Four insights on APAC shopping behaviours

When it was first launched in 2020, the dunnhumby Consumer Pulse survey gave a snapshot of changing shopping behaviours as a result of the pandemic. Using findings from 400 shoppers in individual countries, each survey tracks trends and shows changing habits to help retailers adopt a ‘customer first’ approach. Additional ‘waves’ have given us the opportunity to continue analysing changing behaviours, comparing global markets as the recovery from COVID-19 continues.

Here we draw on findings from Wave 8 of the survey to identify four key shopping behaviours in the Asia-Pacific region, which covers Australia, China, Malaysia, New Zealand, Thailand and Japan. Specifically, how COVID-19, inflation and other factors outside of the retail environment are impacting customers and their shopping habits.

We’re not back to normal yet – but people want to be there.

Our survey shows that while concerns about COVID-19 are declining (despite the recent surge in infections), most do not feel we are back to normal yet – but people want to be there.

The ‘worry index’ – a measure of concern about COVID-19 – has dropped globally and is as low as 11% in China and 16% in Australia, although it has risen slightly in Japan and Malaysia in line with increased cases.

However, some of the adaptive behaviors are changing, with people making more trips to stores and restaurants.

In APAC, people are making most trips in Thailand (10.6 per week) and China (9.9 per week).

Retailers should be mindful of the dual nature of the market. People want to feel normal and in some countries many no longer feel stores are doing a good job in how they are handling the virus. Yet others are still concerned about being infected while shopping and about unvaccinated shoppers.

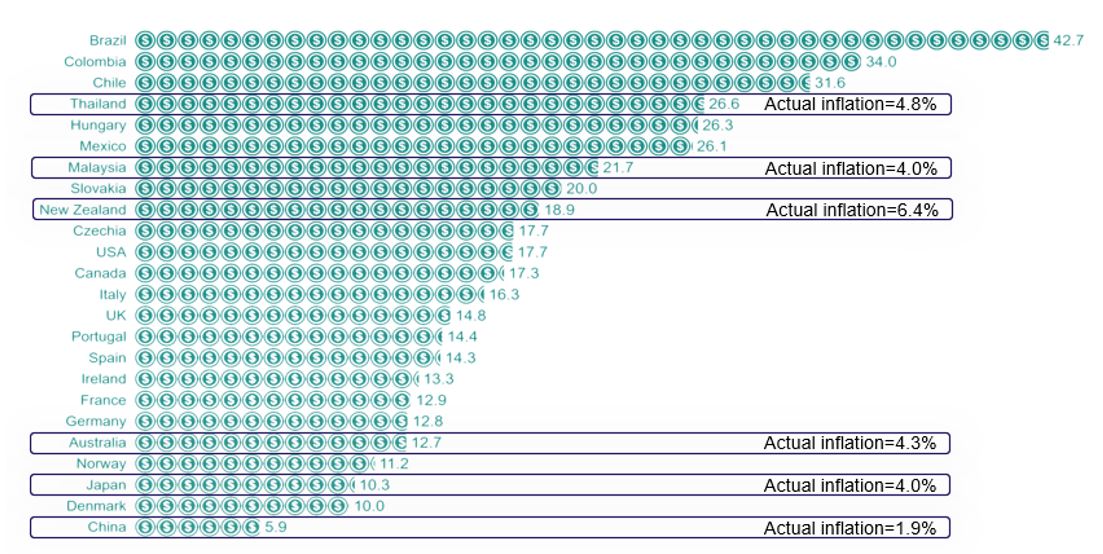

Customers think inflation is even higher than actual figures.

Food inflation remains a concern and even more significant for retailers is perceived inflation, where many shoppers think that food inflation is even worse than actual figures largely due to continued media coverage.

On average worldwide, people over-estimate the actual inflation rate by 14 points, although this fluctuates between APAC countries from Thailand (26.4 points) to China (4.9 points).

One result of perceived inflation is that shoppers are continuing to demonstrate value seeking behaviours, such as using coupons, buying products on offer or shopping online for sales. However, whilst value-seeking behaviour is still the dominant approach to shopping, it has decreased slightly and people seem to be less focused on a specific strategy for shopping. The question for the future is whether this attitude will continue if prices continue to rise.

Inflation is high but dramatically over-estimated

People combine online and in-store shopping – but make more trips to stores.

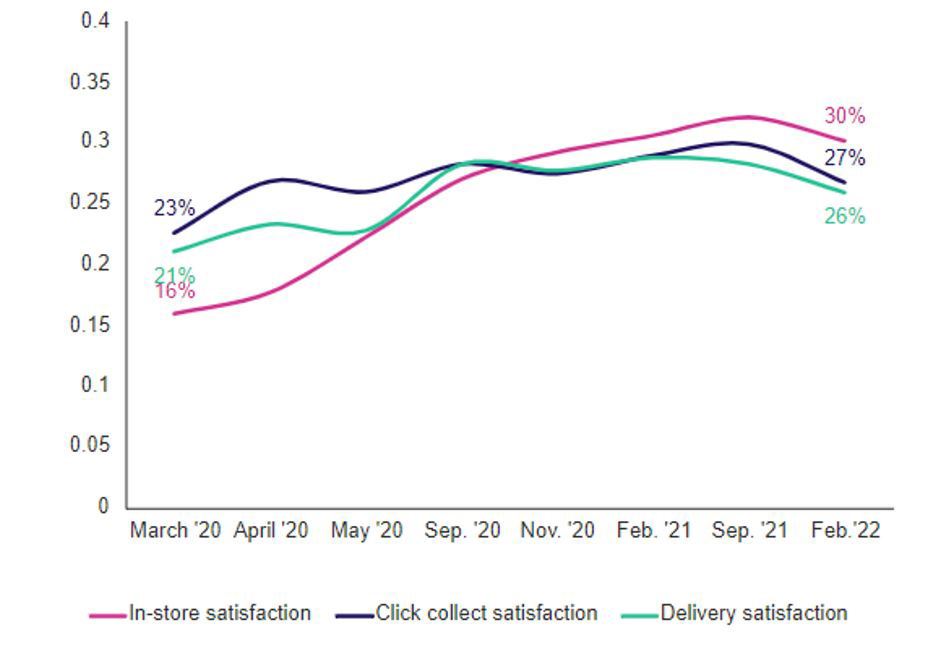

One of the most interesting shifts during the peak of COVID-19 was the rise of online shopping and it is important to note the long-term trend around shopping behaviours and frequencies.

In the latest wave of our survey, data shows that about half of people shop both online and in-store, but in-store accounts for most trips. Satisfaction with online shopping is at the same level as in-store shopping, but the number who say they will increase online shopping is declining.

Satisfaction for in-store and online shopping

Satisfaction with online shopping (with delivery)

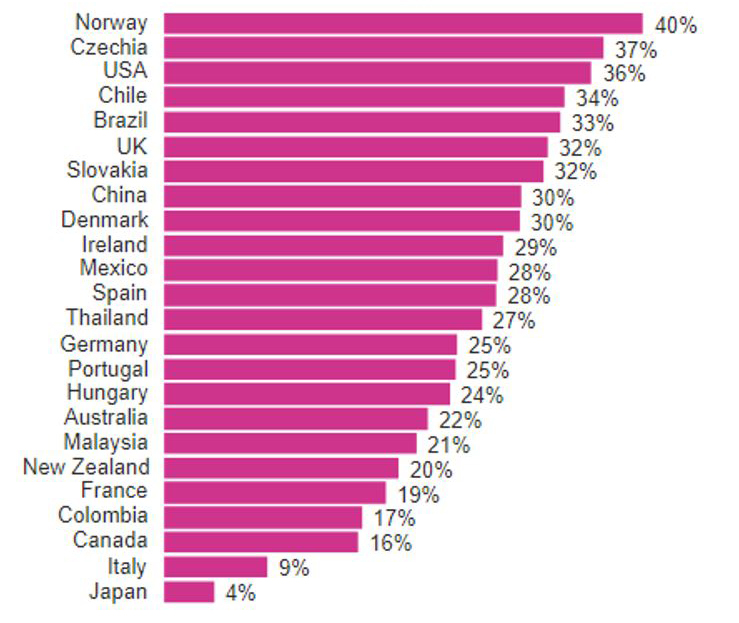

Health is an important trend – but not all health-conscious shoppers are on a diet.

Across all APAC countries, health is an important shopping trend as increasing numbers of customers recognise the benefits of healthy shopping for healthy eating. The primary benefit cited by people is that “eating healthy makes me feel good”, suggesting the reward is an emotional one.

This trend is more evident in Malaysia and China, where exactly half of all shoppers are categorised as ‘health-focused’ shoppers, which means they agreed with three or more positive health statements. In Japan, this is figure is around a third (34%). Interestingly, under half of global respondents are actually on any form of diet.

Retailers should be aware that there is little or no difference in demographic between health-focused shoppers and non-health-focused. Identifying those people among customers will depend on transactional data using solutions like those provided by dunnhumby.

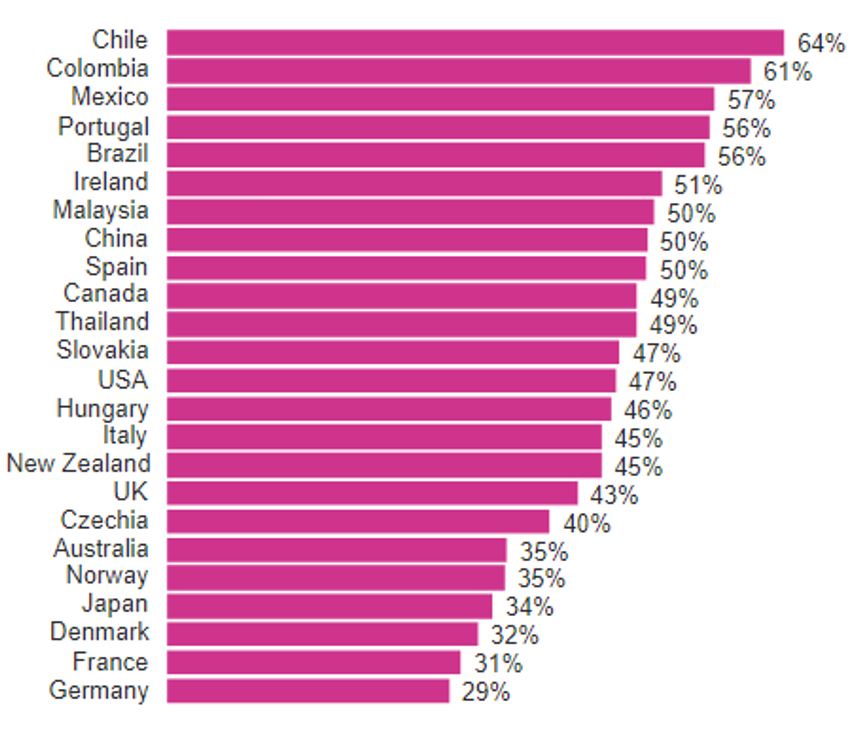

% who show focus on health by country

At this present time of perhaps the highest inflationary rates in Shoppers’ lives and likely our professional careers, Retailers and Suppliers need to be thinking and activating to keep up with Customer demands. These extraordinary times call for an exceptional understanding of and focus on how Shopper needs and buying habits are undergoing even further changes post Covid. Utilising valuable data is the answer to unlocking these.

We recommend the following five steps that CPGs and Retailers should be taking now, both internally within their business and in collaboration with each other.

- Refresh your Shopper Understanding and Strategy

- Focus on the right categories and products, according to Shoppers

- Ensure competitiveness on the right items to protect your value perception

- Rebalance how prices and promotions work together to deliver real value

- Help Shoppers find smarter and easier alternatives

Even though we see differences in how the increase in food prices impacts each market, the challenge we are facing together, both as retailers and CPG’s, is that the customer perception already far precedes the reality and shopper’s perception is reality.

TOPICS

RELATED PRODUCTS

Amplify Customer understanding to create strategies that drive results

Customer First solutionsThe latest insights from our experts around the world