Multichannel retail pharmacy part three: category and pricing

Retail, in its purest form has, and will be, building long term, meaningful, connections between customers, retailers and the solutions they offer. How do you provide them with the best possible way to meet their needs, at the right place, right time, and at a fairly perceived, mutually beneficial exchange?

This interaction, which used to be simple and straightforward, has become significantly more complex with the advance of technology and questions about how it can be used for purchase and fulfilment. While innovation and evolution have always been a constant, Retail Pharmacy is in the midst of a paradigm shift as it moves closer to healthcare. The role it plays in customer and patient lives has expanded, resulting in increased expectations from those customers on these purveyors of health and wellness.

This three-part series explores how this strategic shift, customer embrace of technology, and the overall accelerant provided by a global pandemic have translated to a very disruptive environment. And in no way has this been more apparent than the proliferation of ways customers can interact with retail pharmacies when purchasing goods and services.

In the first and second parts, we explored the ecommerce boom and the path to purchase. In this concluding part, we take a look at how transparent categories and pricing are important elements in providing a great omnichannel customer experience.

Omnichannel Category and Pricing

As we have seen with their behaviours, channel engagement has dramatic effects on performance and value. We also see how the ease of decoupled purchasing and fulfilment continues to weaken the traditional competitive advantage of convenience for retail pharmacies. As a result, retailers must understand how to best serve the new and expanded expectations of their customers. Shifting the levers of channel engagement require insight around which to move, how much, and for what individuals. Customers are buying differently depending on the channel. Additionally, many legacy pricing strategies are built for a peripheral digital-only customer and are in need of major realignment. In this article, we will dig deeply into the multichannel customer sensitivity to price as well as channel specific shopping missions and how best to optimise for the customer, retailer, and supplier.

A typical multichannel customer splits their spend unequally, with approximately 30% online, while 70% still occurs via instore purchases. While this is an average, the narrower you focus, the greater the variation. It is managing that variation that allows a world class operator to get closer to the individual customer and their needs. When looking at the category level, online spend ranges from as low as 15% to as high as 40% sales. Categories such as Baby and Medical Equipment are premeditated and considered purchases, resulting in strong digital sales, while First Aid and Beauty are an acute need, or more experiential purchase, and still predominantly purchased offline. While the variation in sales indicates the relevancy of categories by channel, it is also important to consider the pricing and its impact on customers. Through our experiences with multiple global retailers, dunnhumby has built a framework of customer segmentations across four price sensitivity levels:

- Least Price Sensitive

- Price Sensitive

- Most Price Sensitive

- Save & Splurge

Customers who fall into the first three segments shift purchase relative to pricing variations ranging from little to no impact, to highly sensitive to price change. The final segment encompasses customers that express significantly different purchase behaviours depending on the product. They may only buy certain items at a strong discount and then purchase others regardless of pricing. Understanding this customer behaviour will inform how to best price items in order to provide maximum benefit to customer while balancing the needs of sales and margin.

At an initial level, multichannel customers register as 20% less price sensitive than a typical customer and align 15% more to Save & Splurge. This would indicate a strong opportunity to potentially raise prices and increase margin with little impact on customer purchases. Armed with this information, a retailer may do just that, thinking the customer would happily trade price for digital convenience. This perspective only tells part of the story as it follows the assumption that customers behave the same across all channels that they use. When looking deeper into the customer activity, it becomes clear that the reality is far more nuanced. In actuality, customers use different channels for different missions and as a result, they have different price sensitivities depending on what is purchased and how it is purchased.

As an example, one could consider a nappy (diaper) purchase. A customer may pre-plan the purchase, monitor prices online, and buy on promotion. An alternative mission may be an emergency nappy run to a store where having access to the product at that moment supersedes the price. That said, the customer’s likelihood of more purchases in store (both intended and incremental ‘nappy cream’ that was forgotten until seeing it on the shelf) will have a much stronger chance of occurring if offered the best prices to those customers who care about price as indicated by their online behaviour. They will not feel taken advantage of in the acute situation which will strengthen loyalty to the retailer.

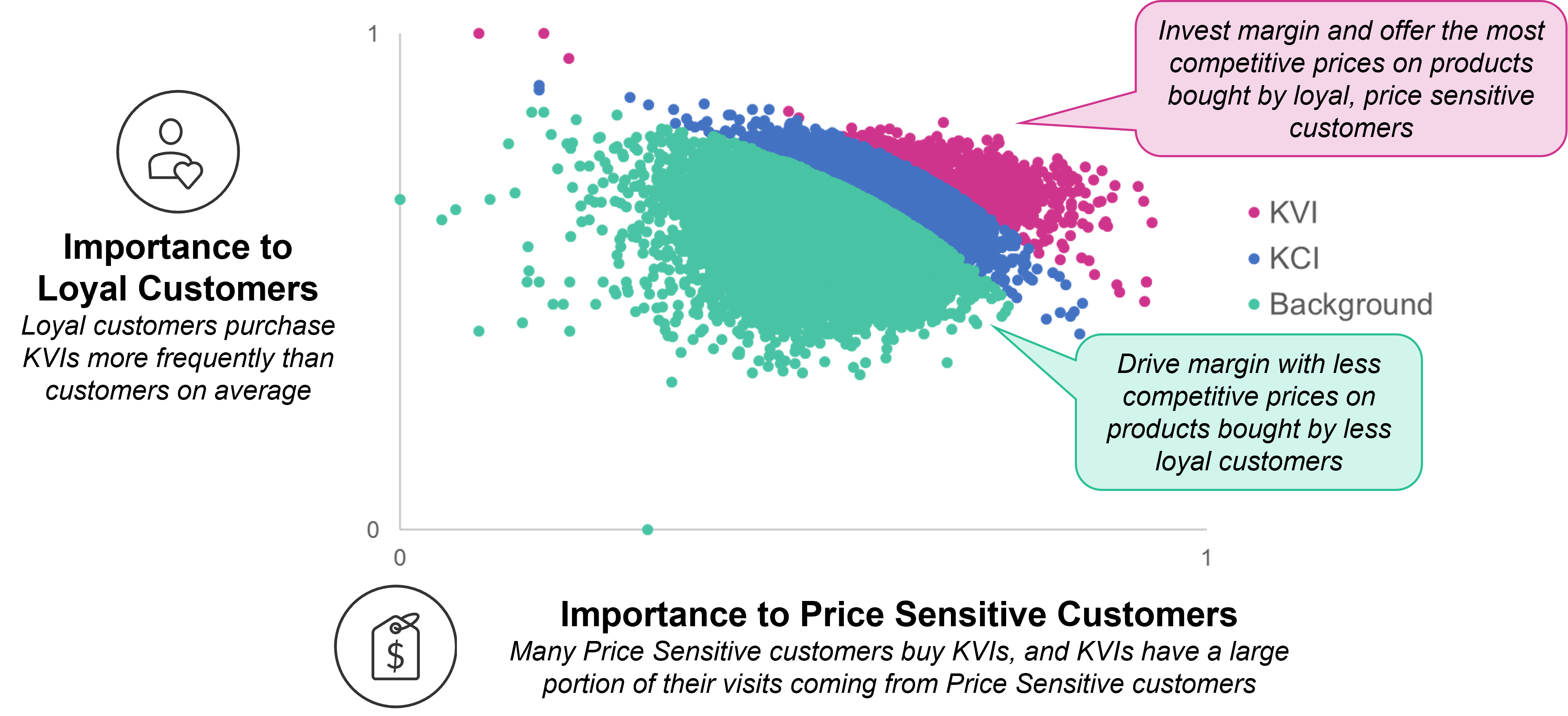

At dunnhumby, we segment products into three groups: KVIs (Key Value Items), KCIs (Key Competitive Items), and background items.

To best identify the right products for multichannel KVIs, the sensitivity needs to be reviewed separately for instore and online purchases. If the behaviour is sensitive in either channel, it must be accounted for. As a result, a critical look at KVIs will identify the right products for the retailer as a whole, but also this very important multichannel segment.

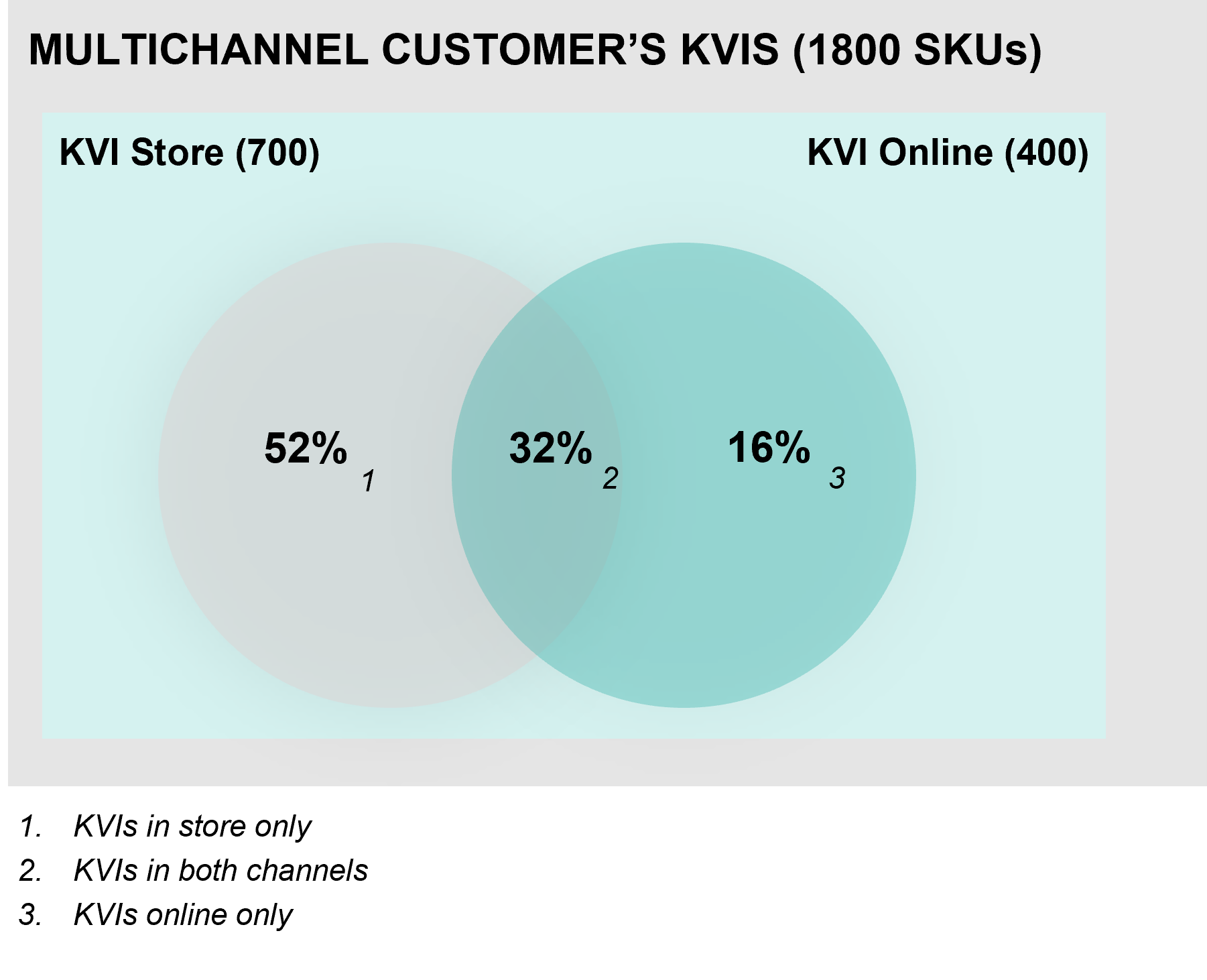

With the review of a retail pharmacy’s product offering against multichannel customers, 700 items were identified as instore KVIs, while 400 were flagged for online. For their purchases instore they are more present in over-the-counter (OTC) medicine, personal hygiene (women), first aid, vision care and oral hygiene while online KVIs are primarily in OTC medicine, vision care, first aid, vitamins and child categories. The overlap between the two groups totalled 32% of the products while the rest only existed as KVIs in a single channel. To be clear, this is the single group of multichannel customers, but their sensitivity to items differs significant depending on what channel they use to shop those items.

In applying a customer first approach, we would recommend that pricing should be consistent for those customers across the channels in order to reinforce that trust and encourage a stronger relationship with these most important customers. The primary issue is ensuring that the pricing investment is aligned to the customers that will give credit for it. One may be concerned that complexity will increase dramatically with both chain level KVIs as well as multichannel specific. As it happens, there still remains a strong overlap.

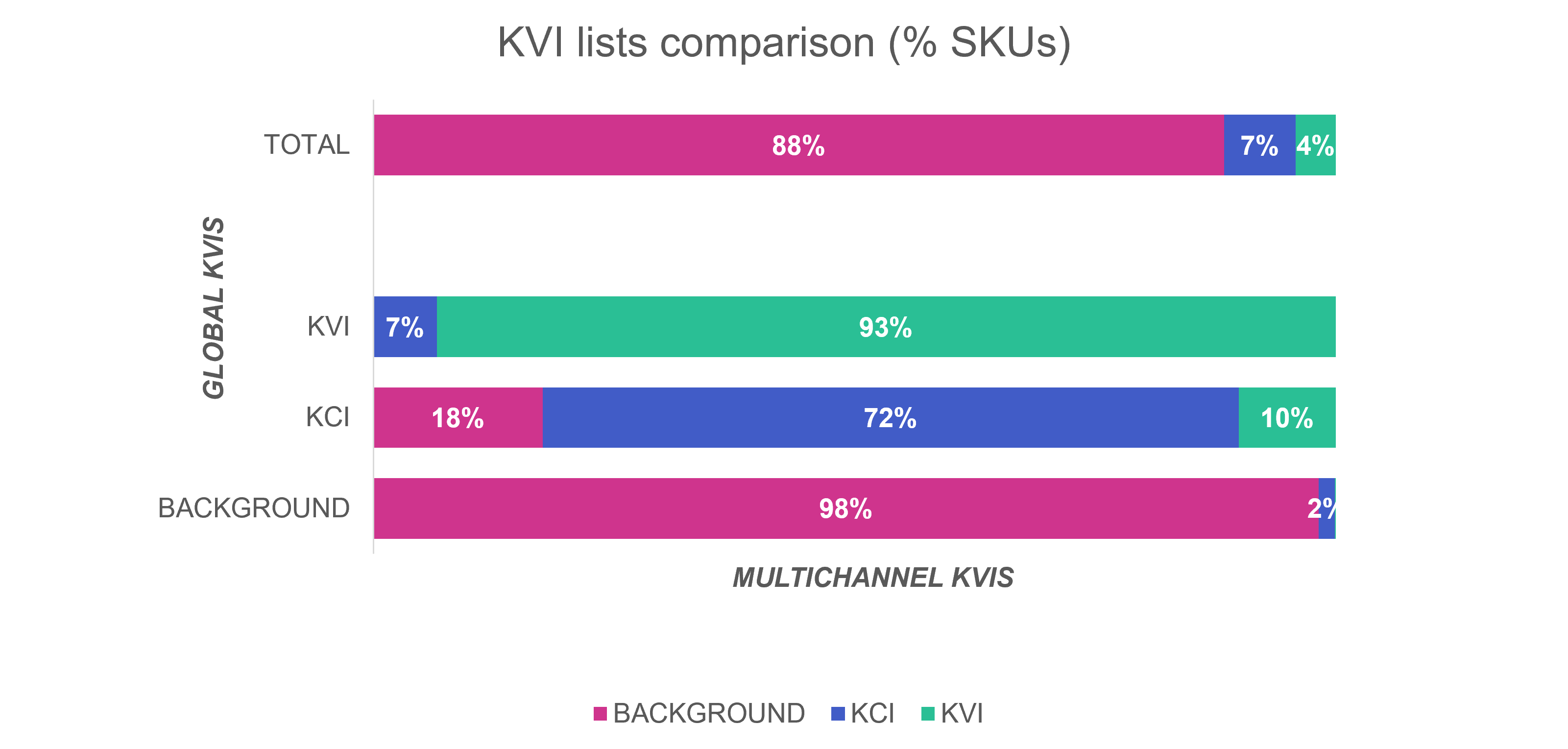

93% of chain KVIs are also multichannel and therefore the strategy remains consistent. The major point to note is that 4% of SKUs and 18% of sales have different importance for chain level and multichannel customer KVIs list. Those 4% must be priced accordingly for these important customers.

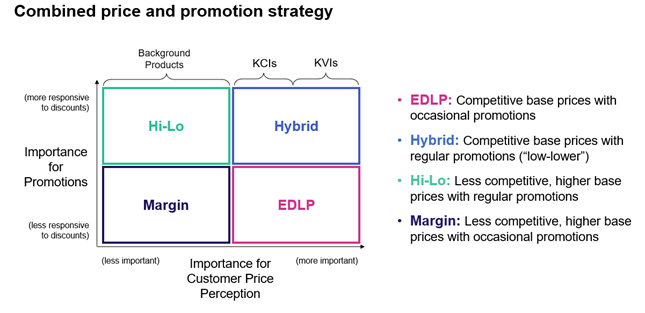

Rather than switch the base price, we apply our framework around promotional strategies based on the importance to loyal price sensitive customers as well as response to promotions to identify the best way position these 4% of SKUs to cater to these specific, high value customers.

Mass promotional strategies can be correctly implemented in the areas of overlap and alignment to chain level KVIs, but special care must be taken for those unique to customer segment and channel. This can be accomplished through personalised offers that are tailored to the individuals and provide the right price to the right customer without needlessly eroding sales and margin to the customers that are not looking for it.

Conclusion

With the rise of this increasingly prevalent multichannel customer, retail pharmacies need to evolve their thinking on how instore and online businesses operate. This successful decoupling of how a customer interacts with multiple channels for purchase and fulfilment make each an extension of the other. Customers will heavily engage when it solves their needs but will also leave as quickly with poor experiences or inconsistent offerings. By understanding more about these customers, we have established their value, differences, and priorities. With a customer first view and deep analytical expertise, retail pharmacies can regain and grow their competitive advantages and continue to lead the way into a new retail future.

References: Numbers referenced in this article are based on dunnhumby data or anonymised dunnhumby client data, and rounded to the nearest signific

TOPICS

RELATED PRODUCTS

Make Retail Media work for your business with Customer Data Science

Retail Media solutionsBoost value perception and execute promotions that drive results

Price & Promotions solutionsThe latest insights from our experts around the world