Insights into a changing grocery market

After over two years of COVID-19 impacting shopping habits and trends, the grocery sector is facing new challenges. Rising global food inflation and the cost-of-living crisis is changing customer behaviour. Retailers and consumer brands are having to adapt once again – and with knowledge, comes power.

The dunnhumby Consumer Pulse study, now in its ninth wave after it was launched in 2020, surveys 300 shoppers in each country to give retailers the insights they need to stay ahead of the game.

Here are five key findings from the latest study in Australia and New Zealand.

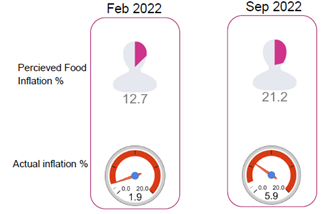

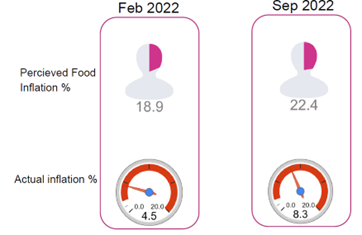

- Perceived vs actual inflation rates are still dominant – but are customers slowly adjusting their perception?

Shoppers have recognised that food prices are on the rise – our study shows 95% of Australians and 96% of New Zealanders say food prices are higher than they were one year ago. However, perceived inflation is still higher than actual inflation, which means customers think they have risen more than they actually have.

In Australia, perceived food inflation is 21.2% versus actual food inflation of 5.9% in September 2022. In New Zealand, perceived food inflation is 22.4% against the reality of 8.3%.

Despite this, there is some evidence that customers are slowly adjusting their perception. In both countries, perceived inflation has risen relatively less than actual inflation since February 2022 and so the percentage difference between the two has narrowed.

Australia:

New Zealand:

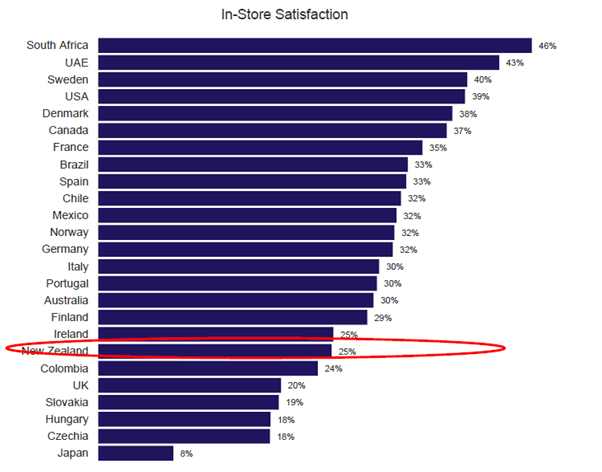

- In-store satisfaction is declining

One of the main concerns for retailers in the current climate is that in-store satisfaction amongst customers is falling. In Australia, in-store satisfaction fell from 34% in September 2021 to 30% in September 2022. In New Zealand, there is a similar story – down from 28% to 25% in the same period. Both countries are in the lower half of the global data, falling well below world-leader South Africa where 46% of in-store shoppers are satisfied, but above the UK where just 20% are satisfied.

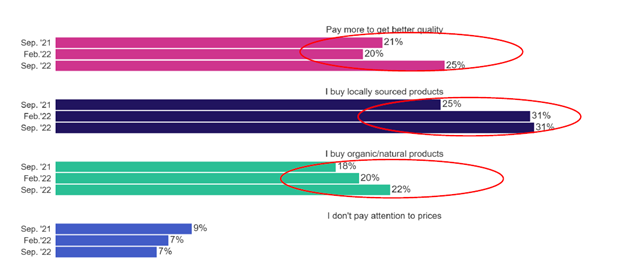

- Shoppers seek value – but more shoppers are also seeking quality in New Zealand

As you would expect in a period of high food inflation, customers are using value seeking behaviours more frequently. This includes searching online for the best deals (43% in New Zealand, up from 31% last year / 40% in Australia, up from 30% last year) and using coupons/offers on products they regularly buy (43% in New Zealand, up from 29% last year / 34% in Australia, up from 22% last year).

However, an interesting trend from New Zealand is that customers appear to be seeking quality too. The number of people who pay more to get better quality, who buy locally sourced products and who buy organic/natural products have all increased in the last 12 months. In Australia, all three indicators declined.

New Zealand:

Australia:

- In a cost-of-living crisis, customers are less loyal

Loyalty is always a significant topic for grocery retailers and our study shows that customer loyalty has dropped in ANZ over the last 12 months. In Australia, 43% of shoppers always do their shopping at the same store, down from 48% in September 2021. In New Zealand, the figure has dropped from 59% to 52% of shoppers.

New Zealand:

Australia:

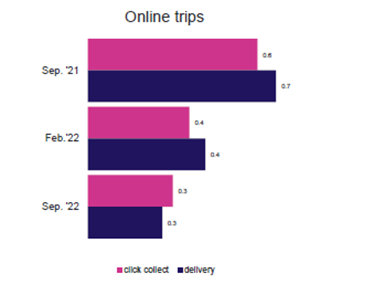

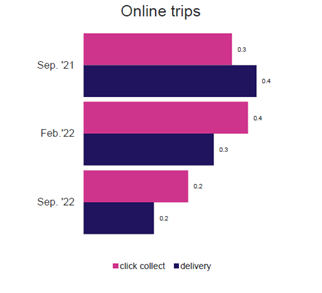

- Australians and New Zealanders are making fewer shopping trips – both online and in-store

Inflation is impacting the number of shopping trips made by customers in Australia and New Zealand. The frequency of both online (click & collect and delivery) and in-store trips have declined in the last 12 months. In addition, both countries are in the bottom eight nations in the world for the number of online shopping trips per customer.

Australia:

New Zealand:

In Summary

Food inflation in Australia and New Zealand is predicted to drop in 2023 and again in 2024 after peaking in 2022, according to Trading Economics.

With value seeking behaviours ever-more popular (along with some quality driven behaviour in New Zealand), retailers must continue to focus on relevant targeted offers in order to maintain spend, particularly in light of falling loyalty.

Follow dunnhumby’s Consumer Pulse surveys throughout 2023 to keep up to date with grocery trends and the continued impact of inflation on customer behaviour.

TOPICS

RELATED PRODUCTS

Amplify Customer understanding to create strategies that drive results

Customer First solutionsThe latest insights from our experts around the world