How can grocers battle against the impact of price perception

A customer-first approach toward smarter pricing and promotions

At a recent industry webinar, I spoke with several dozen grocers about a problem we have surfaced over the last two years: shoppers are consistently overestimating the rate of inflation, as well as the profits that grocers are earning. And as we observed in a report on long-term trends, price sensitivity (what we call “fiscal conservatism”) historically ranks as the number one factor in shopping behavior – for all shoppers, no matter their socioeconomic status – and it is likely to persist in the years to come. Regardless of whether we’re speaking about a discount grocer with an everyday low-price strategy, or a grocer known for higher-priced premium goods, it matters increasingly to customers that the grocer prices fairly.

With a customer-first approach – powered by customer data science – practically every grocer can compete in the continuing age of “fiscal conservatism.

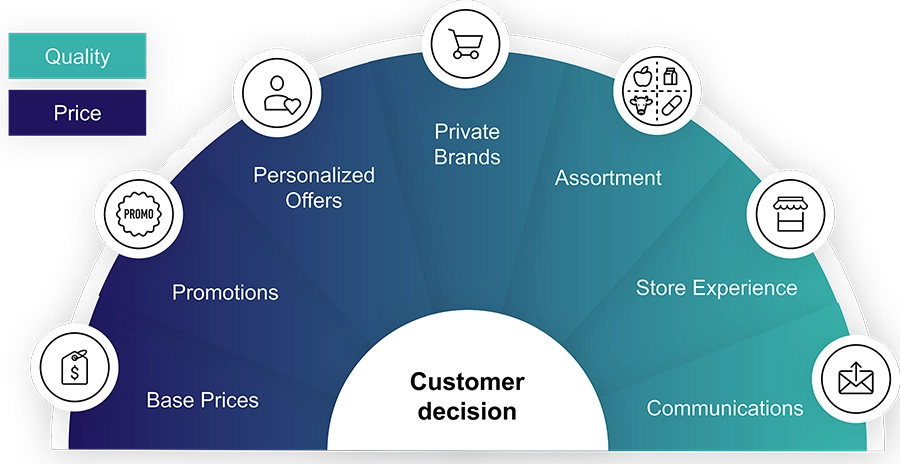

We are past the days of the pandemic, when grocers could prioritize for convenience and less on pricing, and many grocers are aware of this. But what can they do to battle price perception at a time when shoppers are becoming more price-aware and shopping around more for a smarter overall basket? This new normal has led to a scramble among grocers to find the right approach to pricing and promotions (P&P). This brief looks at the common traps that grocers find themselves in when designing P&P programs and offers a more holistic approach that prioritizes the needs of the most important perspective in the P&P equation: the point of view of the customer. And there is reason to be hopeful. Base prices account for roughly half of shopper price perception. A customer-first approach reveals the levers that grocers can pull for the remaining fifty percent of shopper experience that factor into the perception of price.

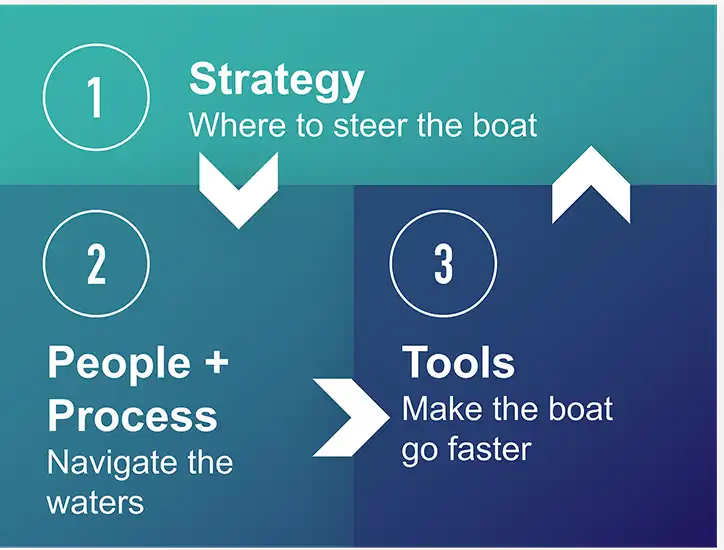

The dunnhumby approach – partnering from strategy to execution

There is a common practice in the management consulting industry. When hiring a firm known mostly for its consulting prowess, a grocer may need to hire another provider to implement software (tools). This parallels what we see in the grocery industry. The siloed approach often leads to breaks in continuity – slowing down the overall journey – and myopic traps in thinking. These traps can easily be avoided. Unlike traditional consulting firms, dunnhumby seeks to provide a holistic approach to price and promotion that balances strategy, people, process, and tools.

Strategy traps

By isolating strategy from the entire lifecycle of change management, grocers commonly fall into traps. For example, isolation of strategy might result in short term bias of “following the competition” to hit a target index, or the decision to forego competing on price and instead focus on differentiating from the competition (on personalization or assortment). Approaches like these are likely to fail today. As our research has shown, price sensitivity to specific products must factor into P&P, even if just for a select group of products in the store.

People & Process traps

When it comes to people and processes, grocers may lack the perspective to address legacy issues like changing old habits (“we’ve done it this way as long as I can remember”) and past failures in innovation (“the last executive we had tried to take us down a similar path”). This bias can be fatal. The literature on business failures is rife with case studies of companies that refused to adapt to evolving best practices. More importantly, focusing exclusively on people and processes can result in corporate myopia. Without an appreciation of the big picture, leaders and employees cannot be prepared well enough to allow change. Instead, change will be seen as futile.

Tool Traps

Then there’s the tendency to focus merely on tools – the price and promotion technology systems that compete in the marketplace today. There are many challenges with P&P technology solutions, among the top of the list is disconnected data and lack of science that considers base price, promoted price, and other impactful variables. Tools often fail to address the needs of users in their day-to-day work: dealing with conflicting pricing rules, incomplete cost data or lack a view of historical performance. Relying exclusively on software tools to improve the business leaves grocers in a holding pattern of cycling what was done last year and prevents the prioritization of customer data to guide the work that can make the biggest impact.

What does it mean to be “Customer First”?

A lot has been said about the need for grocers to think and act customer first. But what does this mean? At dunnhumby, which has long championed customer-first strategy and operations, it means looking at all decisions – including those relating to pricing and promotions – from the perspective of the evolving needs of the customer. This is more important than working against the competition. The customer matters more. It is also more important than merely addressing legacy behavior and practices or leveraging software to execute the same thing faster. A customer-first strategy sits above and shapes all three – it is the first principle, so to speak, of P&P. Practically speaking, therefore, it also demands the integration of strategy, people, processes & tools. As I have shown above, neither can be realized in isolation.

And here’s the big opportunity, by enabling the customer to drive all decisions, grocers can deliver base prices customers can trust and promotions that are both meaningful and effective. While Price and Promotion can have a significant impact on price perception, there are other levers to consider. Figure 1 below illustrates additional levers that influence perception.

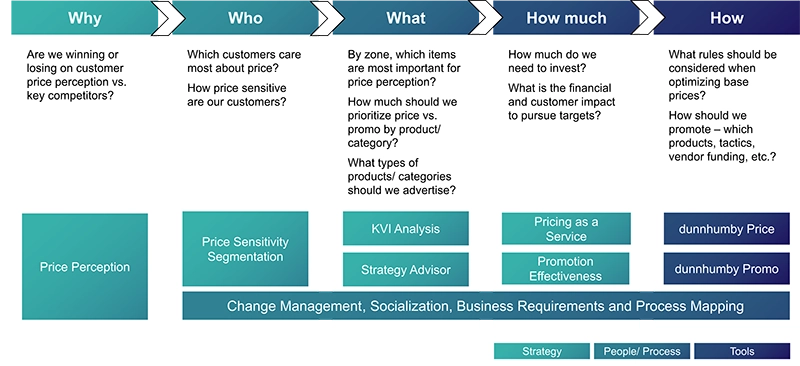

How then does a grocer put these principles into action?

The dunnhumby approach enables grocers to define a customer-centric strategy that considers both price and promotion, mapping business processes that bring the strategy to life, and software deployment that will maximize the efficiency to execute. Along the way we will answer, are you winning on customer perception relative to competitors? Which of your customers care most about price? Which products and categories are most important to customer price perception? Where should you prioritize base price and which promotions are most effective? What is the financial and customer impact of pursuing targets? What are the optimal promotion tactics?

A winning approach, powered by customer data science

While there are many ways to answer these questions – questions that combine strategy, people, processes, and tools collectively – this framework provides grocers with a single picture – a “single pane of glass” – for approaching price and promotion. Imagine you are the Chief Merchandising Officer (CMO) of a traditional grocery chain – which is currently perceived as an expensive grocer – with the immediate challenge of improving the chain’s value image. Leveraging dunnhumby’s customer data science platform, we can develop segmentation to understand which of your customers care most about price and how price sensitive they are. This will help shape how we define a unified price and promotion strategy that prioritizes your most loyal and price sensitive customers, identifying where to compete on base price and how to drive value through meaningful promotions. You might discover, for example, that these customers expect a low price on quality bread. To bring them into the store, you communicate with them about the reduced price for that bread. During their visit to the store, these customers see that you have other products – say imported cheese and cultured butter – that go with their bread and are on sale, fitting into their budget. These customers begin expanding their shop across other categories, overtime growing loyalty and improving their perception of overall value. This approach can be tailored for each grocer according to their unique customer data, shifting away from competitor focused “pricing wars” to customer driven decision making powered by dunnhumby science.

More importantly, by putting the customer first in all your decision making, you can set the stage for a continuously evolving engagement which can deliver both short-term and long-term results. With a cadence of annual refreshes, most grocers – no matter how large or small, no matter which sector -- can keep up with the times. In the meanwhile, one principle remains immutable: the customer should drive your decisions.

TOPICS

RELATED PRODUCTS

Boost value perception and execute promotions that drive results

Boost value perception and execute promotions that drive resultsThe latest insights from our experts around the world