Nine new insights on global shopping behaviours

First launched in March 2020, dunnhumby’s Customer Pulse was created to keep track of changing shopper behaviours in the wake of the pandemic. In the two years that have followed, we’ve seen worries wax and wane, new behaviours emerge, and attitudes about the retail response to Covid-19 shift.

Our latest study in the series was conducted just as infection rates in many countries soared as a result of the Omicron variant. And while we wanted to understand how the resurgence of the virus might have influenced shopper perceptions, we were also keen to learn how they felt about some of the other significant issues dominating the headlines: rising food prices, health, and the environment among them.

Let’s see what they had to say.

- Concerns continue to fade, even as Omicron spreads

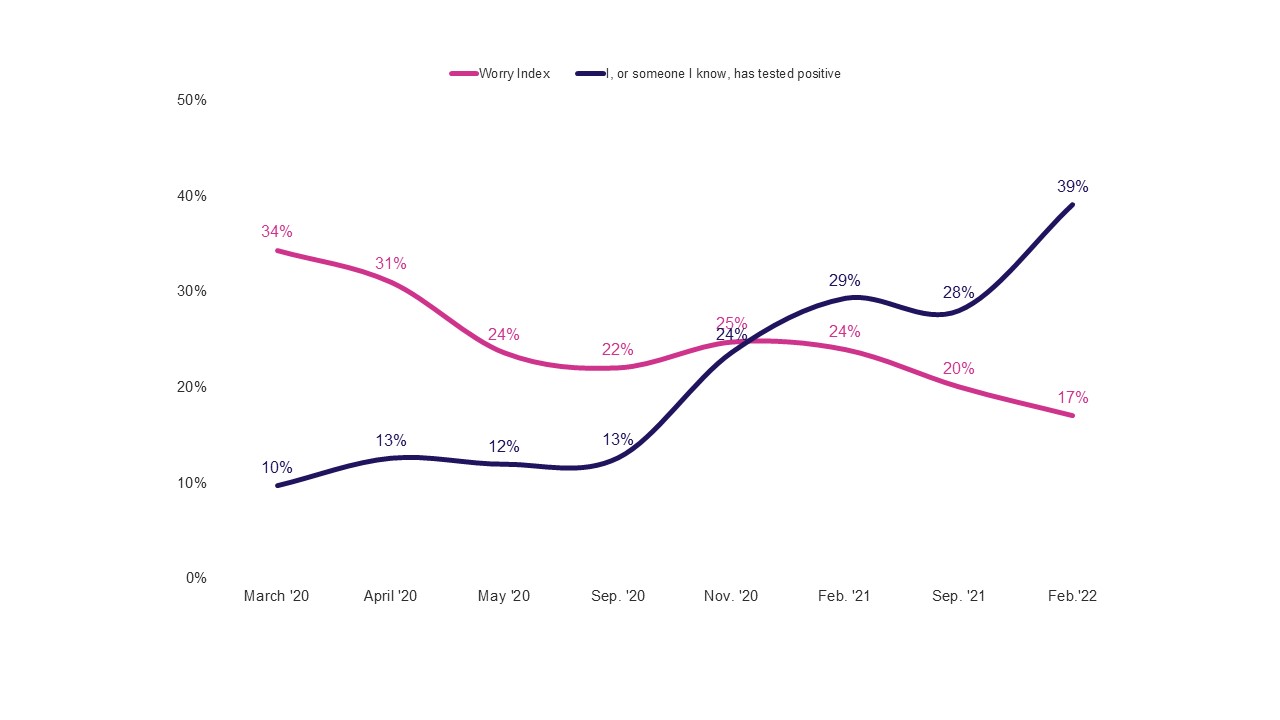

Are we getting used to living with Covid? There’s a clear hint of that in our latest study. Around two fifths of our respondents (39%) say that either they or someone they know has tested positive – the highest result since our research programme began. At the same time, worry about the pandemic is now at an all-time low; just 17% say that it gives them cause for concern.

- Worries about the virus have given way to other concerns

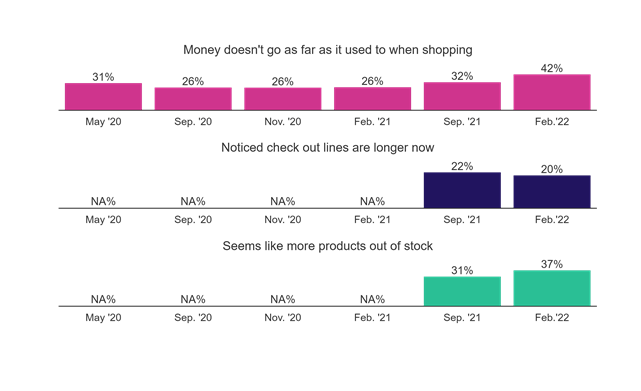

As well as the pandemic, the Pulse tracks consumer attitudes to some of the other big issues of the day. Of those, the rising cost of food is by far and away the most significant. Although a growing number of shoppers say that they’re finding more products to be out of stock (up from 31% to 37%), those who believe their money doesn’t go as far when shopping sees a 10 point rise from our previous survey – now standing at 42%.

- Price pressures are mounting, but perception is worse than reality

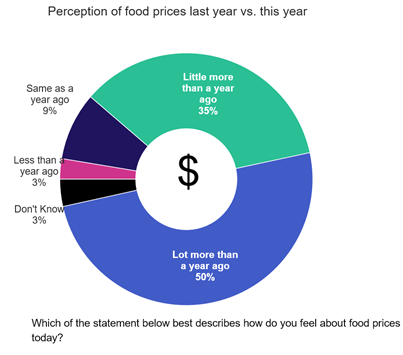

Just one in 10 shoppers say that the price of food is the same as it was a year ago, with half now believing that they’re paying “a lot” more than they were in February 2021. Is that sentiment accurate? Partially, but there’s also some severe overestimation at play. Asked to state exactly how much they believed food prices had risen by, the average shopper said 19%. The actual food inflation rate over the past is 5% across these 23 markets[1]. Brazilians and Colombians are particularly vocal on this issue.

- Value seekers are more acutely aware of inflation

Over past studies, the Customer Pulse has helped us track a growing number of shoppers who identify with “value seeking” strategies; 60% of shoppers can be classified as such today, compared to just 29% of “quality seekers”. Amongst this group of value-centric customers, perceptions about the impact of inflation are particularly skewed. The average shopper in the value seeking group believes that the price of food has risen by 20% in the past year.

- “Normality” is still an elusive concept

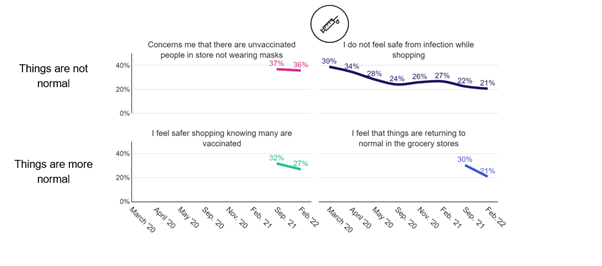

Although in #1, we learned that people may be less worried about Covid, that doesn’t mean that they’re not cognisant of its effects. In tandem with a surge in new cases, we see a clear decline in the number of people who say they feel safer when shopping knowing that people around them are vaccinated (down from 32% in September to 27% today). Correspondingly, the number of people who believe that “things are getting back to normal” in supermarkets has dropped by around a tenth (down from 30% to 21%).

- Satisfaction has slipped, but stores continue to be held in high regard

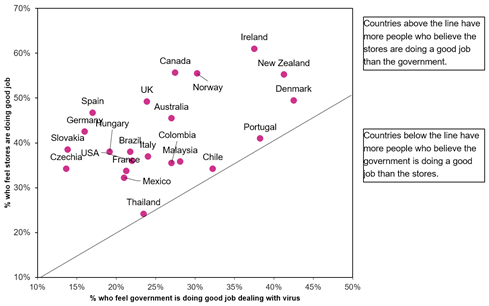

Satisfaction with the in-store experience, something that has been on an unwavering upward trajectory during the past two years, finally slips here – falling from 32% to 30%. Nonetheless, the number of people saying that retailers are doing a good job at dealing with the pandemic has risen, and respondents in every country say that stores are outperforming their governments in that regard.

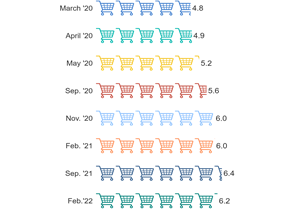

- Customers are shopping less often, albeit fractionally so

One major trend from the early days of the pandemic was the focus by customers on taking fewer trips to store. While that behaviour has been on a steady decline over the past couple of years, some customers do seem to have readopted it in recent weeks. The average number of trips to store each week has fallen from 6.4 to 6.2, with the percentage of people saying they’re consciously making fewer visits rising from 25% to 31%.

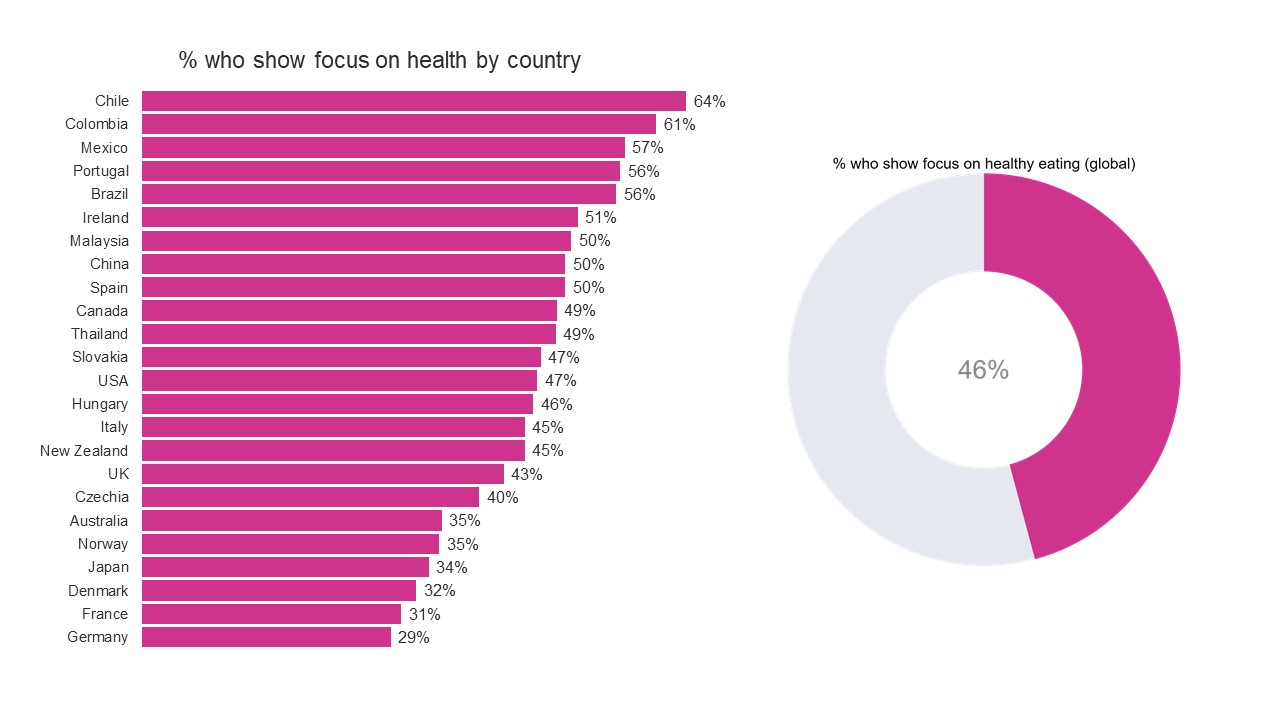

- Around half of shoppers are now focused on healthy eating

Seeking to understand the extent to which Covid has influenced behaviours around health and wellbeing, we asked a range of questions about how people shopped in pursuit of those goals. At an overarching level, we found that 46% of shoppers are focused on healthy eating, with Latin American markets leading the way.

Women are 10% more likely to be health conscious than men (49% vs 44 though age and income have little bearing on the results. Of those shaping their diet with health in mind, a reduction in meat (specifically red meat) and dairy are the most frequently cited behaviours.

- Sustainability takes a back seat to personal wellbeing

Using a similar set of indicators to the ones that employed above, we found that around a fifth (21%) of shoppers can be classed as being focused on the environment and sustainability. Respondents from China, Thailand, and Colombia were all much more likely to fall into this category.

An interesting addendum to this finding is that while almost all of those who are focused on sustainability are also focused on health, the same is not true in reverse. More than half of those who care deeply about their personal health do not feel the same way about sustainability.

The Customer Pulse is a global research programme conducted over multiple waves. This latest edition is informed by the views of 9,640 shoppers from 24 countries.

[1] tradingeconomics.com

RELATED PRODUCTS

Amplify Customer understanding to create strategies that drive results

Customer First solutionsThe latest insights from our experts around the world