Assessing the impact of a global cost of living crisis on grocery shopping in Central Europe and Ireland

How are consumers reacting to the new challenge of global inflation and rising prices? How is the global cost of living crisis impacting shopping habits and trips? And what are the lasting effects of the global pandemic on grocery retail, more two and half years since the outbreak of COVID-19?

The dunnhumby Consumer Pulse study was launched in 2020, initially to assess the impact of coronavirus on shopping trends. Now published twice a year, we survey 300 shoppers in each country to provide insights on current trends and attitudes – giving retailers the insights they need to stay competitive.

Here we focus on key findings from the September 2022 report (Wave 9) across the EMEA region, looking specifically at results from Czechia, Slovakia, Hungary, Denmark, Norway and Ireland to give a snapshot of trends in Central Europe and the Nordics.

1. Prices are on the rise – but perceived inflation is higher than actual inflation

The vast majority of shoppers recognise that food prices have increased in the last 12 months, with 93% or more shoppers in all six highlighted countries saying that they felt food is more expensive than it was 12 months ago. In Hungary and Ireland, 99% of respondents have noticed an increase.

Concern over finances is also on the rise, with more shoppers in Czechia, Slovakia, Hungary, Denmark, Norway and Ireland all saying that personal finances and the economy are both weaker than they were 12 months ago. Interestingly, Denmark is the only one of the six nations where more people said their personal finances are weak (47%) than said the economy is weak (38%).

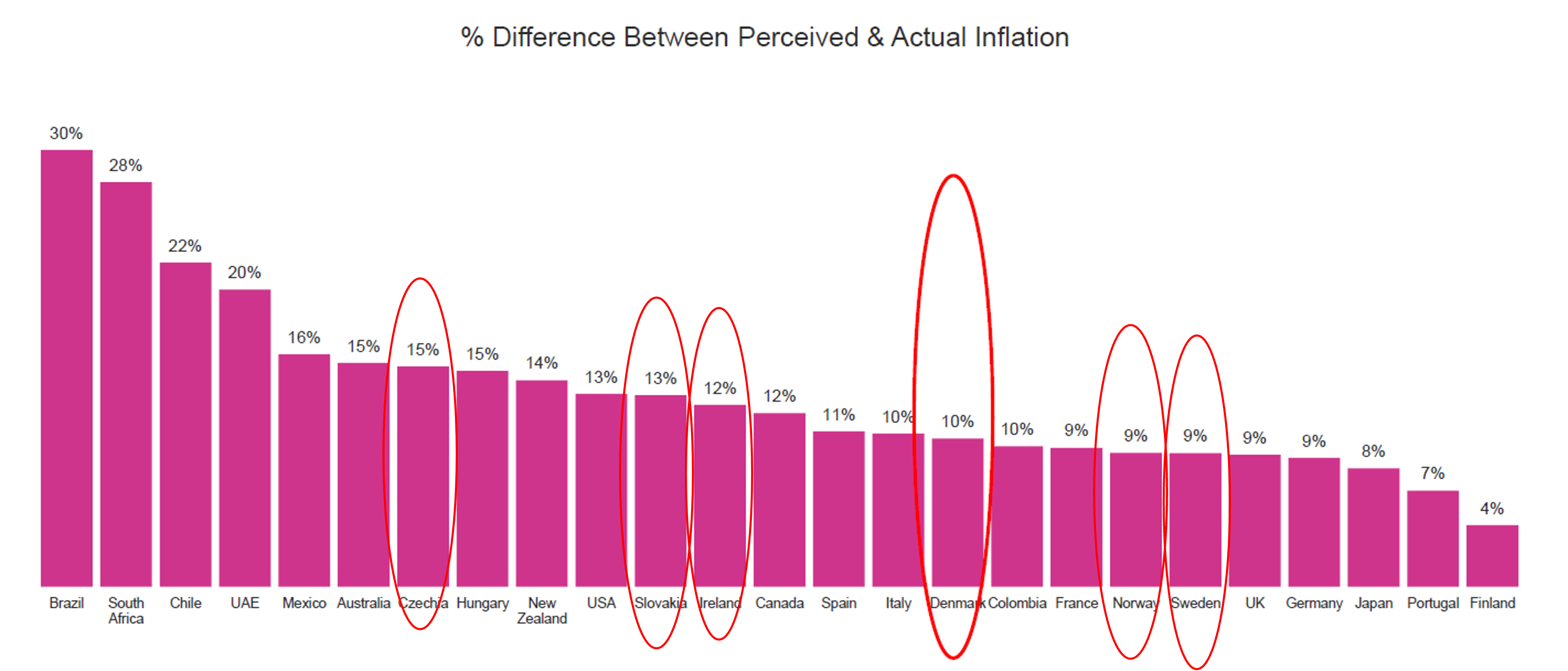

The reality of the situation, however, continues to be skewed by perceived inflation, which is still higher than actual inflation in all six countries – and indeed in every nation across the world. Customers universally think food prices have risen more than they actually have, with the % difference between perceived inflation and actual inflation in the stated EMEA countries ranging from 9% in Norway, to 15% in Czechia.

2. In-store satisfaction is declining

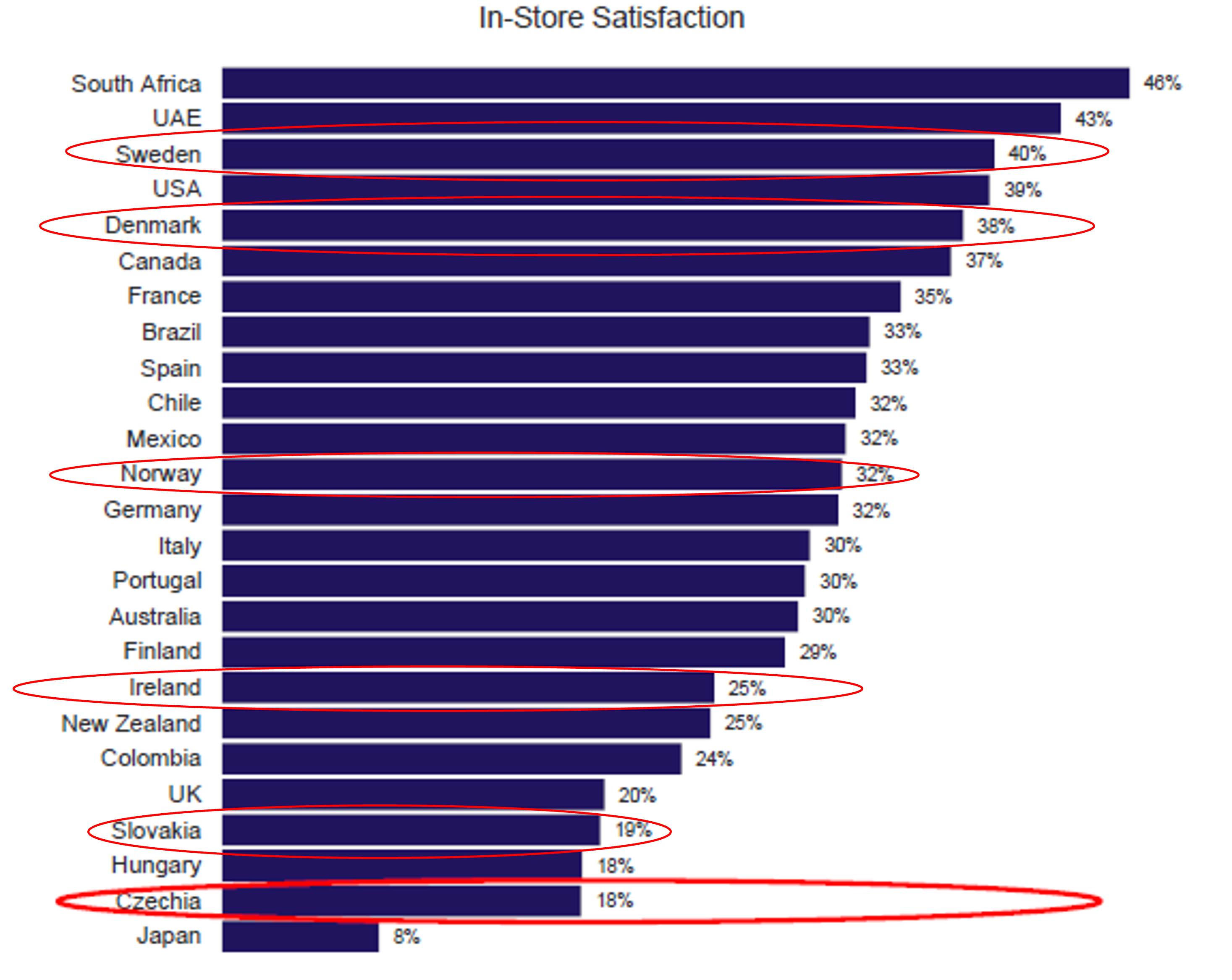

Another consistent trend across the highlighted countries – and that should concern retailers in the current climate - is that in-store satisfaction amongst customers is declining. Satisfaction levels for customers shopping in store fell between September 2021 and September 2022 in all six countries – and this is despite the fact that it initially increased from September 2021 to March 2022 in four countries (Czechia, Norway, Slovakia, Ireland).

EMEA countries are currently among the worst in the world for in-store satisfaction levels. Only Denmark from the six specified countries is in the global top ten. Czechia, Hungary and Slovakia are among the worst globally, taking up three of the bottom four slots after worrying declines in the last six months.

Making the stores easier to shop was never as important as today. Substitutability and importance for the shoppers should become key drivers of range composition, presence of private label and flow of goods in stores. Supported by personalized communication of rewards on most important lines and inspiration of cheaper alternatives, jointly, will help to create the perception of a retailer that understands Customers daily struggles and helps them to find the right products for their needs and budgets.

3. Shoppers seek value – but more people are seeking quality too in New Zealand

As you would expect in a period of high food inflation, customers are using value seeking behaviours more frequently. More shoppers are ‘searching online for the best deals’ and ‘using coupons/offers on products they regularly buy’ in all six countries than they were 12 months ago. The most widespread increases in value seeking strategies have been identified in Czechia, Hungary and Norway, suggesting retailers must focus on relevant, targeted offers to entice customers and maintain spend.

Czechia

Denmark

Hungary

Norway

Slovakia

Ireland

4. Customers are less loyal in a cost of living crisis

As the cost of living crisis bites, the general global trend is that customers are less likely to shop at the same store and this is evident in all but one of our highlighted countries. The decline in the number of customers who say they do every shop in the same store from September 2021 to September 2022 is relatively small in Czechia (41% to 39%), Hungary (47% to 42%), Slovakia (42% to 39%) and Ireland (48% to 42%) but sharper in Denmark (56% to 40%). Norway is the anomaly, where 49% of shoppers say they always use the same store, compared to 44% this time last year.

The growth of shoppers switching between the stores should be addressed by the retailers through the competitive pricing strategy on the right items. The KVI (key value items) list should be reviewed, considering changed shopper needs and habits during the inflationary times. Price Sensitive and vulnerable shoppers are finding this inflationary period to be particularly tough, so an even deeper investment on KVI pricing might be required.

Czechia

Denmark

Hungary

Norway

Slovakia

Ireland

Conclusion

Global food inflation is predicted to fall in 2023 but retailers must be mindful of perceived inflation, which remains evident across EMEA. Value-seeking behaviours are growing in popularity and this trend can be expected to continue until perceived inflation drops, even if actual food inflation has already reached its peak as has been predicted in some countries. In the meantime, retailers must continue to focus on targeted offers in order to maintain spend, particularly in light of falling loyalty in most countries.

Follows dunnhumby’s Consumer Pulse surveys throughout 2023, where we will be highlighting key trends and assessing the continued impact of food inflation on customer behaviour.

TOPICS

RELATED PRODUCTS

Understand changing Shopper behaviours through unique Data Science

Shopper insights solutionsThe latest insights from our experts around the world