Innovating and activating customer data for the next era of retail

We’re standing at the portal of the future in retail, and we’re never going back to how it used to be. David Ciancio, Global Head of Grocery at dunnhumby, examines the role of customer data in a changing retail market.

The global pandemic has changed the way in which both consumers and brands operate and in many cases, it’s a permanent shift. Take grocery retail, for example, where inflationary pressures and the threat of recession means shoppers are looking to cut costs, while COVID-19 accelerated the shift to online shopping at a rapid pace. Retailers are having to adapt and the result is the elevation of four key needs in the grocery retail mix:

- Value, including price investment, working capital and better buying strategies

- Digital capabilities, including ecommerce, partnerships and mobile app development

- New revenue streams, such as media, data insights and additional retail services

- Efficiency, covering everything from store labour management and automation, to ERP and new ways of delivering ‘convenience’

If there’s one thing that has become evident more than anything else, it’s the value of data to retailers. One of the most important lessons for retailers from the Covid-19 pandemic is that innovations in technologies, services, and science are more urgently required to differentiate and, indeed, to survive.

Best practice data habits

No longer a ‘nice-to-have’, data is now a strategic asset for any retailer and the opportunities are evident. Dunnhumby data shows those retailers that view data as a strategic asset are outperforming their peers on average, with a 3% sales increase above ‘business as usual’ (involving 400+ global grocery retailers) and 7% market share growth (calculated over five consecutive years).

Individual retailers have reported even stronger results, such as a Scandinavian retailer, which reversed eight consecutive years of market share decline to post a 4-5% growth, and a North American grocer, which doubled its retail sales across a ten year period by refocusing its strategy on customer analytics.

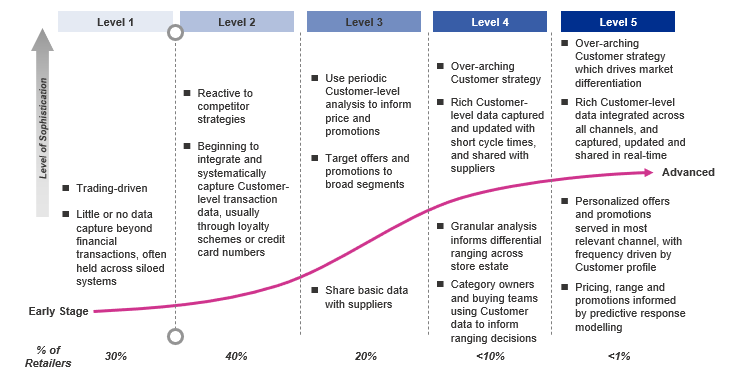

Of course, not all retailers are at the same stage in the maturity curve in terms of using data to grocery propositions. The figure below shows only 30% of retailers are at Level 3 or above, and so putting themselves in the best position to take advantage.

Facing into the truth

As Mark Twain said, “It ain’t what you don’t know that gets you into trouble, it’s what you know for sure that just ain’t so.” And this offers some valuable inspiration for transformation in the current retail market.

Think of those patterns and behaviours that retailers thought they knew in recent years, but which data has proved false. “We must acquire more customers in order to grow.” “Loyal customers give us most of their spend.” “Price-sensitive customers are neither profitable nor loyal.” “Customers are different everywhere.”

In fact, data can prove all of these and others wrong, creating a common language about growth in the process. It has never been more important to base strategic decisions on true insights.

For example, analytics shows that existing customers are the best customers with whom to build preference. One customer with a strong preference for your brand is typically worth at least 12 new or uncommitted customers. They are most profitable (because they tend to buy the product at full price as well as when you reward them) and deliver a significant increase in your marketing ROI compared to the money invested in offers to uncommitted customers (often as much as six times the uplift per dollar spent). That’s why the big wins for brands don’t lie in acquisition, but rather in cementing and growing a strong preference for the brand in existing customers.

Translating to store strategy

This idea of a common customer language is a very important concept but the trick for retailers is how to translate it into actions that customers feel in store, in order to improve the shopping experience. Because earning loyalty is about much more than just a loyalty programme.

Data can support retailers in getting the channel/store right, whether that is smarter pricing, better promotions or customer-led assortment. Also getting the message right, including through personalised media and communications, as well as more effective mass media campaigns. And finally getting the processes right, such as test and learn, staff motivation and more effective ways of working.

Above all else, customer science must be balanced with retailing art to enchant customers, in turn driving sales uplift from four key levers; better availability, more transactions, improved pricing/promotions and an improved range.

Your most important asset

All of this shows the potential – and the requirement – for data for drive all key decisions and processes across the modern retail business.

Whether driving change management to facilitate a culture that balances both art and science to put customers first, or whether accelerating the systems that enable the right internal capabilities for customers. Data empowers and upskills people within the business, supporting policy reviews that block enchantment. It also drives rewards, enabling the identification of KPIs around customer priorities.

Data is the single most important asset in any retail business. Can you afford to ignore it?

TOPICS

RELATED PRODUCTS

Make Retail Media work for your business with Customer Data Science

Retail Media solutionsHelping brands get the most from retail media

Audience Targeting solutionsThe latest insights from our experts around the world

Navigating a shifting world: the headline results from our latest Consumer Pulse

Keeping it relevant and authentic: engaging consumers along the purchase journey