EBIT: the next milestone in retail media measurement?

The measurement of retail media is an issue we’ve covered a few times before on this blog. From the implications of closed-loop reporting through to the need for retailers to measure what really matters, we’ve explored the issue from a range of different perspectives. Sticking with that tradition, I’d like to introduce a new angle to the measurement discussion – and that’s the importance of EBIT.

EBIT, or Earnings Before Income Tax, is used to summarise operating profit. By taking a company’s revenues, subtracting any expenses (and ignoring, for the time being, any tax deductions or interest), EBIT provides a quick insight into that organisation’s overall profitability. EBIT calculations can also be divided by total sales revenue to reveal a company’s operating margin, itself a useful measure of past and present performance.

All of that information is undoubtedly vital, but how exactly does it link back to the topic at hand? Why should we take EBIT into account when trying to gauge the effectiveness of a retail media programme? I think, for retailers, there are two reasons – one very obvious, and one that’s a little more tangential:

- Retail media is a revenue-driving activity and, implemented successfully, it should have a positive impact on EBIT. Retailers have numerous competing priorities. They should consider EBIT contribution as a mechanic to compare the value of retail media to other business initiatives.

- The revenues retail media can generate don’t begin and end with insights and advertising. By introducing greater levels of personalisation into their operations, retailers can expect to see sales uplift too – something EBIT will reflect.

Another good thing about bringing EBIT into the equation is that doing so helps you to understand more about retail media’s impact on your bottom line.

Where is the money coming from?

Before we look at how you can use EBIT to demonstrate the value of retail media, I think it’s important to establish a few facts about the financial realities of the industry as a whole.

The first thing to know is that retail media presents a gigantic and growing opportunity. Data from the IAB suggests that, by 2026, spending on retail media across Europe will amount to €25bn[1]. For the avoidance of any doubt, that’s more than double last year’s figure, indicative of the huge attention the discipline is beginning to attract.

Better still, a significant amount of that money is “net new” to retailers. A separate study suggests that between 60 and 70% of the retail media revenues generated in the next few years will be entirely distinct from existing sources of income[2]. While there will inevitably be some cannibalisation, principally from trade budgets, most of those gains will result from organic growth in digital, and the shifting of budget away from other forms of media.

Retail media also tends to be an incredibly high-margin pursuit, particularly when compared with “traditional” retail revenues. Even the best-performing retail categories – beauty and home improvement, for example – tend to have margins that top out around the mid to high 30% mark. Offsite retail media margins typically sit between 20 and 40%, with onsite somewhere around 70 to 90%[3]. The difference is pronounced.

Finally, there’s that issue of personalisation-driven sales uplift that I mentioned above. Most retail media programmes today involve the use of personalised recommendations, promotions, and offers – activities that in our own experience usually drive an uplift of around 2% in addressable sales. While that might not sound like much on paper, a 2% increase in total sales is no small matter.

Combined, this all serves to tell us one thing: there is a prolific commercial opportunity emerging around retail media. The only question left to answer is how much that opportunity is actually worth to your own business.

If you’re interested in using EBIT to measure the effectiveness of your own retail media programme, it helps to have a few specific figures to hand before you begin. These are:

- Your current EBIT and gross margin: understanding the margin your company makes on sales will provide a baseline figure for attributing profit to incremental sales that are attributed to personalisation. The logic for how to do this is explained below.

- Your gross revenue from retail media: this figure includes all the channels in your organisation in which you have advertising space and is used by CPGs or agencies to promote their products and brands. The channels included as part of the retail media portfolio are onsite media (on the retailer’s own website), offsite media (advertisements on digital properties not on the retailer’s website, such as Facebook or Google), store media (advertisements at the shelf, or digital screens in-store) and CRM media (newsletters, mailings or personalised coupons sent to customers).

- Margin on retail media: Generally, retailers can expect that across media channels, they see a 40% margin on retail media, and although this figure varies a lot depending on the maturity, location, size and scale of the retailer’s operations, this is a good reference figure to use in understanding the effectiveness of retail media.

- Your total retail (i.e. non-media) sales: these are your overall sales as a retailer, across both digital and physical properties. This number will be used to identify a portion of sales that can be attributed to loyalty card holders.

- The percentage of your sales that come from loyalty card holders: of overall sales, how many come from people or households who use their loyalty card when shopping?

- Sales uplift delivered by personalisation: From our experience working with partners globally on media and personalisation, we estimate that retailers can expect a 1% uplift from personalisation when compared to non-personalised channels.

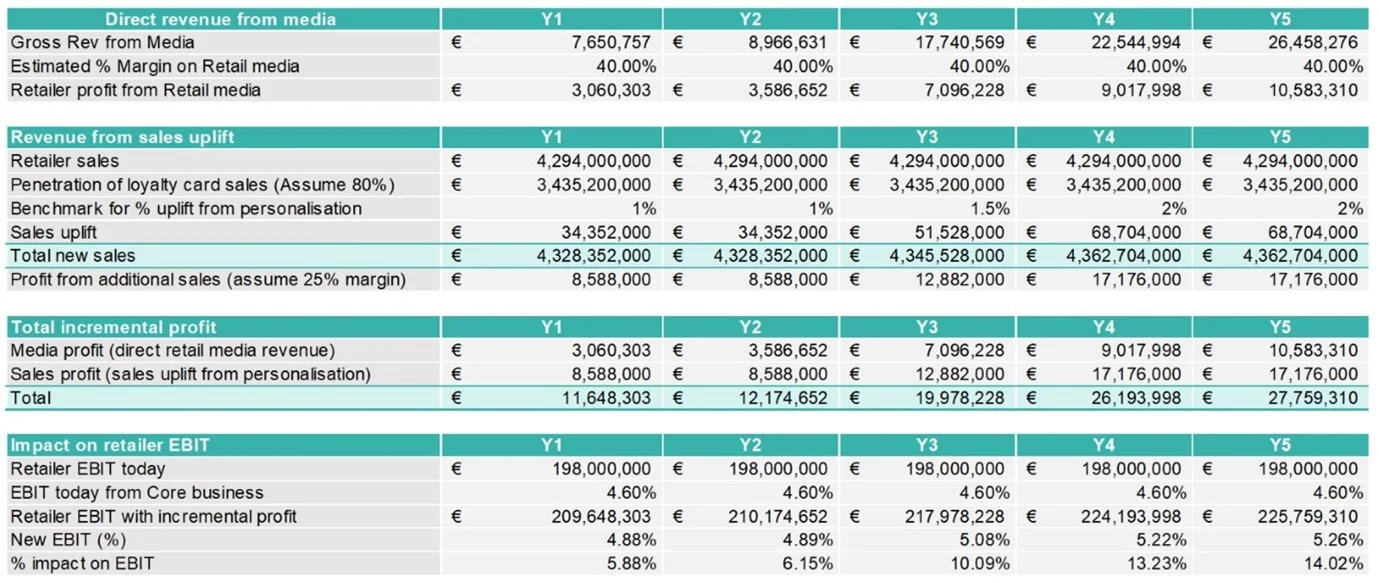

With those numbers, the process for calculating the EBIT impact of media and personalisation actually becomes relatively simple. Below is an example of how you would work out the impact on retailer EBIT using some sample figures:

Part 1: Working out your total incremental profit

- Start with your gross revenue from retail media. Work out what 40% of this figure is (easily done by multiplying it by 0.4). This provides the estimated profit delivered by your media programme.

- Now take your total retail sales and use the percentage from d) above to calculate revenues from loyalty card holders only.

- Take the result from step ii and work out what 1% of this figure is. This provides the estimated sales uplift delivered by personalisation. This can be scaled up to 2% if your personalisation programme is particularly mature.

- Now take the result of step iii and work out 25% of this figure (assuming Retailer ABC sees a 25% margin on their sales). This provides the estimated profit delivered by personalisation.

- Add the results of steps i and iv together to get your total incremental profit.

Part 2: Calculating your gross margin with media and personalisation included

- You should already have your existing EBIT figure. Now, you can add your total incremental profit to this.

- By dividing this new figure by your total sales revenues, you’ll get your gross margin with retail media and personalisation included.

- This can be compared against your existing gross margin to give you an understanding of the difference that media and personalisation make to your EBIT.

The chart below provides an example of these calculations in action.

One important thing to note here is that the process above does utilise some assumptions. The 40% profitability figure for retail media, 80% loyalty card sales, and the 1-2% sales uplift resulting from deeper personalisation are generalisations, and should be treated as such. Naturally, it’s always better to use actual values if you have them.

If you’d like to get a detailed – and more accurate – understanding of what retail media can do for you, that’s something that we can help with. Please reach out to Katherine Mainardi (Katherine.mainardi@dunnhumby.com).

[1] International Retail Media Trends & 2022 Outlook - IAB

[2] Commerce Media Survey (2022) / BCG CPG Retail Media Benchmarking Survey (2021) - BCG

[3] Commerce Media Survey (2022) - BCG

TOPICS

RELATED PRODUCTS

Make Retail Media work for your business with Customer Data Science

dunnhumby Sphere – The Customer first platform for Retail MediaThe latest insights from our experts around the world