Customer First Business Practices for Inflationary Times: Part Two

Customers should not shoulder the full burden, and price increases are not inevitable

Part 2 in our Inflationary Times series (Part 1), by David Ciancio and Charles Llewellyn

An organisation that is truly centred on the Customer believes that escalating costs arising from the COVID-19 pandemic should not automatically result in higher prices to Customers. In this perspective, second in a series about dealing with inflation, we offer thoughts on how retailers and brands should consider changes to their business practices to find new sources of revenue or save on costs of doing business, rather than solely shifting the burden onto Customers via price increases.

At times like these, it’s never more important for Retailers and Brands to put the Customer first. Accordingly, we recommend five best Customer First business practices to be undertaken with urgency:

1. New sources of revenue

Monetising insights and media to reinvest in Customers

The strong business case has earlier been made around the value of Customer insights to optimise business results – using data science to grow sales by earning greater Customer loyalty, to optimise pricing and promotions and personalisation, and to find operational efficiencies.

Yet, according to a Forrester study commissioned by dunnhumby just months before the pandemic, The Future of Retail Revenues Must Be Data Led, 85% of grocery retailers globally lack the capabilities, technology, people and processes to drive a better Customer experience, let alone to monetise their data.1

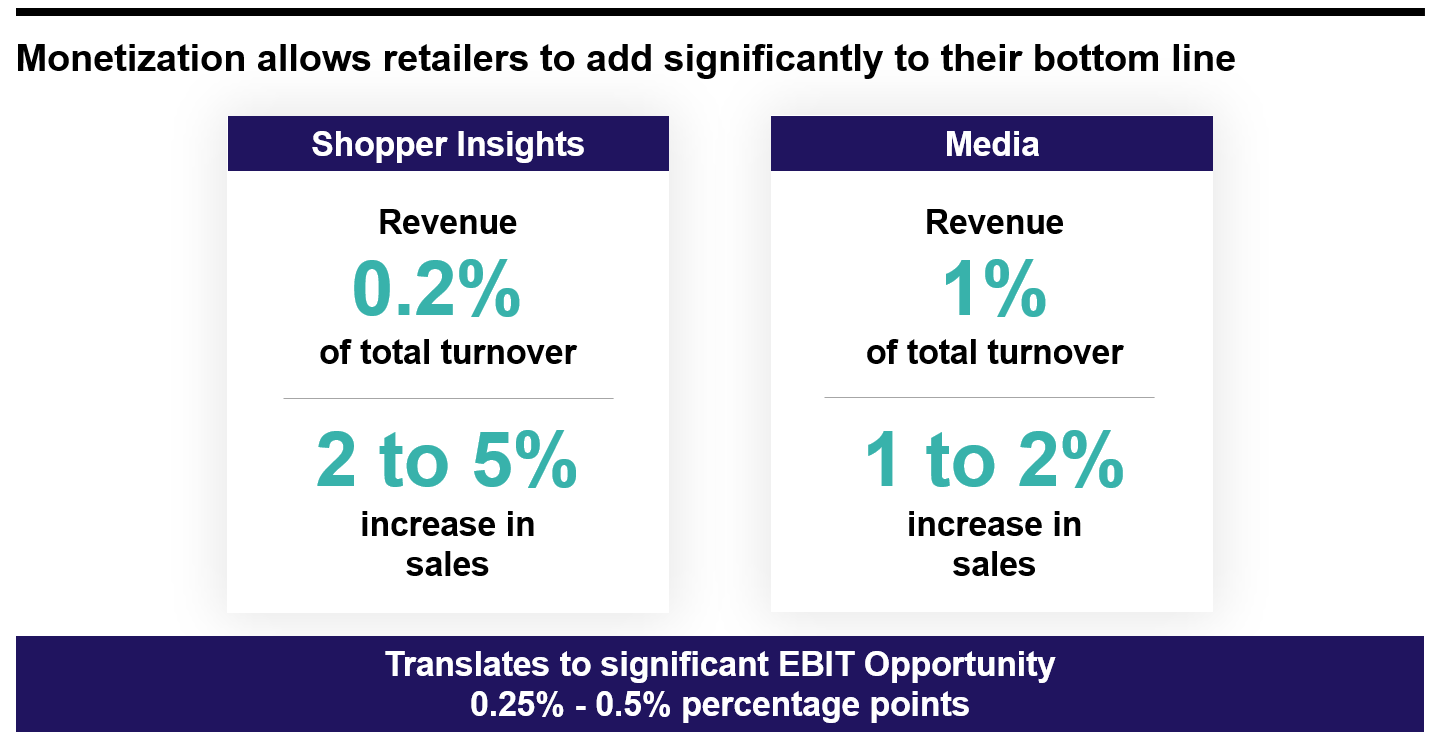

Turning data into new profit sources has become more urgent as the COVID-19 pandemic accelerated the growth of online shopping, and the rise of digitally based competitors cut into traditional retailers’ revenue.2 And, the global data monetization market is growing rapidly, estimated to reach US$371b by 2023.3 Our own experience proves that this profit source can be significant – an incremental direct income of up to 0.2% of total retailer revenue from the monetisation of insights alone.

Moreover, a growing number of retailers have realised that monetising their high-value data through media channels (including in-store) and social platforms can be very powerful for all the parties involved. Led by Amazon whose platform attracts an estimated 90 percent of advertising by US media buyers, other giant retailers such as Walmart, eBay, Target, Albertsons, and Kroger are achieving billions in alternate revenues by monetising their data assets. Our own experience proves an incremental direct media income of up to 1% of total retailer revenue, on top of the insight revenue mentioned above.

Most importantly, the big profit source isn’t just the direct revenues / income from insight and media; the much bigger prize is the extra sales growth these generate. A representative EBIT opportunity therefrom is illustrated in this chart:

New partnerships

The pandemic greatly accelerated the speed of change in consumer expectations4; one retail response involves building an ecosystem of partners to help share the burden of meeting these new Customer expectations whilst also generating new sources of revenue. Notable recent partner ecosystems include Kroger + Bed Bath & Beyond, Target + Ulta Beauty, Hy-Vee + DSW shoes, HEB + James Avery Artisan Jewellery, and Morrisons + Amazon.

2. Simplify; Reduce cost to serve

Eliminate inefficient Customer investments

An almost reflexive response to inflation – but not the correct response for building sustainable sales or longer-term loyalty in our experience – is to increase the number of promoted products each week. In fact, the percentage of retailer sales on promotion is edging back up to pre-COVID levels, again approaching 40-50% of sales (according to our data). And this causes us great worry that:

- Most trade promotions are ineffective in the first place. According to a classic Nielsen analysis, 67% of trade promotions don’t break even. Further, eliminating 22% of trade promotions would help companies increase sales revenue. Overall, only 33% of promotions actually make money.5 And our global data often shows that these ineffective investments are getting worse – so inflationary times offer a great opportunity to reset promotional strategies to save money and margin that can be reinvested elsewhere.

- Increased promotional activity has a knock-on (negative) effect vs. pricing position in high-low strategies and tends to erode overall value perception, creating a kind of vicious circle of more promotions = poorer value perception. And this is particularly harmful during inflationary times.

- Ever-increasing promotional dependence is not sustainable against the growing Discounter/ Modern Convenience channel, which is expected to grow at an ‘above average’ CAGR of 4.4% (through 2026).6 Perhaps of more concern to traditional supermarket operators, discounters are more rapidly growing ecommerce sales – with a CAGR of 12.2%, well above the average across all other channels of 8.2%.6

- Promotions are necessary for driving consumer excitement and stimulating demand in certain categories – but not in all. Getting the price v. promotion formula right in each category using Customer data science will be even more critical during times of inflation.

Reduce activity-based costs and complexity

Moreover, poor promotions and some forms of ‘proof of performance’ cost store labour and increase operational complexity. A retailer case study of activity-based costs showed considerable hidden costs of delivering promotions, including store labour to sort / validate / hang shelf tags, tag print costs, and process management to be $1 per tag for ‘promotion highlighter’ tags on electronic shelf labels and $1.50 per tag for SKU-specific paper shelf tags. Eliminating the 30% of ineffective promotions (using Customer data science, of course) saved $1.5m per week in activity-based costs within a retailer with 1000 stores.7

Another client grocer determined that Customers now don’t want so many promotions that force them to shop around every week to find value, and that heavy promotional activity was counter-productive to building loyalty. So, they made a new promise to Customers: ‘no need to shop around for value day-in and day-out’. The retailer reduced promotions by 8% of sales, converting those former promotional investments into lower everyday prices (using category roles data science), and they introduced member pricing to better reward loyalty via the card. They realised a 26% reduction in activity-based costs at store level relative to promotional execution and signing, a +430bps improvement in brand favourability perception, and a +530bps improvement in value perception.

Focus on front margin, and away from back margin

Admittedly a controversial topic, back margin practices deserve honest examination particularly during times of high inflationary pressures, when the goal should be meeting Customers’ needs in the most efficient way to ensure we can remain competitive.

Back margin is defined as the ‘buy-side’ of a retail business (versus the front margin, aka ‘sell-side’ or ‘gross retail margin’), and includes all other discounts/allowances, trade funding, listing fees, etc., beyond the pure cost of goods paid by suppliers. We have noticed some 60+ forms of back margin practices, like slotting allowances and sponsorship fees to name a few, which can add up to a majority of the quantum commercial gross margin for some retailers and contribute to higher shelf prices for shoppers.

We have observed (and the data proves) that back margin practices can unwittingly create costly inefficiencies (and ultimately higher prices); for examples, listing fees for products that don’t sell or featuring products based on a trade ‘investment’ rather than on Customer appeal – subsequently, the promotion really doesn’t work for the brand or the retailer, and certainly not for the Customer.

And more often than we’d like to admit, we see poor-selling or low-profit products taking up valuable shelf space, placed based on some form of ‘support payment’ on the back margin, earning a relative pittance on the front margin and even less Customer loyalty.

The pandemic has already triggered governmental probes of commercial and pricing practices in many countries, like the recent order by the Federal Trade Commission (US) for nine companies (including Walmart and Kroger) along the grocery supply chain to turn over detailed information for its study of “empty shelves and sky-high prices”.8

Some pressure is coming from inside the industry itself: according to the National Grocers Association, “This study is a key first step in promoting competition in the food supply chain”. The trade group for independent grocers said that “dominant grocery power buyers” bullied their way to the front of the line with foodmakers and left small grocers and their customers bearing “a disproportionate burden of surging food price inflation during supply chain crunches.”8

We are suggesting a Customer-insight led view of certain ‘pay for performance’ requirements that sit behind some back margin practices. Taking the weekly ad flyer for example, vendor funding for front page placement often does not offset the lost margin dollars on other products cannibalized by the feature, or for the activity-based costs mentioned above. The data tells whether the feature works to drive accretive sales and loyalty. There is not one answer to this complex and controversial question, certainly, but looking to the Customer data is a critical step, especially during times of inflation.

- A recipe for fighting inflation (whilst minimising price increases to Customers)

- Now is the time to reset P&P and Assortment strategies to create a better value perception and to lower costs. Let’s face it – the crisis has forced the entire industry into “rehab” to re-examine its practices on many levels. This catharsis gives both retailers and CPGs an opportunity to step change category management effectiveness and efficiency, led more by data than by legacy.

- Make the range work harder to drive value perception and save on cost-to-serve

- Reset categories to reduce the range and simplify choices for shoppers.

- Eliminate duplicate products that satisfy the same shopper need-states, aiming for breath of choice over depth

- Category resets are the most significant tactics to help retailers ensure they fight passing inflation onto Customers

- KVIs for PS Customers, using Customer data science to understand Category Roles, optimised using an automated price management tool

- Compete only where you need to without overinvesting – you don’t need to be cheapest on every item

- Watch out on full basket cost, cut the long tail of promotions that don’t work for the business or for Customers, and use multi-buys more strategically

- Convert some promos to lower EDLP using net-effective pricing approach (via the science)

- Show a clear price advantage to national brand (e.g., 15-20% cheaper) and position with a logical and consistent flow on shelf (e.g. left of national brand). Consider offering a quality guarantee on private brands.

3. Reduce packaging costs to lower shelf prices – and be more sustainable

Spanish retailer Mercadona is famed for its private brand strategy that relentlessly focusses on cutting shelf prices through its packaging innovations, which include peelable tuna tin lids (cheaper, easier and safer to open, thus adding value by also solving Customer frustrations), and toothpaste tubes without cardboard packages stood on end (because that’s how Customers prefer to store them). Not only cheaper for Customers, but more sustainable as well, as in their reformulated coffee capsules, which have reduced 783 tonnes of plastic per year.

Tesco are aiming to eliminate unnecessary and oversized packaging that add costs with their Loop partnership. Tesco has calculated that if Customers in the stores using Loop switch three items in their weekly food shop, the packaging would be used and reused more than 2.5 million times a year. As of this writing, prices for the contents of each of the 88 branded and 25 own-brand items are comparable to the original single-use pack (although Customers pay a refundable deposit as well). The theory is that reusable packaging will later effectively and significantly reduce costs and prices.

Independent observers of our industry are beginning to call for packaging-free alternatives and reusable packaging to lower shelf prices, like in a study completed by Zero Waste Scotland (cited in the footnotes) that concludes that the average Scottish household buys 130kg of single-use grocery packaging each year, at a cost of almost £250 – or 7% of their average annual grocery bill. The study urges more ‘clear price signals’ to help consumers avoid certain types of packaging to save money at the store.9

4. Helpful service trade-offs

Being Customer First does not mean being always all things to all Customers; rather, it means doing the right things for strategic Customers at the right times. Customers understand trade-offs, like self-scanning and reduced service department hours in exchange for cheaper prices or a more frictionless experience; the trick is to use the Customer data to understand which services Customers value more or less. And from this analysis, to find efficiencies that help reduce prices or even improve the shopping experience.

For example, one client knew that their deli hotplate service departments were complex to operate and required specialist staff and equipment. Operating costs and wastage were high, causing ever-decreasing profitability. Using the Customer data science to understand the specific hotplate shopper (who were largely concentrated in one region) and how they interacted there and across the store, the retailer was able to close departments in many stores without losing the shopper, and even added hotplates to 7 different stores to match previously unmet shopper needs.

‘Digital transformation’ also means adding helpful services

Today and in the future, Customer expectations around ‘digital’ are not limited to online channels alone.10 Digital innovations that make shopping easier, faster, safer, and lower contact will all be sought after, with shoppers looking to retailers to deliver useful and helpful new applications.

New services that grocers should be offering today include:

- Pre-trip planning applications that enable crowd avoidance based on levels of in-store custom, e.g., list builders

- Recommender apps to help make shopping choices easier, like ‘my usuals’, ‘my personal promotions’, and curated guide apps like ‘cheaper alternatives’ and ‘healthier alternatives’

- Touch-free replacements for loyalty cards, coupons, receipts, reward vouchers, and payment

- Self-scan mobile apps and self-service checkouts, and any additional technologies that reduce one-on-one contact

- Paperless adverts and personalised promotions via a mobile app

And all these digital services can also help manage store labour costs and advertising costs, therefrom reducing pressure to increase prices to Customers whilst maintaining profitability during times of inflation.

5. New reward mechanics

There are two new types of loyalty mechanics that benefit Customers making longer-term commitments with greater stability in prices – subscription offers, and fixed-cost delivery passes. We think that retailers should consider both to help mitigate price increases, particularly during times of inflation.

Delivery passes

Fixed-cost delivery passes are an important lever for earning Customer loyalty amongst a consumer base that has dramatically shifted to digital shopping. These passes aim at keeping a greater share of spend by helping online shoppers save money on delivery fees and give options to secure delivery during busy peak times. They are also a competitive response to Amazon Prime and Walmart+, membership programs that offer broad benefits like streaming content or mobile scan-and-go and fuel discounts in addition to unlimited no-fee delivery.

Retailer eCommerce passes also compete with memberships from third-party intermediaries like Instacart, Shipt, Uber and DoorDash, which have soared in popularity during the pandemic and arguably offer more value for shoppers’ money.12

- Ocado was the first online grocery retailer to launch a Smart Pass scheme in 2011, now costing £8.99 per month, £49.99 for six months or £89.99 for an annual one. Other examples include Tesco’s Delivery Saver, a £7.99 monthly cost for free delivery on a £40 minimum basket or £25 for Click+Collect and available for 6 months only at the time of this writing; Asda’s Anytime Delivery Pass £6 a month for 12 months or a £72 one-off payment; and Sainsbury’s £20 for three months, £35 for six months or £60 for 12 months. In the US, Kroger’s $79 annual program called Delivery Savings Pass, which waives the normal $10 delivery fee, but applies only to orders of $35 or more; Albertsons’ Unlimited Delivery Club, available for $99 a year or $15 a month and is eligible for orders over $30; SpartanNash’s Fast Lane pickup program for $17 per month or $49 per year.

Subscriptions

Prior to the pandemic and the current inflationary times, a kind of ‘subscription culture’ had emerged for services and products on anything from gaming (Apple Arcade, Amazon Luna, Xbox Game Pass) to streaming entertainment (Netflix, Amazon Prime Video, HBO Max), to beauty (Ipsy Glam Bag Plus, Birchbox), just to name a few. Consumers today are very comfortable with paid membership models that remove friction from their lives, allowing them to ‘set it and forget it’ for experiences they value.

And grocers now compete with a new generation of online ‘category killers’ who offer subscriptions to bastion loyalty for their shoppers, with offers like pet specialist Chewy’s Autoship program which saves 30% on the first order, then 5% thereafter and free shipping on orders of $35 or more; WalmartPetRx.com AutoShip & Save program which matches Chewy; nutritionists Holland & Barrett’s Subscribe & Save 5% off and every fifth order delivered free; and Amazon’s Subscribe & Save that gives up to 15% off when receiving 5 or more products in one auto-delivery to one address.

There are two interesting in-store subscription models emerging in grocery that bear watching.

- X5 Group has introduced subscriptions to in-store services as a core benefit within its loyalty scheme, called “Package”. The generosity of each subscription differs by the anchor offer of each chain, e.g., Pyaterochka (5% cashback), Perekrestok (10% cashback) or 7% back when shopping both. The subscription also gives discounts on products at till, step ups in loyalty tiers, free services and gifts like free coffee. The monthly cost is 199, 249 or 299 rubles, depending on the set of services. Other bonuses include free delivery and bonus Pyaterochka loyalty points for each delivery via 5Post (intermediary).13

- Coop Denmark offers a feature in their Loop app that enables automatic monthly transfer of money into a Prime account to be used for purchases in physical stores. This automatic transfer triggers access to a wide range of special benefits like streaming television and music, eBooks, gasoline and car wash gift certificates, and extra bonuses. The more money a Customer chooses to transfer, the more benefits are available. The goal is to increase the share of wallet for Coop without increasing Customers’ private food budgets.14

Conclusion

The five business practice changes outlined above are difficult, indeed, but these are extraordinary times, indeed. Customers are facing perhaps the highest inflationary rates in their lifetime, and we in our own professional careers. Present times call for new thinking, new leadership, and new applications of insights.

A true Customer First approach demands that Customers alone not bear the costs of disruption and change via higher shelf prices in all cases, not where inefficiencies exist in the ways we work, not where new forms of revenues are available from the gifts of shopper data, and not where Customer data science can show a better way.

dunnhumby is here to help.

References

1 https://www.businesswire.com/news/home/20191119006170/en/Global-Study-Finds-85-of-Grocery-Retailers-Lack-Capabilities-Technology-and-Expertise-to-Use-Insights-to-Monetize-their-Data-and-Drive-Customer-Experience

2 https://www.ey.com/en_us/consumer-products-retail/retailers-can-use-data-as-an-alternative-profit-source

3 Data Monetization Market by End User: Global Opportunity Analysis and Industry Forecast, 2017-2023, Allied Market Research.

4 dunnhumby Consumer Pulse Survey, October 2021

5 The Path to Efficient Trade Promotions, Nielsen 2015

6 Discount Stores Channel Report, December 2021, Edge by Ascential

7 dunnhumby case study, “The hidden costs of executing promotions in store”, 2021

8 https://thefern.org/ag_insider/ftc-probes-grocery-and-meat-supply-chain-and-spiking-prices/. See also: https://progressivegrocer.com/food-retailers-face-pandemic-price-gouging-lawsuits. and https://www.cnn.com/2020/05/13/business/grocery-food-prices/index.html

9 https://www.zerowastescotland.org.uk/sites/default/files/ZWS1479%20Report%20-%20The%20Hidden%20Cost%20of%20Grocery%20Packaging_0.pdf

10 How eight new trends are reshaping Retail’s future [blog link here]

11 cited from Ocado.com

12 https://www.grocerydive.com/news/grocers-look-to-online-subscriptions-to-lock-in-digital-demand/588581/

13 https://www.akm.ru/eng/press/x5-has-opened-a-subscription-for-all-customers/

14 https://lobyco.com/features/prime-account/

RELATED PRODUCTS

Amplify Customer understanding to create strategies that drive results

Customer First solutionsMake Retail Media work for your business with Customer Data Science

Retail Media solutionsThe latest insights from our experts around the world