Multichannel retail pharmacy part two: path to purchase

Retail, in its purest form has, and will be, building long term, meaningful, connections between customers, retailers and the solutions they offer. How do you provide them with the best possible way to meet their needs, at the right place, right time, and at a fairly perceived, mutually beneficial exchange?

This interaction, which used to be simple and straightforward, has become significantly more complex with the advance of technology and questions about how it can be used for purchase and fulfilment. While innovation and evolution have always been a constant, Retail Pharmacy is in the midst of a paradigm shift as it moves closer to healthcare. The role it plays in customer and patient lives has expanded, resulting in increased expectations from those customers on these purveyors of health and wellness.

This three-part series explores how this strategic shift, customer embrace of technology, and the overall accelerant provided by a global pandemic have translated to a very disruptive environment. And in no way has this been more apparent than the proliferation of ways customers can interact with retail pharmacies when purchasing goods and services.

In the first part of this series, we explored the ecommerce boom. Now, in the second part, we take a look at how the path to purchase is changing at pace.

The path and process of purchase

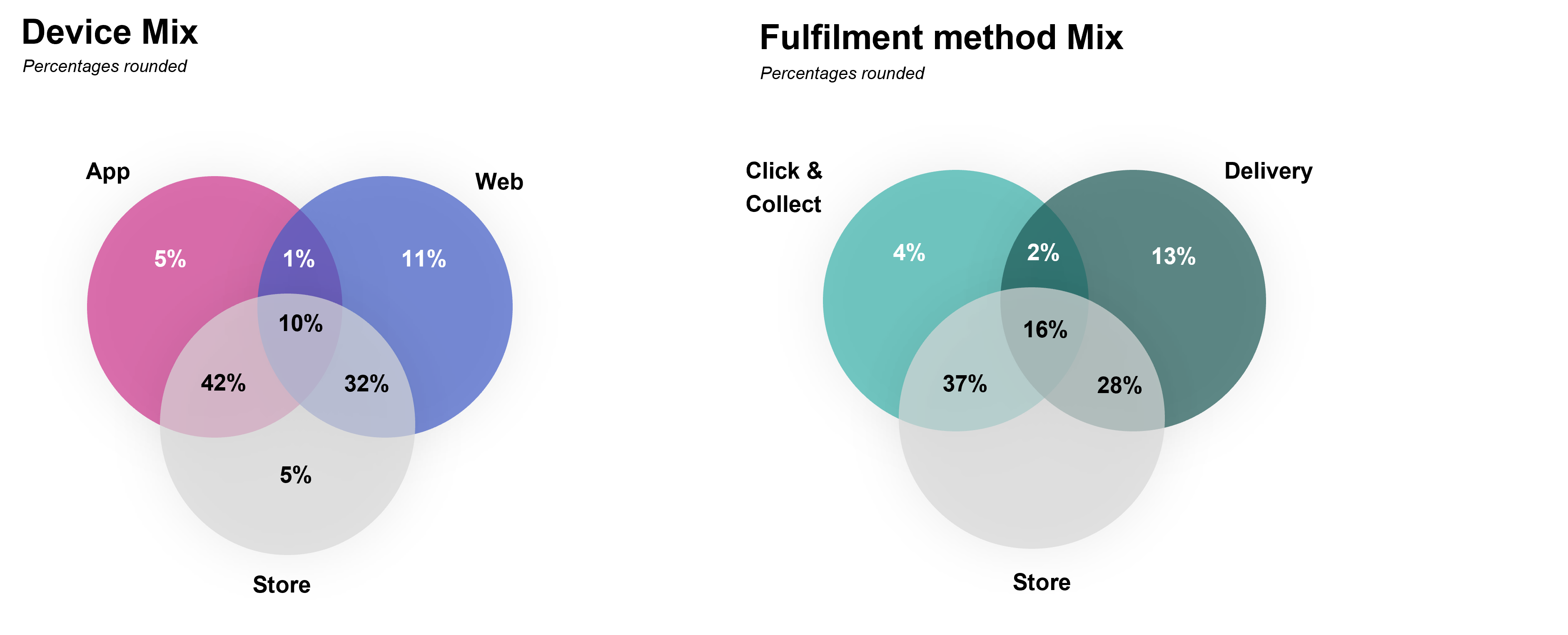

Digitalisation of retailing coupled with rapid delivery has stratified the purchase and receipt of goods and services in retail pharmacy. Multiple combinations now exist to purchase instore, by mobile or web, and receive through delivery, click & collect, or traditional checkout. Questions now arise about how customers use these different methods. Which are preferred by the most valuable and, as a result, where should retailers and brands invest their resources? As we mentioned, most customers in the sector are still reliably traditional in their bricks and mortar engagement, but the path to multichannel adoption continues to grow and is led disproportionately by the most valuable customers as revealed in an in-depth analysis aligned to their purchasing engagement. Once a customer moves to multichannel engagement, they typically find their preferred methods and stay with them.

- 40% customers use app and store only

- 30% customers use web and store only

- 10% customers use all three

Similarly with fulfilment

- 40% use click & collect and store

- 30% use delivery and store

- 15% use all three

As a result, the necessity of providing all these options is high as large majority groups of customers prefer different methods to purchase and receive goods. These findings also indicate opportunities because customers who leverage the most channels across purchase and fulfilment spend 5x the traditional instore customer and 25% more than the single digital channel users. Consistently, the combination of app purchase and C&C fulfilment has the greatest penetration at nearly half of total online customers. This group has both higher spend and frequency than customers using the other single combinations. Their online spend is actually lowest of the combinations but is made up by additional purchases instore. As such, app purchase and C&C fulfilment customers are the most valuable actually due to their instore behaviour.

The use of multiple channels is highly intertwined in the overall value equation of these customers. It should come as no major surprise that 9 in 10 C&C customers were instore customers before incorporating this fulfilment method. Despite their tenure with the retail pharmacy, the use of C&C begins to clearly evolve their spend as a 30% incremental growth is measured by the third month after the first C&C transaction. Those leveraging delivery also show an incremental increase, but it is just 20% over the same period. Frequency increases also occur as 75% of C&C users also make a second online visit after three months relative to 45% for delivery customers.

Finally, the critical advantage of C&C customers having to go to locations to pick up their items results in 4 in 10 making an additional instore purchase as a result. There is also a product and price difference between the digital and instore purchase as the online purchases are consistently more expensive items.

In addition to frequency, spend, and product difference between multichannel customer groups, certain channels attract different types of customers. A focus on each can be used based on key customer strategies.

| New online customers | Total | Click and Collect | Delivery |

| % Existing customers | 83% | 90% | 75% |

| % New customers | 17% | 10% | 25% |

- Delivery is an additional acquisition lever as customers are twice as likely to be new to the retail pharmacy that C&C customers

- C&C is a strong feature to drive increase in spend and frequency as their customers are more frequent shoppers, buy more expensive items online and purchase incremental items when picking up. In order to entice customers into this behaviour, they must be surgically targeted and offered the right products at the right prices. Our analysis has shown that expensive items (100% above average price) are three times more important for C&C visits. They typically save 20% relative to instore pricing and retailers do need to consider their pricing strategies as the investment in online pricing that activates these customers.

While the benefits of these fulfilment methods are clear, retail is still detail, and poor execution of these offerings can have significant negative impacts on customer engagement and, ultimately, performance. Given the ability to review data points not easily captured in traditional instore transactions, we are able to measure the collateral damage based on pre and post customer performance due to execution shortcomings in delivery. In terms of customer spend drop-off, we see the following:

- Delay in expected delivery time: -5%

- Experience results in bad review: -20%

- Unexpected OOS refund: -40%

While the benefits of multichannel offerings are clear, poor execution can quickly alienate even the most loyal. A retailer must understand the importance of these factors with their customers and be willing to invest to ensure strong execution against those insights. Only then will they be able to deliver on the customer expectations.

References: Numbers referenced in this article are based on dunnhumby data or anonymised dunnhumby client data, and rounded to the nearest significant number for simplicity

TOPICS

RELATED PRODUCTS

Amplify Customer understanding to create strategies that drive results

Customer First solutionsThe latest insights from our experts around the world