The Best Customer First Strategies for Inflationary Times: Part One

As inflation rises, here are five opportunities to grow Customer loyalty and sales

Part 1 in our Inflationary Times series (Part 2)

Food prices around the world continue to climb, with many countries recently hitting their highest food price index level since 2011 (and in the US, the highest since 2008), according to the latest authoritative reports.1,2 Global prices for food, energy, and other commodities have soared – and look to continue to increase well into (and perhaps beyond) 2022 – in part driven by inevitable shortages in labour and throughout the supply chain triggered by the pandemic.

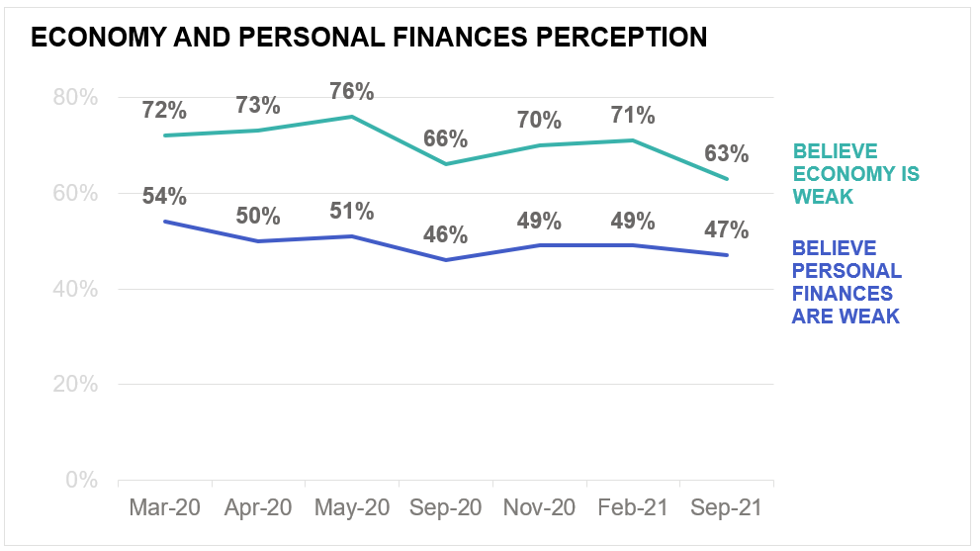

The percentage of inflationary price increases is hovering around 5%, the historical tipping point around which shopper buying habits start to change – again – even given the changes in shopping behaviours already triggered by the pandemic. Shoppers are worried; nearly two thirds feel their country’s economy is weak, and nearly half see their own personal finances as challenged (see chart below). Higher food prices are felt by everyone, but are especially hard on poorer households that need to expend a larger share of their income to keep themselves and their families fed.

Nearly 2/3 of consumers still feel their country’s economy is weak. Concern over personal finances continues, indicating that economic pressures still persist 3

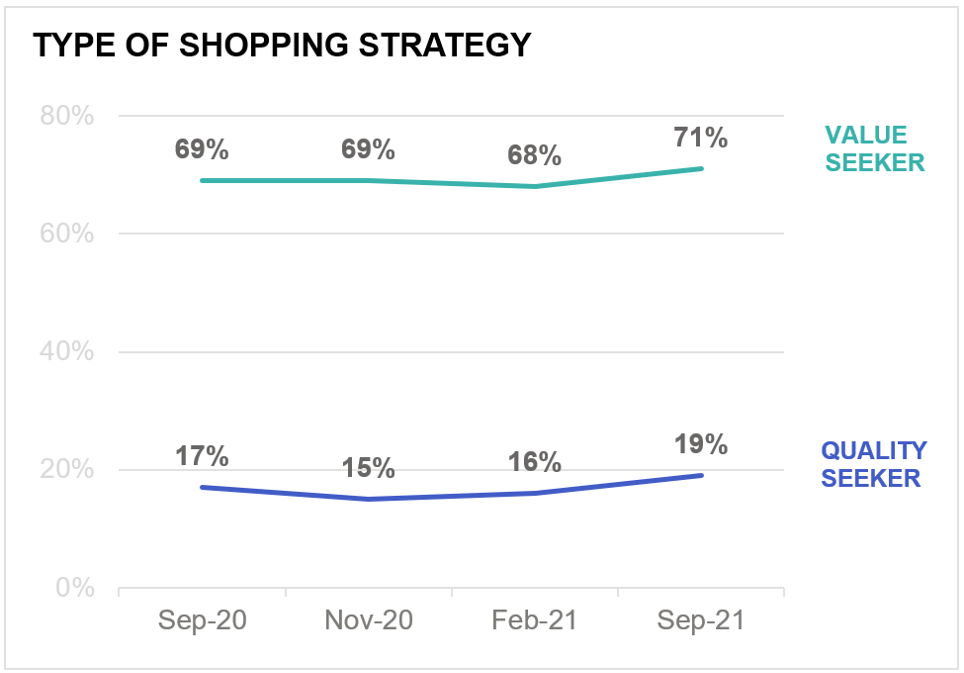

This perspective reflects on what retailers should be thinking about and activating in this present time of perhaps the highest inflationary rates in their Customers’ lives, and in their own professional careers. We conclude that these extraordinary times call for an exceptional understanding of and focus on how Customer needs and buying habits are undergoing even further changes. But one thing is certain – value remains top of mind.

Throughout the pandemic, the number of value seekers has far outnumbered the number of quality seekers3

At times like these, it’s never more important for Retailers and Brands to put the Customer first. Accordingly, we recommend five best Customer First strategies and immediate steps to be undertaken with urgency:

- Refresh your Customer Understanding and Strategy

Many of the changed Customer expectations and behaviours noticed during the pandemic continue to endure4, including Value as a determinant of store and product choice, and the elevated importance of digital – referring both to the online / click & collect channel and contactless in-store experiences.

Within these changes, basic shopping habits have likely evolved. Consequently, what we thought we knew for certain about shoppers pre-COVID may no longer be true.

Recommendations:

Now is the time to refresh your Customer understanding, using deep Customer Data Science to re-examine:

- Shopping Habits, e.g., changes in frequency, spend, and loyalty (including retention or churn) amongst key Customer segments

- Customer affluence, e.g., changes in number and spending by price-sensitive Customers

- Shopping Missions and Channels

- Changes in sales by format / banner or channel, decomposed as a function of changes in Customer behaviour

- Attitudes, needs, and mindsets resulting from the traumatic pandemic experience

From this Customer knowledge refresh, you should also review your Customer Strategy to ask:

- Are we still focussed on the right strategic group of Customers, e.g., should we shift to think more about value-seeking or price-sensitive Customers?

- Should we elevate any of our commitments (Customer Promises) to Customers, e.g., ‘Fair prices everyday’, knowing that shoppers are seeking even greater value? And how can we do this?

- Focus on the right categories and products, according to Customers

The ‘supply shock’ that started in early 2021 and the ‘demand shock’ that followed as the global economy shut down exposed vulnerabilities in the retail supply chains everywhere5. And images of empty shelves and weeks-long queues for online deliveries put CPGs and retailers at front of shoppers’ minds as they recall pain points throughout the pandemic – pains that are continuing even today.

But one cannot focus on every category and product, especially during a crisis. Fortunately, Customer Data Science identifies categories and products that are most important to Customers in terms of growth and loyalty, and this is a lens that can reveal opportunities for grocers to increase their assortment flexibility or lower their inventory costs when faced with a shock.

We believe that all these shocks have created an urgent call to action for retailers to revisit their product strategies. The pandemic has certainly changed the old paradigm: offering consumers more choices isn’t always better.

Recommendations:

Using the science of substitutability and a framework called Customer Priority Assortment, it is becoming business critical for growing sales and loyalty post COVID-19 to:

- Review assortment / range strategies to meet Customer need states more optimally, and to make choice easier for Customers.

- Understand which items can be safely delisted without losing sales or profit. The pandemic has taught most retailers that they do not need as many items in their range; the data science typically proves that as much as 20% of the assortment can be delisted without negative consequences for Customers or to commercial results (and, in fact, toward actually improving sales and profits), and possibly helpful toward lowering the cost of goods.

- Understand which ranges can be optimised to reduce inventory towards liberating working capital (to reinvest toward price, etc.). Please see the examples of potential efficiencies in the sidebar comments.

- Deliver productive innovation in new products and private brand items.

- Know where flexibility around stock levels and availability really matters, so that your organisation can worry only about the right categories and products.

- Note: Not all out-of-stocks are created equal

- Days-on-hand (DOH) targets for some non-core minimum (non-Customer Priority items) can be raised, potentially releasing working capital by reducing the inventory balance to target

- For example, if a DOH target for a ‘non-Customer Priority’ SKU is 45 days, and the new DOH forecast demand target is raised to 60 days (with a $50,000 inventory balance) because the product is non-‘essential’ to the core range, we can release more than $12,000 in cash back into the business on just this one SKU

- As most grocers hold tens of thousands of inventory items, this can be a significant area of opportunity

- ‘Customer Priority Assortment’ thinking is also useful to validate the reasonableness of the set points (inventory target levels), order points (inventory level where replenishment orders are placed), service level from the DC, and the overall stocking schema (number of facings, etc.)

- Optimising / reducing the assortment effectively and with less risk requires Customer insights!

- Days-on-hand (DOH) targets for some non-core minimum (non-Customer Priority items) can be raised, potentially releasing working capital by reducing the inventory balance to target

- Ensure competitiveness on the right items to protect your value perception

Key Value Items (KVIs) are a small set of products that have a very large impact on value / price perception. A retailer should have its most-competitive prices on KVI products, in balance with a small set of Key Competitive Items (KCIs) and a large set of less competitively priced Background products, in a way that earns a good price perception and Customer loyalty without compromising profitable growth.

Uncompetitive prices on KVIs can drive Customers to switch to another store – particularly during inflationary times – whereas competitive prices on KVIs can create a halo effect where Customers add more items to their basket or make subsequent visits to the retailer. Although Customers can only recall a handful of product prices, KVI prices are the ones they are most likely to remember. KVIs are sometimes also called Known Value Items, Items That Matter Most, The List, “A” items, or the front basket.

The pandemic elevated certain value-seeking strategies like shopping at low-price stores and searching for sales3

Recommendations:

The KVI list should be reviewed again considering changed shopper needs and habits during the pandemic, plus the supply and demand shocks noted above.

- For examples, the trend toward cooking more at home is continuing, making some basic cooking and baking ingredients more important to value / price perception. And availability challenges on some key KVI essentials might have shifted Customer value perceptions onto other sizes or formulations or brands.

- Moreover, Price Sensitive and vulnerable shoppers are finding this ‘recovery’ period to be particularly tough, so an even deeper investment on KVI pricing might be required.

- Online channels should continue to also reflect in-store prices, and certainly not diverge during this time, particularly on KVIs!

- Pricing Optimisation software enables best practices in managing a high number of price increase requests at once whilst balancing all other parts of the value equation.

Today is a good time to confirm your KVIs using Customer Data Science.6

- Rebalance EDLP v. Promotions

Most retailers executed fewer promotions during the pandemic because of a combination of supply chain issues, a retraction of funding from CPGs, to simplify operations or redistribute store labour, or because they did not need deal marketing or promotions to drive sales.

But shoppers need to find Value in both base pricing and promotions, perhaps now more than ever. Value for money has become a heightened driver of behaviour as consumers face an inflationary economy and Customers expect some level of promotions as their faith in the store’s supply chain is regained.

But retailers cannot simply reboot their old pre-pandemic promotional strategy in this current transitional inflationary economy. Pre-pandemic, the percentage of retailer sales on promotion hit an all-time high, ranging between 38% and 50% of sales across the sector, according to our data. Ever-increasing promotional dependence is not sustainable against the growing Discounter/ Modern Convenience format and the new disruptors that emerged during the pandemic, like delivery intermediaries (see box below). Getting the price versus promotion formula right will be even more critical post pandemic.

And the old, continuous ‘slash & dash’ cycle might seem attractive during inflationary times, but it comes with a long-term cost. Focusing on excessive promotions or deal marketing only attracts Customers who are deal loyal (a lesson learned long ago), and this is not sustainable or productive to earning true loyalty especially with unknown timelines in front of us.

Recommendations:

Use the science to rebalance how prices and promotions work together to deliver real value

- Use the science and the data-led frameworks called Compass (aka Balance Matrix) and Category Roles & Levers to define category and product strategies that strike the right balance of price and promotion. Some categories and product deserve a more “strategic EDLP”- based tactics, whilst others benefit from even more promotions. This Customer First approach to pricing and promotion is still the right answer.

- Deliver fewer, more efficient promotions. The crisis has forced the entire industry into “rehab” to re-examine its practices on many levels. This catharsis gives both retailers and CPGs an opportunity to step-change promotional effectiveness and efficiency, led more by data than by legacy.

- Continue to use personalised offers and targeted promotions to drive frequency and spending.

- Rethink Trade Planning. Disruption to the traditional model that now puts supply over demand means that more than ever, grocers and CPGs cannot simply follow last year’s promotional plan – and we see this disruption continuing at least throughout 2022.

- Don’t forget fresh. As consumers face into variable inflation even by category, we think it imperative for retailers to institute selective pricing and promotional efforts for perishables and fresh items in the basket mix. Conversely, higher expected inflationary pressures in some core centre store categories – but not all – calls for precision pricing and promotion to minimise overinvestment.

- Seasonal and event promotions have also changed. Understanding shopper attitudes and future intentions around key events will be an important data point in event planning over the foreseeable future.

Note: Disruptive pricing and promotion models are expanding because of consumer behaviour changes during the pandemic. The crisis has triggered a tipping point for retailers to switch from the paper flyer to more digital communication through their website and app, with a more urgent priority to make this personal. In-store media will become more important and impactful as well. Subscription models are being adopted by retailers such as “Delivery Savers” to help manage online demand. Online pure players are pointing the way to opportunities for new pricing bundles and subscriptions on destination areas, in collaboration with suppliers.

- Help Customers find smarter and easier alternatives

Base prices, KVIs, and promotions are critically important, but not the sole drivers of Customer value perception. Personalised offers and rewards, the availability and quality of private brands, the type of assortment carried, signage and marketing communications, and the store (or online) environment all influence the perception of how much total ‘value’ a retailer offers; all these latter factors become increasingly important during times of inflation.

For more background on effects of the pandemic on Customers and their expectations that retailers deliver more value, and how all the above levers drive value perception, please see our report How to Win in the Age of New Value, linked here 7.

Helping Customers on the experiential elements of the value equation, like making it easier to find smarter alternatives, is a great contributor to improving a retailer’s overall value claim during hard times.

Recommendations:

Re-examine the holistic value perception drivers, particularly to:

- Make the store easier to shop. Substitutability is the science of how unique or similar shoppers perceive a product to be, looking at cross shopping between two products in the range, and in the same or in separate baskets, to determine which are substitutable or complementary. Applying this science makes store fixtures easier to shop for Customers and helps them better find the right products for their needs and budgets.

- Help Customers find cheaper alternatives, for example, using the science of complementary product choices and API services to enable personalised ‘recommenders’ on all mobile apps and online channels.

- Highlight Private Brands. The presence and availability of private brand products goes beyond a cheaper basket value at checkout. A wide range of own label items can also help to encourage a sense of value choices within a retailer’s range, something that improves perceptions of value in and of itself. And even when a shopper ultimately opts to purchase a CPG branded product, even the awareness of a better value alternative can have a positive impact on sentiment, especially during inflationary times. For more information about Private Brand strategies and a best-practice framework for development, please see your local dunnhumby representative, or a summary blog here on Why Private Brand should form part of every Retailer’s growth strategy8.

Conclusion

These extraordinary times call for an exceptional understanding of, and focus on, how Customer needs and buying habits are undergoing even further changes. During inflationary times like these, it’s never more important to put the Customer first by using Customer Data Science within a clear Customer Strategy. For more information, please contact us.

Footnotes:

1 fao.org/worldfoodsituation/foodpricesindex/en/

2 ers.usda.gov/data-products/food-price-outlook/summary-findings/ and supermarketnews.com/technology/retailers-turn-price-optimization-inflation-shows-no-signs-slowing-down

3 + 4 dunnhumby Consumer Pulse report, Wave 7

5 hbr.org/2020/09/global-supply-chains-in-a-post-pandemic-world

6 Reminder: KVI products are not calculated based on unit volume sold, but rather on Customer importance using a weighted formula that considers priorities for those Customers who care most about price. KVIs can be localised by zone or region as well.

7 dunnhumby.com/resources/reports/price-value/en/how-to-win-in-the-age-of-new-value/

8 dunnhumby.com/resources/reports/customer-insight/en/why-private-brands-should-form-part-of-every-retailers-growth-strategy/

TOPICS

RELATED PRODUCTS

Amplify Customer understanding to create strategies that drive results

Customer First solutionsThe latest insights from our experts around the world