Food inflation: why perception may be worse than reality

Inflation rates are at the highest for decades in many economies around the world. With the global economy facing multiple challenges from the pandemic, supply chains, and military conflict; price rises are being seen on everyday essentials like fuel and food. And this is already having an impact on consumers, with dunnhumby’s latest consumer pulse report making for sombre reading1.

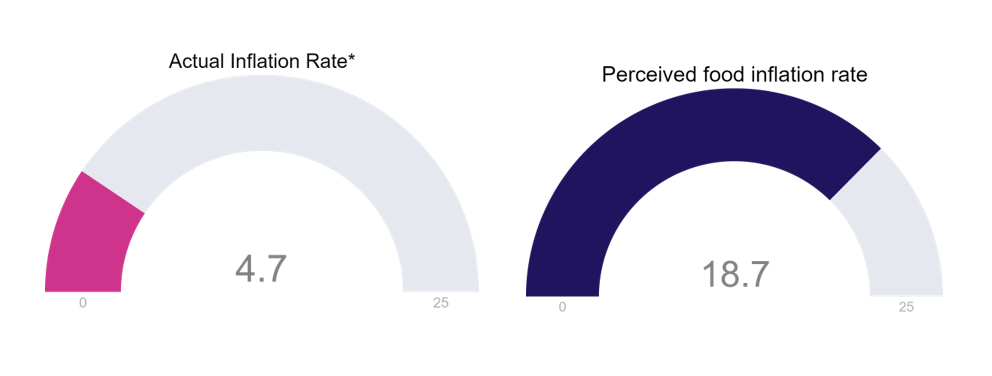

But how much of this is down to customer perception? Figure 1 below shows the global perception of food inflation is nearly four times that of actual food inflation:

Figure 1: shows actual global food inflation on the left and perceived food inflation on the right. Perceived food inflation is vastly higher than actual food inflation. Actual food inflation was sourced from Tradingeconomics.com

Clearly, actual food inflation is one thing, but perceived food inflation is another. This implies retailers and CPGs (Consumer Packaged Goods) need to view food inflation from their customers’ perspective and not just as an economic metric.

This blog examines the following:

- Which markets are more concerned?

- Who is more concerned?

- When are customers more concerned?

- What more can retailers do?

Which markets are more concerned?

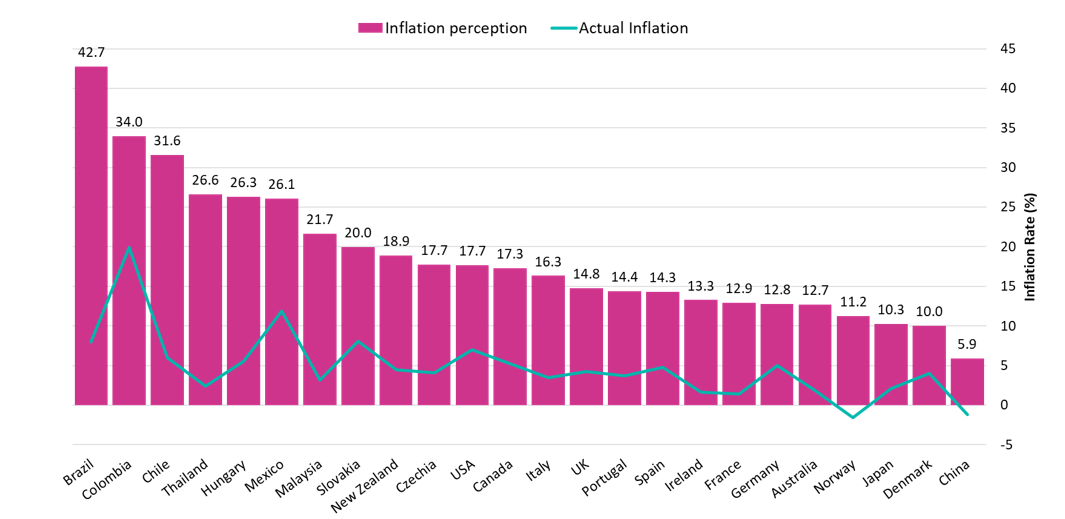

Inflation perception is not felt equally around the world. Figure 2 below highlights food inflation perception in key dunnhumby markets together with the actual inflation rate. Food inflation perception ranged from 42.7% in Brazil to 5.9% in China. The markets that are more concerned broadly include Latin America and Central Europe.

Figure 2: shows perceived and actual food inflation in key dh markets. Perceived food inflation is not felt equally around the world.

Even if one were to subtract actual food inflation from perceived food inflation, the over-estimations are on average 14 percentage points higher, (ranging from 34.7% for Brazil to 6% for Denmark). So, even when we consider the degree of actual inflation, the perception of food inflation is still very high.

Who is more concerned?

The consumer pulse found evidence that females are slightly more concerned with higher perceived food inflation relative to males (20% vs 17% respectively). There was also evidence that the youngest demographic had a slightly greater perception of food inflation compared to the oldest demographic (19% for 18-34 yrs and 16% for 65 yrs+).

This corroborates with some general inflation data from the Bank of Cleveland, USA which found that females have higher estimations of general price inflation (Consumer Price Index, CPI) compared to males2. This is not because females tend to do more household shopping as there was also a difference between single females and single males. The same study found higher general inflation perception among low incomes, singles, non-whites, and young people.

Based on US grocery data3, it was found that consumers form expectations on aggregate general inflation was not based on expenditure share but frequency of purchase. This may be an important additional variable to identify customers who may need more support.

When are markets more concerned?

In the short term, with the actual inflation rate high and a media spotlight on inflation, one can expect now to be a time when prices are at top of mind for customers. However, in the longer term when inflation may become more stable, is there a time of year when inflation will matter more?

There is an interesting tracker study on perceived general inflation from Denmark4. In this study it was found, perceived general inflation is greatest in July (and lowest in February, the difference between February and July being one percentage point). For the Danish market, this is because of traditional major sales in January/February but higher perceived prices during the long holiday period. It may be the case that customers budget less for the long summer holidays compared to other times of the year.

This data is important as it can help different markets look for those times of the year when customers may need more support once inflation is more stable.

What more can retailers do about it?

Lastly, and perhaps most importantly, what more can retailers and CPGs do about inflation? Traditionally, companies deal with inflation by increasing prices, reducing costs (perhaps quality) and decreasing margins5. dunnhumby has already issued extensive advice on how to handle inflation6, 7, 8. However, given the extent that inflation is biting there are further methods that should be considered:

- 1. Communications

Increase communications which recognise the burden of food inflation. Explain what is being done to keep prices down and how customers can better cope with rising prices. But perhaps more importantly also explain why price increases are often beyond a retailer’s control.9 Avoid assumptions that may work against price fairness. For example, in a classic behavioural economics study, it was found that increasing the price of a snow shovel after a snowstorm was judged to be unfair, even though it made economic sense10.

- 2. Corporate Social Responsibility (CSR)

How can retailers show they care for customers? Another recommendation is to increase CSR particularly for price sensitive customers.9 Retailers should be seen to be helping in other ways to maintain price fairness when prices are increasing.

- 3. Coupons

According to the global consumer pulse data, the most common value seeking behaviour was ‘using coupons/offers on products I regularly buy’ (47%). Note that these are products that are bought regularly, so coupons on irrelevant products are of little use. Use the power of personalisation.The use of coupons has had a long history. The great recession saw overall coupon usage increase by 27% but internet coupon usage increased by 263%.11 This may imply how important online is likely to be as a result of inflation too. To corroborate this, the consumer pulse found the second most-used value seeking behaviour was ‘searching online for the best sales’ (41%). Making sure that online and apps are easy to navigate for all demographic groups is likely to be an imperative.

- 4. Food waste

Globally, one third of food produced for human consumption is wasted12. Furthermore, 61% of food waste comes from households, 13% from retail and the remaining 26% from food service13. Whilst food waste is associated with sustainability (the energy and water used to grow and transport food) it can also be used as a vehicle to avoid food inflation too.There may be some relatively novel ways to reduce food waste. For example, use more dynamic pricing when food is past their prime, such as decreasing prices to reduce food waste in stores14. Encouraging customers to make a meal from what they find in their fridge using flexible recipes and food waste measurement15. Any method to avoid food waste will not just help with sustainability but also food inflation.

- 5. Loyal prices

Another concept is called “precise pricing”, where you update a price to reflect the true product cost for an individual customer5. As the authors explain “Precision pricing — which is highly targeted and enables managers to base prices on each product’s true, current costs and each customer’s true, current profitability — is custom-designed for this unstable environment”. While this may not be perfectly suited for the grocery retail market, where many prices are based on just below a round pound i.e. £0.99, perhaps aspects of this can be used.For example, some retailers already provide different prices for different customers based on loyalty (e.g., lower prices for Tesco Clubcard holders vs non-Clubcard holders). Is there room to create more segmentations based on loyalty, such as providing deeper offers for customers with a deeper level of retailer and product loyalty?

Summary

This blog highlights which markets, who and when a customer is more likely to be concerned with food inflation. Furthermore, it highlights methods to counter high food inflation perception for both retailers and CPGs. More importantly, it highlights how perceived food inflation goes beyond actual food inflation. Implying that to some extent, food inflation may be in the eye of the beholder. Retailers and CPGs need to view food inflation from the customers’ eyes, rather than relying solely on economic metrics.

References

1 Clements, D., Ciancio, D. & Brandt, D (March, 2022). Nine new insights on global shopping behaviours. https://www.dunnhumby.com/resources/blog/trends/en/nine-new-insights-on-global-shopping-behaviours

2 Bryan, M. & Venkatu, G. (2001). The curiously different inflation perspectives of men and women. Federal Reserve Bank of Cleveland Economic Commentary Series. Available at http://www.clev.frb.org/Research/ Com2001/1015.pdf

3 D’Acunto, F., Malmendier, U., Ospina, J. & Weber, M. (2021). Exposure to Grocery Prices and Inflation Expectations. Journal of Political Economy 129 (5)

4 Abildgren, K. & Kuchler, A. (2019). Revisiting the inflation perception conundrum, Danmarks Nationalbank Working Papers, No. 144, Danmarks Nationalbank, Copenhagen

5 Byrnes, J. & Wass, J. (Feb, 2022). Precision Pricing When Inflation Is Rising. Harvard Business Review. https://hbr.org/2022/02/precision-pricing-when-inflation-is-rising

6 Ciancio, D. and Llewellyn, C. (February, 2022). 20 actions that retailers should be taking during inflationary times. dunnhumby blog https://www.dunnhumby.com/resources/blog/all/en/20-actions-that-retailers-should-be-taking-during-inflationary-times/

7 Ciancio, D. (November 2021). The Best Customer First Strategies for Inflationary Times: Part One. dunnhumby blog https://www.dunnhumby.com/resources/blog/price-value/en/the-best-customer-first-strategies-for-inflationary-times/

8 Ciancio, D. and Llewellyn, C. (January, 2022). Customer First Business Practices for Inflationary Times: Part Two. dunnhumby blog https://www.dunnhumby.com/resources/blog/price-value/en/customer-first-business-practices-for-inflationary-times-part-two/

9 Lu, Z., Bolton, L., Ng, S., Chen, H. (2020) The Price of Power: How Firm’s Market Power Affects Perceived Fairness of Price Increases. Journal of Retailing. 96 (2):220–234.

10 Kahneman, D., Knetsch, J.K. and Thaler, R. (1986). Fairness as a Constraint on Profit Seeking: Entitlements in the Market. The American Economic Review 76 (4): 728-741

11 Beatty, T.K.M. and Senauer, B. (2013). The New Normal? U.S. Food Expenditure Patterns and the Changing Structure of Food Retailing. American Journal of Agricultural Economics 95 (2): 318-324

12 Gustavsson, J., Cederberg, C. and Sonesson, U. (2011). Global food losses and food waste – Extent, causes and prevention. Food and Agriculture Organization of the United Nations.

13 Forbes, H., Quested, T.. & O’Connor, C. (2021). Food Waste Index. United Nations Environment Programme https://www.unep.org/resources/report/unep-food-waste-index-report-2021

14 Fan, T., Xu, C. and Tao, F. (2020). Dynamic pricing and replenishment policy for fresh produce. Computers & Industrial Engineering 139. 106127

15 Unilever (2021) https://www.unilever.com/news/news-search/2021/one-use-up-day-a-week-cuts-food-waste-by-third/

TOPICS

RELATED PRODUCTS

Amplify Customer understanding to create strategies that drive results

Customer First solutionsThe latest insights from our experts around the world