari totali.

Tuttavia, ciò che emerge chiaramente da questi risultati è che per gli inserzionisti il cui obiettivo principale è persuadere un consumatore ad effettuare un acquisto a loro favore, il retail media è ora uno dei modi più efficaci per raggiungere questo obiettivo. Nei nostri studi equivalenti per Francia e Germania (mercati più maturi sul fronte retail media), abbiamo scoperto che i canali di retail media come le offerte personalizzate e il direct mailing hanno avuto il livello di influenza maggiore sui consumatori in quei mercati rispetto all’Italia.

Dato che il mercato italiano continua ad evolversi, difficilmente passerà molto tempo prima che questo scenario si verifichi anche da noi.

[1] Advertising – Italy – Statista

RELATED PRODUCTS

Make Retail Media work for your business with Customer Data Science

Retail Media SolutionsThe latest insights from our experts around the world

In-house vs. Outsourcing: qual è la scelta migliore per il business del retail media?

Quali formati dominano la nuova era post-inflazionistica in Italia?