- Leading research of over 3,000 Singapore shoppers shows they visit 9+ retailers across multiple formats each month

- Ease of Shopping and Price & Variety are the main drivers of customer preference when shopping for groceries according to inaugural dunnhumby report

- Customer data crucial for Singapore retailers to meet changing demands in a disloyal market

SINGAPORE, June 24, 2021 – dunnhumby, the global leader in customer data science, today released the first annual Singapore Retailer Preference Index (RPI), a comprehensive, nationwide study examining the Singapore grocery market.

The RPI, based on research of over 3,000 Singapore shoppers, ranks 21 of the state’s retailers and evaluates their ability to deliver on customer demands through a combination of their Share of Wallet and Emotional Connection with shoppers.

The Singapore RPI shows that homegrown brands are the strongest performers, in contrast with other Asian markets where RPI results are dominated by multinationals. And when it comes to preferred method of shopping, Singapore leads the way with 81% of shopping omnichannel, compared to just 30% for many European countries. The RPI also reveals that over half (51%) of shoppers say that a recommendation from loved ones or relatives influences their Retail preferences.

“In a year where Covid has led to huge shifts in where and how consumers shop food retail globally, this report helps gain an understanding of the changing behaviour and expectations demanded of retailers today in Singapore,” said Adriano Araujo, President of APAC dunnhumby. “Data-driven Customer First strategies will be key to building successful and long-term business strategies to navigate beyond Covid, understanding and adapting to changing behaviors to deliver what truly matters to customers.”

The Seven Singapore Drivers

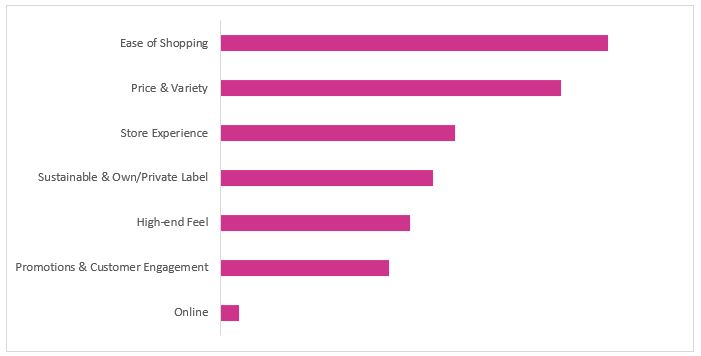

As well as ranking retailers in terms of their overall performance, the RPI evaluates overall performance against seven drivers of customer preference, with each having an influence on where customers choose to shop. For Singapore, the RPI shows that Ease of Shopping is the most influential driver, while Online is the least influential.

| Driver | Top ranked Retailer | Customer comments |

| Ease of Shopping | FairPrice Xtra |

|

| Price & Variety | Mustafa Centre |

|

| Store Experience | Marketplace by Jasons |

|

| Sustainable & Own/Private Label | FairPrice Xtra |

|

| High-end Feel | Cold Storage |

|

| Promotions & Customer Engagement | FairPrice Supermarket |

|

| Online | FairPrice Xtra |

|

How retailers can respond to the RPI

For retailers, there are several trends and learnings revealed in the study, namely how retailers can look to differentiate themselves from their competitors and build on their position in the dunnhumby RPI.

- The dominance of the FairPrice banners makes this a tough market in which to compete.

Few of the markets dunnhumby study trend so heavily towards a single group of companies. The FairPrice banners are fierce competitors indeed, capturing nearly half of the nation’s grocery spending, and present in three of the top four places in the RPI ranking. - Shoppers treat some pillars as ‘basic requirements’ for those they see as top performers.

Comparing shopper expectations with perceived performance under each pillar leads to an interesting observation about what customers really want: in several instances, when banners perform well in a certain area, shoppers also say that it isn’t actually important for that store to do so. - Online has little impact on offline choice – but the same is not true in reverse.

Ecommerce is a major factor for the grocery market in Singapore. At the same time, the choice of where customers shop online has very little impact on where they decide to shop in-store; Giant Online customers don’t necessarily default to Giant Hypermarket, for instance. The opposite is also true, however. Omnichannel presence is a key differentiator when it comes to online choice, and customers are much more likely to buy groceries from digital stores with whom they already shop in person. For any banner looking to launch or grow its online presence, their existing customer base is almost certainly the best place to begin. - The complexity of the market provides strong ground for differentiation.

The Singapore grocery market is complex. While the two leading pillars (Ease of Shopping and Price & Variety) do have a greater sway on preference than others, the difference between them is not so great that retailers cannot achieve strong differentiation by focusing on other tactics. Ease of Shopping provides clear evidence of this. While it may be the key preference pillar in this RPI, retailer performance here is actually fairly uniform. With some exceptions, banners are separated by just a few points in this area and customers are broadly satisfied wherever they choose to shop. For retailers seeking to win business and loyalty, this homogeneity makes it even more important to differentiate themselves in other areas.

Methodology

Summarising the views of 3,089 respondents, the inaugural Singapore RPI ranks 21 of the state’s etailers and evaluates their ability to deliver on Customer demands. Respondents participated in a series of online interviews conducted between 8th and 19th January 2021. As with all of dunnhumby’s RPI studies, a Retailer’s ranking is based on the combination of two things:

- Share of Wallet: where Customers claim to spend their grocery budgets.

- Emotional Connection: Customers’ feelings towards a banner, and the extent to which they relate to or connect with it.

Combined, these factors produce an RPI score. This is used to rank Retailers against each other, a process which forms the core of the study.

About dunnhumby

dunnhumby is the global leader in Customer Data Science, empowering businesses everywhere to compete and thrive in the modern data-driven economy. We always put the Customer First.

Our mission: to enable businesses to grow and reimagine themselves by becoming advocates and champions for their Customers. With deep heritage and expertise in retail – one of the world’s most competitive markets, with a deluge of multi-dimensional data – dunnhumby today enables businesses all over the world, across industries, to be Customer First.

The dunnhumby Customer Data Science Platform is our unique mix of technology, software and consulting, enabling businesses to increase revenue and profits by delivering exceptional experiences for their Customers – in-store, offline and online. dunnhumby employs nearly 2,500 experts in offices throughout Europe, Asia, Africa, and the Americas working for transformative, iconic brands such as Tesco, Coca-Cola, Meijer, Procter & Gamble and Metro.

Get in touch

For press-related inquiries, or to just learn more about dunnhumby, please contact [email protected].